Crypto startup Pebble has announced their $6.2M seed round as it launches its crypto-powered financial platform: providing its users with an alternative to what it calls a “broken financial system.”

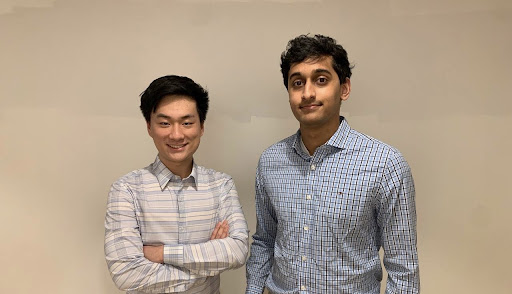

Pebble was founded by UC Berkeley alumni Aaron Bai and Sahil Phadnis, and this announcement will finally take them out of stealth.

The funding round counted participation from some of the biggest names in the space, with some of them having companies like Facebook, Coinbase, and Uber in their early stages. The list includes Y Combinator, Lightshed Ventures, Eniac Ventures, Global Founders Capital, Montage Ventures, and Soma Capital.

While the crypto space has seen an increase in the number of financial platforms available, most of them are focused on investing or saving. Pebble is designed to provide its users with a means to actively reap the benefits of blockchain for their day-to-day needs.

Hence, the core product offered by Pebble is a financial platform intended to be a better alternative to traditional banking services both from a user experience and feature perspective. While powered by blockchain technology in the background, users have access to a debit card, cashback, bill pay, high-APY rewards on their balance, and payroll connection capabilities. This launch provides a major paradigm shift in comparison to how “stuck” crypto feels in exchanges like Gemini and Coinbase.

The Pebble team chose to only use the most trustworthy cryptocurrencies (in this case USDC — a fully asset-backed stablecoin) to build a sustainable and scalable platform for its users. On the Pebble platform, USDC is not only used for the usual transactions such as transfers, deposits, withdrawals, and payments. It is also lent out to regulated institutions with a 150% over-collateral to generate rewards for its users. This approach also allows Pebble to offer its services in a fee-free manner with better rewards than banks.

As part of its effort to make the platform as convenient and beneficial as possible, Pebble has partnered with 56 big-name merchants, including Uber, Amazon, Chipotle, Airbnb, Adidas, and many more. Through these partnerships, these merchants benefit by cutting the middleman, and the costs that come from dealing with card issuers, payment processors, point of sales teams, and similar nuisances. In return, merchants reward users on the Pebble platform 5% cash back to continue this more efficient method of payments.

Pebble shows a clear intention of having the platform distinguish itself from traditional banks despite offering similar services, while also protecting its users from the volatility of crypto by using USDC. This product is likely to play a major role in the push to reach crypto mass adoption by exposing new users to them in a safe, versatile, and regular manner.

One of the features that Pebble seems to consider essential to avoid the pitfalls of traditional banking is its “Pebbles”. This point-based reward system allows users to earn points for every operation they do with the platform. While the company has yet to announce exactly how this system will work, it has made it clear that early adopters will be rewarded.

According to the announcement, this is “just the first pebble dropped in the pond” as Pebble is looking to create a new movement in the financial industry by creating new opportunities for people. With this in mind, Pebble will be prioritizing its expansion to new locations around the world as well as its offering of products.

Credit: Source link

Comments are closed.