Southeast Asia (SEA) is one of the world’s fastest-growing economies, and its transition journey will bring about $218 billion worth of ClimateTech investment opportunities between 2018 and 2025.

In Part 2 of my series on demystifying ClimateTech investment in Southeast Asia, I may have set out a rather dreary picture of climate issues in our region — but a low base also means that there are many low-hanging fruits that founders and investors can go after.

I hope to conclude this series with a more hopeful note by zooming into specific ClimateTech areas with great potential in Southeast Asia, as well as how we as venture capital (VC) investors can play a role in evaluating and backing high potential regional ClimateTech startups.

In this final Part 3, co-authored with Lee Zi Xin, we will cover the following:

- Identify the market and economic factors that will likely drive new opportunities in the key Greenhouse Gas (GHG) emission sectors in the region.

- Spotlight some regional ClimateTech startups that are positioning themselves to capture such opportunities.

- Suggest an assessment model that investors, specifically focused on markets with emerging market characteristics like Southeast Asia, can adopt when evaluating the various potential investment pathways for the diverse and complex ClimateTech genre.

Energy

The demand for electricity in Southeast Asia is projected to increase by 60% by 2040, driven by skyrocketing appliance ownership and cooling demand. If you are bullish on emerging green innovation in renewable energy, the tide is turning in your favour. Widespread perceptions on renewables have been that:

- New energy facilities require more upfront costs than their fossil predecessors, and

- Variable energy like solar and wind is technically difficult to integrate into the grid

However, these perceptions are increasingly at odds with price trends and market realities.

- While still not yet at parity with conventional energy, the cost of solar and wind technologies has dropped rapidly, and new renewable energy projects are increasingly cost-competitive with fossil fuel technologies.

- Initially low levels of variable renewable energy penetration are manageable through operational changes to grid dispatch and load planning, even for countries with relatively underdeveloped grid systems in SEA.

These developments pave the way for a shift from early tech to real deployment for startups dealing in renewable energy. Already, policy planning documents have been recently revised to boost the long-term share of renewables, usually at the expense of coal. In the first half of 2019, approvals of new coal-fired capacity were exceeded by capacity additions of solar PV for the first time. The market for microgrids and energy storage will also grow as developing SEA countries seek solutions for remote and island communities.

As renewable energy takes off, startups offering storage solutions (including batteries), grid solutions and P2P trading are emerging to solve infrastructure problems and improve the return on investment ratio (ROI).

Transport and Mobility

Sustainable and equitable transport systems are key for economic growth and social development. Rising affluence in the region will also result in higher demand for new transport infrastructure, upgrading and improved access.

Regional road networks have not kept pace with the rising number of vehicles. As a result, SEA is home to some of the world’s heaviest traffic conditions. Micro mobility and shared trips are convenient, reliable and affordable ways to get around in congested cities. Empirical studies show that micro-mobility and shared trips replace a larger number of trips from cars than from public transport. They are also less pollutive per person per kilometre than car trips by virtue of being light vehicles or by ferrying more passengers at once. Thus, they could be the critical link to help speed up a transition toward lower congestion and pollution levels while increasing the quality of life in SEA.

SEA is reportedly the fifth-largest automotive market in the world, with approximately 3.5 million units of passenger cars and light commercial vehicles sold per year pre-Covid. Several SEA countries have set targets for electric vehicle (EV) fleet size and designed incentives to promote EV adoption among their populace.

Traditional auto manufacturing hubs in Southeast Asia, namely Thailand and Indonesia, also seek to promote local manufacturing of EVs to defend their positions in the auto sector. The economic opportunity in EV charging infrastructure lies in e-bikes, which require less powerful battery technologies and fit our regional context where motorbikes dominate road transport. Regional players in the EV space may benefit from decoupling the battery from vehicle production, to achieve more innovative and affordable business models for the end-users.

Agriculture, Forestry and Land Use

As a region, SEA relies heavily on agriculture, natural resources, and forestry for livelihoods. Agriculture and forestry constitute a total of 78.89% of Southeast Asia’s total land area of 434,070,000 ha. By the mere size of their coverage alone, it is no doubt that these sectors are important pillars in contributing to food security as well as to the achievement of sustainable development goals.

