Shares of Chinese technology companies are selling off at home and abroad this week as the nation’s ties to Russia add to investor uncertainty at the expense of China’s tech industry. China is also enduring a COVID-19 outbreak, leading to mass lockdowns in technology hubs, and some of its leading technology concerns are looking to bring their listings back to domestic shores due to regulatory pressure.

The scale of the recent drop in the value of Chinese equities was dubbed “panic selling” and “relentless,” for context. In numerical terms, the Hong Kong Hang Seng Index fell more than 5.7% today, reaching a new 52-week low; the Shanghai Composite fell 5%, also a 52-week low.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

If you are parsing the public-market carnage this morning, you might expect that Chinese venture capitalists would pull back their investment cadence. After all, when the market’s risk tolerance flips, we often see more conservative behavior from money managers, right?

Maybe.

One key surprise in 2021 was the fact that despite a regulatory barrage from the central government, Chinese startups had a pretty good year when it came to raising capital. You would have been forgiven for expecting the opposite. After all, the scale of the 2021-era regulatory crackdown on Chinese tech companies was one of the most important technology stories last year, leading to a huge reshuffling of not only economic power in the country, but also where private capital flowed.

Naturally, we’re curious if the recent selloff in Chinese equities will have the sort of impact on private-market investment that we expected to see last year, even if our confidence in being able to read the nation’s economic future is low. Let’s dive into recent data and see what we can find out.

Naturally, we’re curious if the recent selloff in Chinese equities will have the sort of impact on private-market investment that we expected to see last year, even if our confidence in being able to read the nation’s economic future is low. Let’s dive into recent data and see what we can find out.

Declines

If we tracked a few days of declines in the public markets and then asked what impact the market movement had on historical venture investment, we’d sound a little silly; near-term public market movements don’t impact trailing private-market results. But the recent declines in the value of Chinese equities are more continuation than new movement, so we can look at Q1 venture capital data and do a little bit of compare-and-contrast.

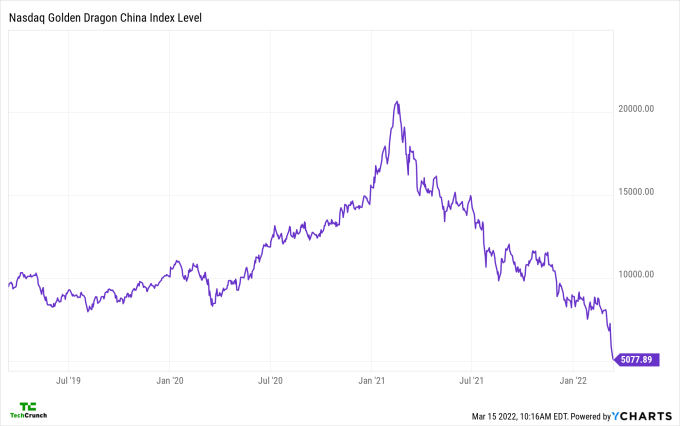

On the historical declines point, the NASDAQ Golden Dragon China Index tracks the value of U.S.-listed companies with a “majority” of their business “within the People’s Republic of China.” And oh boy is it a hot mess. I have never seen a chart quite like this one:

Image Credits: YCharts

You can see a clear trend from early 2021 to today, including the recent selloff that has caused such a stir.

Adding up our data thus far: Chinese equities are taking body-blows as geopolitical, regulatory, and pandemic-related uncertainty led investors to race for the exits. And, even more, the valuation declines that we are discussing are not a new phenomenon, but could instead be considered an acceleration of prior trends (see above chart).

So are we, at last, seeing a deceleration in the pace of Chinese venture capital?

Maybe!

Credit: Source link

Comments are closed.