If you took his claims at face value, Patch Baker appeared to be the embodiment of everything America stands for.

As a Marine Corps veteran, he told war stories that would make Michael Bay blush, recounting the savage battles he fought all over the world, including being shot in the chest and blown up by an IED, during his career in special operations. His stories about life in the civilian world were just as dramatic, where he talked about stacking win after win until he had amassed fifty four companies generating nearly sixty million dollars in annual revenue in just a few years. He even boasted of prestigious clients like Nike, Black Rifle Coffee, and Grunt Style.

Except it was all a lie. Including his real name, which is not Patch Baker. It’s Jefferson Scott Baker. But since most people know him as Patch, we’ll stick with that in this article.

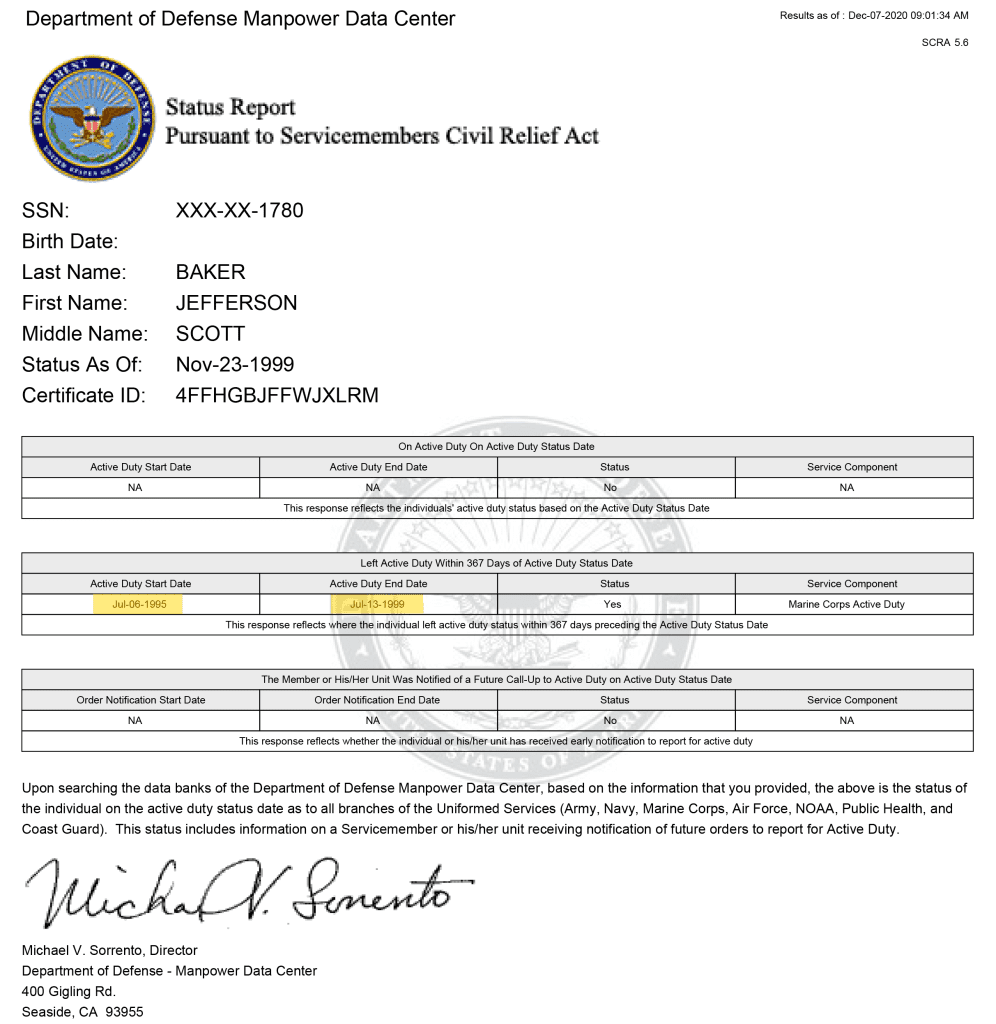

According to information gathered during an extensive investigation, Patch Baker did serve in the Marine Corps, but his claims of deploying nineteen times over the course of fifteen years were pure fantasy. Not only did Baker not serve fifteen years—he only served four, but he also never deployed. And his stories of combat, while colorful and exciting, were also completely fabricated. In stark contrast to the image of a battle hardened warrior that he liked to present, Baker actually served in an administrative role. He was what infantry Marines refer to as a POG, which is an acronym for Person Other than Grunt. Basically, he stood around handing out backpacks in North Carolina for four years.

Stolen valor—lying about military service—is a controversial topic for many. Especially for veterans.

Technically, lying about military service is protected by the First Amendment. But, when false claims about military service are used for financial gain, it can become a federal crime thanks to the Stolen Valor Act, which was signed into law in 2005 by President George W. Bush.

And that’s exactly what Baker did. He used these made up stories to build trust with other entrepreneurs and investors, and then reel them into his elaborate schemes to defraud them of their hard earned money.

In some cases, he preyed on entrepreneurs’ ambitions by promising to leverage his relationships and capital to catapult their businesses to massive success. Especially veteran-owned companies. He would then “partner” with them, making bold promises about all the amazing things he was going to do for their business, but those promises never materialized. Instead, he simply drained their bank accounts, borrowed money against their companies, and then ghosted them, according to many of Baker’s victims.

In other cases, he persuaded investors to put their money into what he called a Merchant Cash Advance fund, which he claimed was completely safe while promising outrageous returns. He told investors that he had invested millions of his own money into the fund, and managed to get dozens of them to hand over hundreds of thousands of dollars each. In fact, some investors put in over a million dollars. Based on information from investors, it appears that his Ponzi scheme raked in over ten million dollars.

