To get a roundup of TechCrunch’s biggest and most important stories delivered to your inbox every day at 3 p.m. PST, subscribe here.

Hello and welcome to Daily Crunch for January 14, 2022! I suppose that this has been the week of Wordle, in that everyone and their dog are tweeting their scores and results. A small bit of camaraderie for those of you out there who are not good at the game: I am also trash. And since I still get paid to write, I refuse to connect “Good at Wordle” with “Good at words!” – Alex

P.S. Speaking of words, the Equity team had a heck of a good time this week, in case you wanted a chatty dive through recent startup happenings.

The TechCrunch Top 3

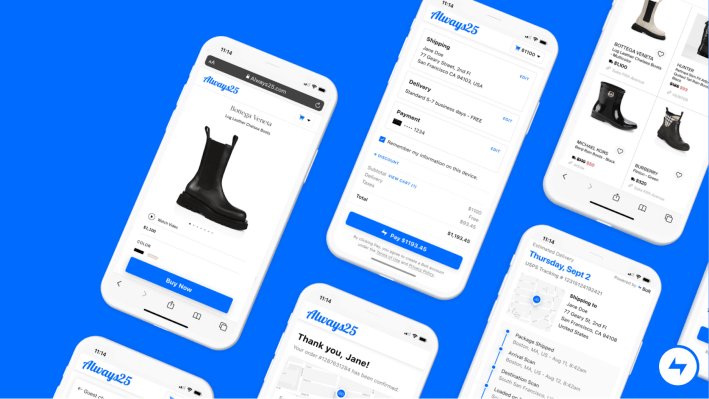

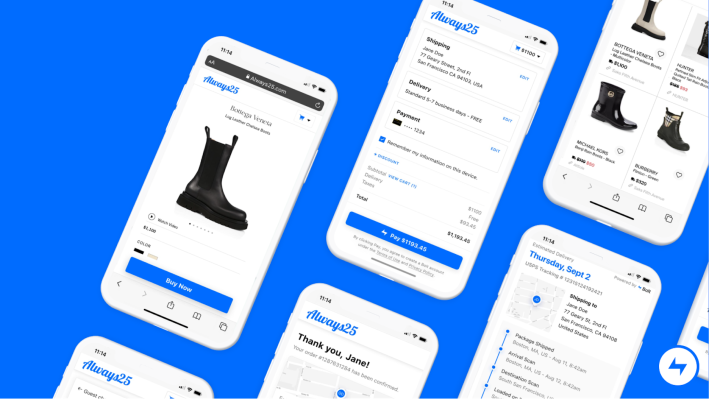

- Bolt raises $355M as the online checkout war continues: Bolt (not this Bolt) has raised a huge new round of capital that pushes its valuation to $11 billion. Bolt provides an online checkout solution for other companies. It competes, variously, with Fast and Checkout.com, which just raised $1 billion at a $40 billion valuation. You can argue that there is separation between the players in terms of where they sit in the world of online payments and checkout, but the overlap appears increasingly material between the competitors. (Just about one year ago we called the online check market a war; the battle continues.)

- Major tech companies subpoenaed by Congress: As an investigation into the January 6 insurrection continues here in the U.S., major tech companies are being caught up in the hunt for answers. YouTube (Alphabet), Facebook and Instagram (Meta), Reddit, and Twitter appear to be in the line of fire.

- All that glitters is not legit trading volume: As the market for non-fungible tokens – digital signatures on the blockchain that often point to assets stored on the traditional web, like images – heats up, we’re tracking the various exchanges where trading takes place. What we’ve most recently learned is that not all trading volume may be what it first appears.

Startups/VC

- Daasity raises $15M to help companies leverage e-comm data: Daasity is a startup that helps customers aggregate their information from various e-commerce platforms (Amazon, Shopify, etc.), “analyze it and push it to marketing channels to optimize customer experiences based on insights from a historical performance,” TechCrunch writes. The company’s new funding round was a Series A, led by VMG Catalyst.

- Commercial EVs for the Indian market: Amazon is working with a number of companies on EVs for its global delivery network, one of which is EVage. The Indian company just raised $28 million for an electric truck-van-box that I must admit is rather fetching – provided you are the sort of person who enjoys brutalist architecture.

- The cannabis labor market is growing startups: TechCrunch notes in this story that there are labor platforms being built to help particular industries hire. The healthcare market has a few, for example. And now the cannabis industry as well, thanks to Vangst, which just raised a $19 million Series B.

Fintech and insurtech innovation in Brazil set to take off on regulatory tailwinds

Nubank’s present day headquarters in Sao Paulo, Brazil. Image Credits: NELSON ALMEIDA/AFP via Getty Images

Regulation is often decried as a hurdle to innovation in most parts of the developing world.

But in Brazil, the Central Bank is being hailed by investors and fintech founders alike as a tailwind for bringing banking to the masses.

“The open banking initiatives adopted by Brazil’s Central Bank are absolutely tailwinds for fintech innovation,” Costanoa Ventures’ Amy Cheetham told TechCrunch.

In an in-depth market analysis, Anna Heim explores Brazilian fintech’s growth in the wake of Brazil’s open banking initiatives and how insurtech is also poised to take advantage.

(TechCrunch+ is our membership program, which helps founders and startup teams get ahead. You can sign up here.)

Big Tech Inc.

Today we have a grip of transit-themed Big Tech news, followed by, what else, some European legal news involving a major U.S. tech company!

- Self-driving taxis work to merge onto the fast lane in China: Our own Rita Liao did everyone a favor by writing up a deep dive into the self-driving taxi market in China. As she writes, it does seem that every week “news arrives that another major player has gotten the green light to launch a new pilot program or a small-scale service” in the country. What do the individual news events add up to? Find out!

- And speaking of self-driving cars: Waymo and J.B. Hunt, a trucking company, are turning their pilot into a long-term program. There is a shortage of truck drivers in the U.S., meaning that trucks that can get along without help could be a big deal in the nation.

- Here’s a review of a car that no one at TechCrunch can afford: Let me be clear, I want a Bentley Continental GT Speed. I would also settle for a standard Bentley Continental. The fact that Kirsten Korosec, our enterprising transportation editor, got to test one is jealousy-inspiring. On the factual front, if you have more than a quarter-million dollars laying around and need 12 cylinders, this is perhaps the car for you.

- Meta faces class-action lawsuit in the U.K.: A class-action lawsuit filed with the U.K.’s Competition Appeal Tribunal in London wants to dock the U.S. social networking giant some $3.1 billion for abuse of its in-market power in the U.K. Let’s see if this goes anywhere.

TechCrunch Experts

Image Credits: SEAN GLADWELL / Getty Images

TechCrunch wants you to recommend growth marketers who have expertise in SEO, social, content writing and more! If you’re a growth marketer, pass this survey along to your clients; we’d like to hear about why they loved working with you.

Credit: Source link

Comments are closed.