In recent years, due to climate change coupled with growing populations and emerging industries, the agriculture sector in Southeast Asia has been under considerable environmental pressure. Market impacts related to economic activity in farmlands and fisheries will face a mean direct loss of 2.2% of GDP by 2100. On top of this, health and ecosystems, as well as disaster and calamity risks, can cost up to 5.7% and 6.7% of GDP.

Climate-smart land use solutions for the agriculture and forestry sectors are aimed at

- Sustainably increasing agriculture productivity and incomes

- Adapting and building resilience to climate change, and

- Reducing and/or removing GHG

Ample innovation and disruption opportunities exist for this genre, including sustainable food productions, precision farming, agriculture supply chain efficiency and various nature-based solutions.

Manufacturing and Industry

Industry is the largest energy consumer in Southeast Asia, accounting for over 29% of the total final energy consumption, with shares of contribution ranging from around 12% in Myanmar to nearly 40% in Viet Nam. Based on the current policies, energy consumption in the sector is expected to double by 2040.

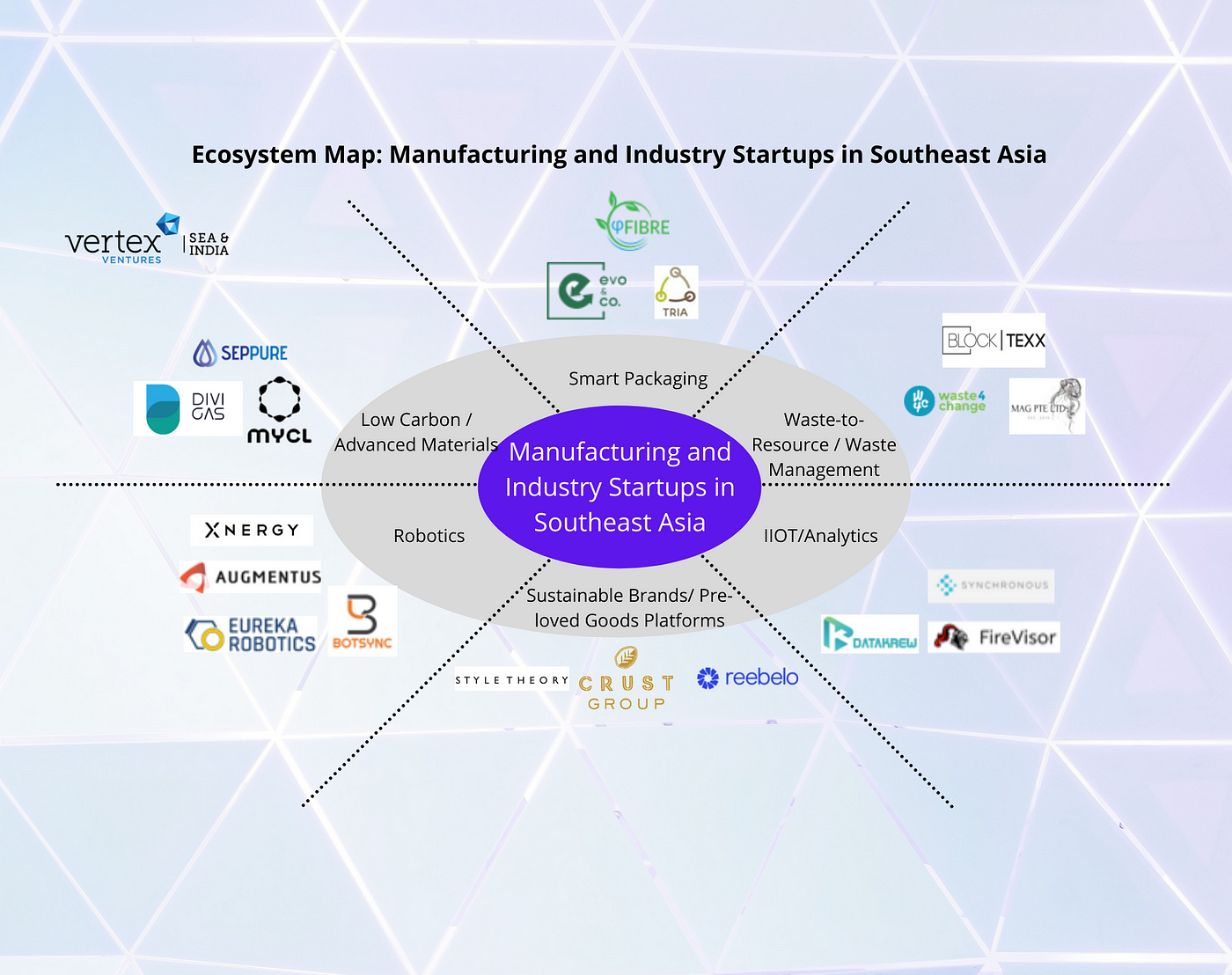

While sustainable manufacturing is a relatively new concept in SEA, several opportunities exist to advance the manufacturing sector’s sustainability across the production value chain. These include industrial automation, circular manufacturing, and sustainable materials.

The manufacturing sector in Southeast Asia is still weak on industrial automation. Personnel often must resort to manual spreadsheets and intuition to make factory floor decisions. This leads to substantial productivity and material loss. Industry 4.0 and the application of information and communications technology to digitize information and integrate systems at all stages of product creation can increase efficiency and reduce required materials inputs.

Circular manufacturing refers to maintaining the value of products, materials, and resources in the economy for as long as possible, and minimising the generation of waste. Today, commercial waste streams lose a significant share of their value the moment they leave the company just because the available information becomes less reliable. IOT is considered a key enabler for circular manufacturing, where reliable waste management information on the material composition of products can now travel along the recycling chain.