Eventually though, as all scams do, Patch Baker’s scams began to unravel.

People began talking about his unfulfilled promises. At first, he was able to rebut the rumors by claiming the entrepreneurs he partnered with didn’t deliver on their end. He claimed he was propping them up and that without him, they would have already gone out of business.

“Bro, who are you going to believe? A guy like me who’s making sixty million a year or someone I’m keeping on life support?” he would ask with a deep southern drawl and a smile. But as his list of detractors grew, the truth became more obvious.

It seems odd that someone supposedly making sixty million dollars a year would have been evicted because his fairly modest house was in foreclosure, forcing him to move into a tiny apartment, but that’s just another detail the investigation uncovered.

The same thing happened with his so-called Merchant Cash Advance fund. When some investors began trying to withdraw the money they had put into it, they were given nothing but excuses. One of the more outrageous excuses was that his bank, Wells Fargo, had frozen his accounts because they were trying to reverse engineer his business model. Baker claimed that Wells Fargo executives told him they had never seen someone make so much money and wanted to figure out how he was doing it so they could do the same. Any rational person can see that with over eighty billion in revenue and surging profit margins, it’s clear that Wells Fargo didn’t need help from Patch Baker to figure out how to make money. But he doubled down on this ludicrous claim anyway.

After Baker failed to meet multiple deadlines to return money to investors, they organized to publicly share their experiences in an effort to prevent him from conning anyone else. They launched the website, Patch Baker Fraud, began sharing their stories on social media, and prepared a lawsuit. Since then, the Office of the Inspector General has also opened an investigation into Baker’s false claims about his military service.

The whole situation is a classic example of “fake it ‘till you make it” except Baker never “made” it. He just took it—from countless hard working entrepreneurs. And in the process, he desecrated the graves of the service members who died doing what he pretended he did. As a Marine veteran who actually did serve in the infantry with multiple deployments, I find his behavior appalling.

In the end, he will face justice as the veteran community has ostracized him, investors are lining up to sue him, and various government agencies are preparing to prosecute him for his crimes.

For Patch Baker, as we used to say in the Marine Corps, it’s all over except for the crying.

Credit: Source link

Comments are closed.