Evolution of confirmation of payee (CoP)

SurePay is a specialist in and founder of the IBAN-Name Check/Confirmation of Payee. Founded in 2016 as a brand of Rabobank and incorporated in February 2020 as SurePay B.V. All the major Dutch banks are implemented and now SurePay is also a trusted CoP provider in the UK where they provide their solution to eight banks already.

SurePay is a specialist in and founder of the IBAN-Name Check/Confirmation of Payee. Founded in 2016 as a brand of Rabobank and incorporated in February 2020 as SurePay B.V. All the major Dutch banks are implemented and now SurePay is also a trusted CoP provider in the UK where they provide their solution to eight banks already.

CoP in the UK

SurePay started an informal discussion about CoP in 2017 and this solution was already live in the Netherlands when it started with the design and implementation of CoP in the UK. CoP has been implemented from Tier 1 UK Bank to Tier 2 Banks and Challenger to Start-up Banks. SurePay has extended its UK team due to the continued growth for their services.

CoP is the key service and focus that SurePay provides, they are delighted that already successfully over 150+ million checks have been performed.

More data, less fraudsters

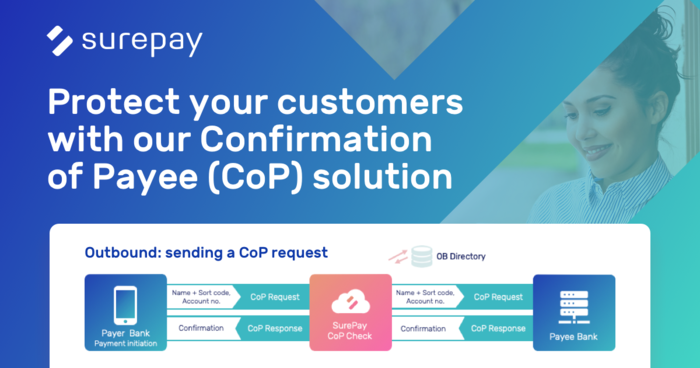

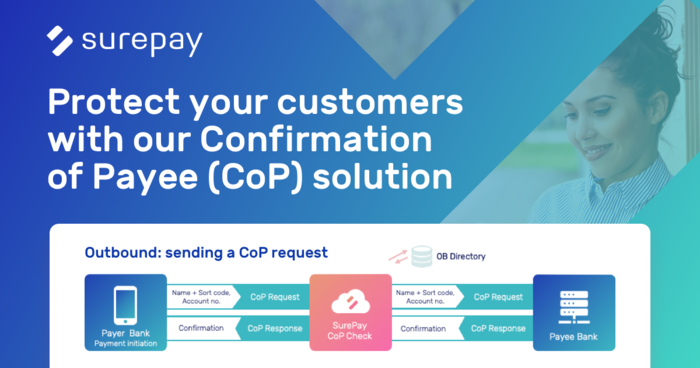

SurePay’s CoP service is an innovative, real-time name checking solution that gives UK payers greater assurance that their payments are going to the intended recipient. With the main purpose of making payments personal, easier and more secure, SurePay has already more than 30 banks and 150 organisations implemented. In the Netherlands, 99.5% of all payments are checked which has helped reduce fraud by 81% and misdirected payments by 67%.

In the UK, eight banks use SurePay’s CoP solution. This results in 30% of all payments being checked by SurePay.

When checking a payment, one of the following responses are provided:

- It’s a match – all of the details match.

- It’s a close match – the name or the account type doesn’t exactly match what you have provided; contact the intended recipient to check the details.

- It’s not a match – contact the payee to confirm the correct details.

- Unavailable/unable to check – this may occur if the account holder’s bank doesn’t support CoP. Contact the payee to confirm the correct details.

Currently SurePay has a 5% “no match” which means our unique algorithm leads to the lowest amount of false warnings, due to its accuracy. This means payments are flowing more easily, less fraud attempts, less reputational damage, and happier customers.

In 2020 there was a total APP fraud loss of £479 million, according to UK.finance. Fraudsters are targeting non-CoP banks, and so CoP has never been more critical. The more data SurePay has, the greater the capability to block fraudsters, all while staying compliant with GDPR.

CoP for all banks and building societies

CoP is in its second phase which means it is available for all UK banks and Building societies. SurePay can help these banks and Building Societies to become a CoP participant. They are also able to offer this as a full service even if the bank is not part of the UK’s Open Banking scheme.

CoP for organisations

Financial institutions and organisations throughout the UK should be able to integrate CoP. Due to Covid-19 induced rise in fraud, it’s more important than ever that organisations implement CoP as soon as possible. With different data endpoints we can reduce fraud faster and make payments more secure.

CoP crossing borders

The next step for SurePay will be to facilitate cross border checks meaning safer international payments. This is an addition to the domestic CoP we already provide, allowing for banks to be connected with the cross border CoP router. Cross border checks are highly necessary because fraudsters are already moving to foreign banks. With this extra addition to the CoP service, this kind of fraud can also be reduced.

CLICK HERE TO READ THE FULL PAYTECH AWARDS WINNERS SUPPLEMENT, IT’S FREE AND FEATURES SOME OF THE MOST IMPACTFUL AND INNOVATIVE PROJECTS, PRODUCTS, SERVICES AND PEOPLE IN THE PAYMENTS SPACE IN 2021!

Credit: Source link

Comments are closed.