Lastly, several industrial processes, such as chemical separation and purification, are resource-intensive and pollutive. Raw materials substitution to advanced or low carbon materials that are more environmentally friendly and safe to process or use will help to minimize waste and/or pollution along with the processing system.

Built Environment

Up to 40% of all greenhouse gases (GHGs) emitted in the world can be attributed to buildings as end-user of energy. SEA’s urbanized population proportion will increase from 48% in 2015 to 64% in 2050, adding 205 million new urban residents in the region from the current 300+ million urbanites. Given this, we cannot tackle the climate change crisis without changing our built environment.

To meet the fast-increasing demand for built floor area in SEA cities in a sustainable and resilient way, enormous emissions reduction potential lies in the use of green or sustainably sourced building materials, increased construction productivity, and smart building design. The latter includes efficient HVAC, circular economy solutions (e.g. reusing water) and management systems that improve energy efficiency.

Carbon Markets and Other Enablers

There is a favourable macro environment for carbon credits due to increasing awareness amongst large enterprises and regulatory concerns. At least one-fifth of the world’s largest 2,000 public companies have committed to meeting net-zero targets by mid-century or sooner through various initiatives, boosting demand for voluntary carbon credits. New carbon regulations (implemented and scheduled) jumped in 2021, causing global emissions covered by a carbon tax or emissions trading system to cross the 20% mark for the first time.

With carbon markets scaling globally, the potential offsets generated in the region may offer $10 billion in economic activity annually by 2030. Avoiding deforestation in Southeast Asia represents a valuable source of carbon offsets, as well as important community and biodiversity benefits. However, the carbon market in SEA is nascent — there is no mandatory carbon market in the region, and Singapore is currently the only nation with a carbon tax. Challenges also abound in SEA voluntary carbon markets, including lack of capabilities to scale supply of offsets, wide variations in credits quality, immature carbon market infrastructure, and lack of regulatory support.

Tech-enabled assurance and verification can improve the integrity of carbon credits and reduce monitoring costs, while carbon exchanges can increase market efficiencies and establish a derivatives market to improve liquidity.

