The best to choose

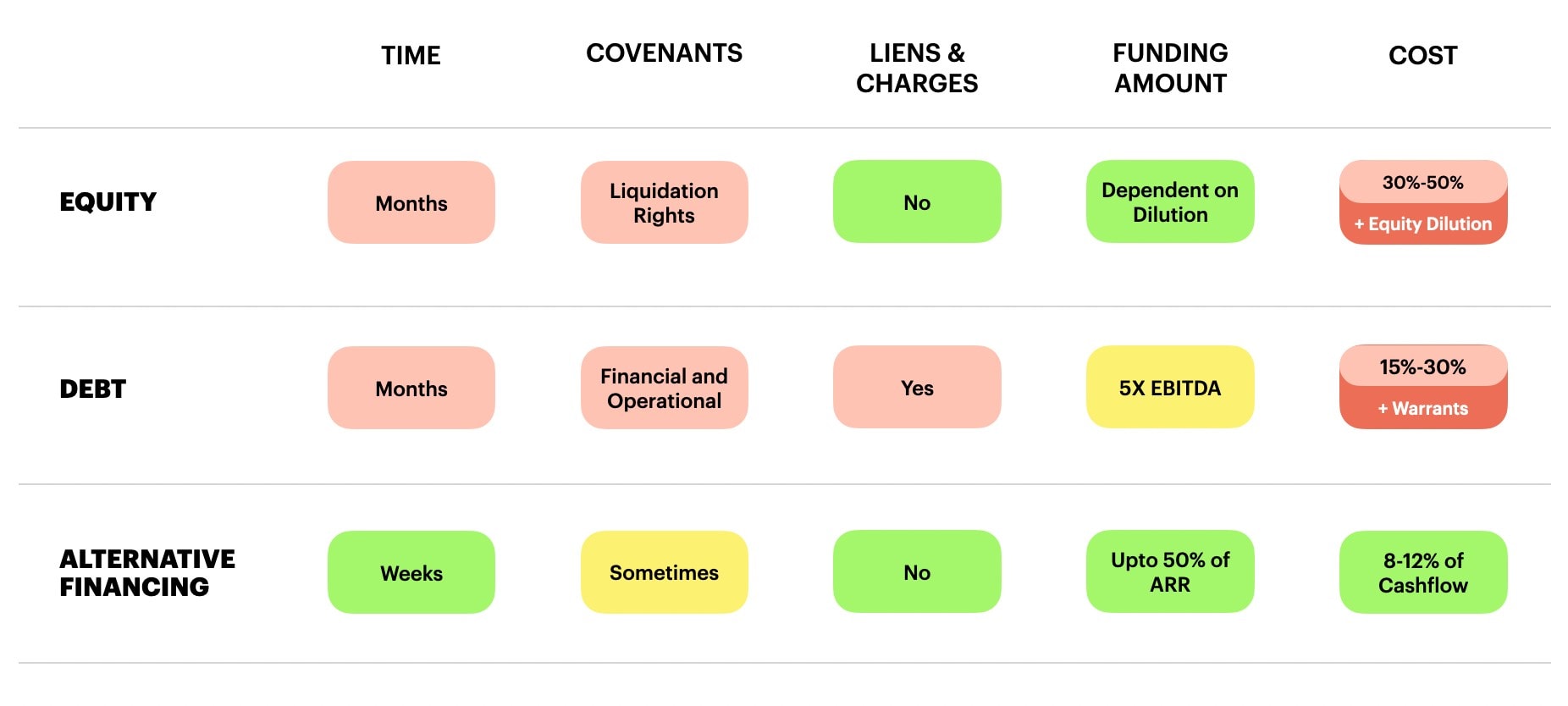

Growth stage companies today have several options to raise capital at their disposal like equity financing, venture debt and alternative financing. Each of these methods has its own set of pros and cons. The choice of which financing option should be availed by your business depends upon the end-use of capital as well as the right balance in the capital stack. Here is all you need to know about equity financing, venture debt and alternative financing:

Equity: A Powerful Tool

Equity financing will always remain an extremely important and popular option for founders. Investors infuse capital and in turn take majority/minority percentage shareholding of a company. Equity can be founder friendly especially in pre-seed or seed round of funding where companies are looking to create something out of nothing. Even during the later stages of a company, equity financing is a powerful tool when financing is needed for research and development, expansion into completely new geographies, or any end-use for growth where the break-even period is longer than 24 months or is extremely hard to predict. Although it is a risky proposition for venture capitalists, it has a significant potential upside which is enticing. For instance, the Freshworks IPO generated 72 percent annualised returns to financial investors.

While historically business leaders and founders have relied on venture capital funding, it comes with its own set of pitfalls. Just the mere process of it being time-consuming and extremely stressful (taking at least six months to cash in the bank and includes preparing a pitch deck, reaching out to potential investors, attending investor meetings, negotiating deals, due diligence, executing final documents and ultimately raising funds). Not to mention the dilution of your company can be death giving especially if the timing isn’t right.

Debt

Debt has been the traditional answer to the problem of dilution. Financing through debt rather than equity allows a firm to maintain ownership and can be less expensive and also have tax deduction benefits. However, in case of delay in cash inflows, there can be an obligation on the company as well as financial covenants which can be very restrictive. Moreover, traditional debt facilities are not provided to asset-light early-stage companies as they usually do not have collaterals to provide as security interest or a track record of more than three years. Alternatively, venture debt firms work with startups without taking collateral but take warrants (which are basically options which can be converted into equity shares at the latest equity financing round’s per-share price in the future) which leads to dilution as well as higher effective cost of capital.

Alternative Financing

When it comes to alternative financing, it enjoys a competitive edge over other methods of raising capital as entrepreneurs don’t dilute equity and the process is technology-driven and extremely fast. Some options such as Subscription-Based Financing (SBF) and Revenue-Based Financing (RBF) have become prevalent in recent years and cater to specific use cases.

SBF is one of the most founder-friendly ways to raise capital for recurring revenue businesses. Companies with monthly or quarterly paying subscriptions can trade them for upfront capital. Companies pay back their investors as their end clients pay, which provides them flexibility. This combined with no equity dilution, no restrictive covenants as well as founders being able to preserve their growth is a new and innovative way for recurring revenue companies to raise capital. This is a great way but can work with businesses once they have recurring revenue streams coming in.

Through RBF, founders can raise capital by pledging a future percentage of the organisation’s ongoing gross revenues in exchange for the money that is invested. This form of financing works well for e-commerce companies and seasonal businesses that are fuelled through financing their digital marketing expenses. However, for a fast-growing e-commerce company, at times the Annual Percentage Yield (APY) can be very high as one ends up repaying capital in a short period of time.

The bottom line

To make a wise investment decision in terms of end-use and cost of capital, it’s important to carefully understand the difference between all the methods of financing. It is interesting to see how alternative financing platforms like SBF and RBF are actively growing and taking share of the financing market. Definitely interesting times for founders but extremely pertinent for one to know to design a capital stack that works best for you and your business.

(The author is Eklavya Gupta, Founder, Recur Club. Views expressed in this article are his own.)

(Edited by : Dipti Sharma)

First Published: IST

Credit: Source link

Comments are closed.