A VC Investment Framework for ClimateTech

Over a decade ago, after an initial boom and bust in ClimateTech investments, venture capitalists turned away from ClimateTech. The renewable startups of the previous cycle, particularly in wind and solar, are now at suitable maturity for the PE playbook since new renewable energy projects are increasingly cost-competitive with fossil fuel technologies. It took longer than most expected to reach this point, and many companies perished with VCs losing billions in the process.

The funding drought has finally come to an end. 2021 saw supercharged ClimateTech interest by VCs. According to Pitchbook, as many climate-focused funds as were raised during the previous five years combined. The jury is still out on how the 2020s, particularly buoyed by the recent new ClimateTech wave, will prove to be different from the 2000s.

Some have argued that it will be different this time. Massive capital is flowing in fast due to new growth drivers that were not present in the previous boom:

(1) Particularly strong demand from corporates and investors for low- and zero-carbon products

(2) Countries setting aggressive decarbonisation goals across the globe

(3) Record-breaking exits. In the first three quarters of 2022, 61 ClimateTech companies have either gone public or have been purchased, up from 33 in all of 2020. That amounts to more than $28 billion in exit value.

A lot of investment dollars has been allocated globally into the frontier, cutting edge and disruptive climate technologies, such as low carbon advanced materials, carbon capture technologies and battery innovations. While Southeast Asia’s deep tech ecosystem has recently become much more well developed and is punching well above its weight, it still arguably trails other more advanced innovation ecosystems such as the US, Europe and China.

However, it would be a mistake to assume that SEA based startups and VCs have no role to play in contributing to climate innovations.

Taking a leaf out of BCG’s Climate Solution Innovation Canvas, ClimateTech companies may adopt various approaches to climate solution innovation. They can both improve existing models (e.g. battery swapping instead of charging) and markets and create brand new ones. At the same time, they can scale up existing technological solutions and also support the development of more disruptive ones.

If we look at companies at their technology inflection point, companies in the “Scale X Existing Model” quadrant, i.e. those who are scaling up existing low-carbon technologies and adopting/improving well-understood business models, will likely face fewer hurdles in driving market adoption. The game becomes one of accelerated deployment and snatching a larger piece of the pie.

Companies in the “Scale X New Models” quadrant are new solutions that satisfy evolving market demand and customer needs. These companies have the potential to become first movers in nascent ClimateTech categories but may require some degree of market education before reaching full potential.

Many startups in SEA are doing their part to make a difference in our climate change journey by applying existing tech with a climate lens, for example managed marketplace platforms but for pre-loved or rental goods, or the integration of smart meters for real-time energy usage analysis and optimisation on the cloud.

As with most deep tech opportunities, ClimateTech startups and investors striving to deliver breakthrough technological innovations must be prepared to invest time and resources not only into not conducting extensive R&D efforts but also into establishing strong ecosystem partnerships to ensure that their technologies have the maximum potential to reach full commercial viability in the shortest possible time.

Despite the seemingly arduous journey, success — for those who achieve it — will be immensely rewarding. This is because the value of these companies lies not only in near term monetization but also in achieving truly bleeding-edge technological advancements.

Startups and investors who choose to play on the right-hand side of the innovation canvas must expect to endure significant technological and commercialization risks, but can also aspire to compete and win on the global stage for outsized commercial returns.

With the influx of capital and interest in the space, we can expect to see more mainstream and sector-focused investors develop higher risk appetites and increasingly venture outside the seemingly lower-risk bottom left quadrant of the innovation canvas, even in markets with strong emerging market characteristics like Southeast Asia.

It is indeed an exciting time to be in ClimateTech. The International Energy Agency calculates that new patents related to core technologies like batteries, hydrogen, smart grids and carbon capture are far outpacing those in other technologies, including fossil fuels. In the next decade, as top talent takes on the hard engineering challenges involved in technology development, we will see more of the solutions on the right side of the matrix reaching their technology inflection point and moving towards the left. At the same time, we can surely expect to welcome more new breakthrough innovations to further advance society and mankind.

Credit: Source link

Comments are closed.