Before entrepreneur Molly Johnson-Jones began fundraising for jobs platform Flexa she was “very against tokenism”. But experiencing the barriers women face when raising from VCs first-hand changed her perspective.

Now, she thinks it’s “one of the only ways” to flatten the uneven playing field in a startup scene that’s so heavily dominated, at a founder and investor level, by white men. And in her case, that doesn’t just mean hiring women, it means finding women investors.

Flexa has just raised a £2.3m seed round led by overlooked-founder-focused VC Ada Ventures, and half of its cap table is women investors — the result of months of concerted effort by Johnson-Jones. And as a share of the capital invested in the round, 76% is from women or funds run by women.

But, depressingly, Flexa is an outlier. While data on the diversity of startup cap tables is scant, data platform Beauhurst estimates that at seed and growth-stage UK companies, just 20% of shareholders are women.

While a cap table that’s more representative is uncommon in European tech, it’s not unheard of. In recent years startups across Europe like legal platform Valla, hybrid work management company Offishal and creator community Passionfroot have all raised rounds featuring a diverse set of investors.

More founders are going out of their way to find investors from underrepresented communities because they believe in the diverse perspectives those people can bring. And many founders believe that if they succeed, they’ll also be helping a more diverse set of investors walk away with new wealth that can then be invested in a next generation of tech companies.

Nevertheless, those startups with diverse cap tables are exceptions. So why are they such a rarity?

Finding women investors

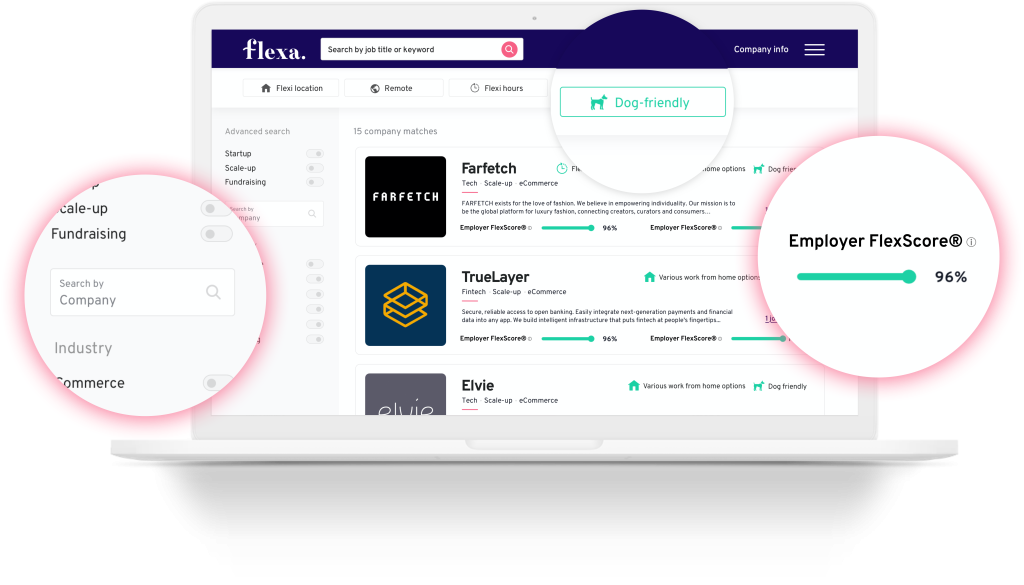

The point of Flexa is to give job seekers a better sense of company culture and flexible working policies when choosing roles to apply for, cofounder and CEO Johnson-Jones tells Sifted.

Most job platforms, she says, don’t allow you to filter roles by culture-focused criteria like how many days work a week is required or whether or not you can bring a dog into the office. That’s where Flexa comes in.

The UK-based startup is approaching 500k users and 160 companies that pay to be listed on the platform — in the hope that showing off their flexible working policies will draw the best candidates in an increasingly competitive jobs market.

Launching just weeks before the UK went into lockdown in 2020 — the beginning of a seismic shift in the way we think about work where flexibility in a role has become a must-have — played into the startup’s hands in terms of getting job seekers to use the platform.

It also broke down some barriers to finding women angels to pitch to, Johnson-Jones tells Sifted.

“Lockdown has made people more comfortable making connections online,” she says. “I’ve met so many brilliant investors [that way], and when we started being very open about the fact we wanted a majority-female cap table, [investors] came out of the woodwork.”

Nonetheless, it’s still “really hard” to find women angels to invest, and both of Flexa’s initial lead angels in its £250k pre-seed back in 2020 were men.

“Everyone said ‘you’re mad’,. But I saw raising funds as like applying for a job: you’re more likely to get it if you make the application really tailored”

“It was the first time we’d ever engaged with the world of VC and we simply didn’t have the network or the awareness we do now,” says Johnson-Jones.

Those initial angels introduced her to a scout at Ada Ventures, who then made introductions to other female partners in Europe, and so on. When Flexa came to raise its seed round, Johnson-Jones decided to only reach out to female-focused VCs.

“Everyone said ‘you’re mad’,” she tells Sifted. “But I saw raising funds as like applying for a job: you’re more likely to get it if you make the application really tailored.”

The tailored approach bore fruit.

“We spoke to far fewer VCs [for our seed round] than when we raised our pre-seed,” Johnson-Jones adds. “By targeting VCs we believe offered a good culture fit with Flexa, we were able to have fewer, higher quality conversations and close this round much more quickly.”

The importance of the right network

Building a network of female angels and VCs through introductions, however, has been trickier for others.

Job site Breakroom has a cap table that’s 17% women after raising $9.4m since 2019, cofounder and CEO Anna Maybank tells Sifted. Despite reaching out to a “large number of female investors” for each round, she adds, the startup has struggled to build a more representative cap table.

“I’ve found two problems,” Maybank says. “One is it’s harder to find [women investors] in the first place. Your best connections come through introductions, and I found it much more likely that people introduced me to a man.”

The other is that, in her experience, women were more likely to say no.

“It’s very hard to break into circles that you don’t have a connection into, and the circle’s almost entirely men”

“Sometimes this is because they said they couldn’t add anything to the business,” she adds. “I think there is a bit of the classic imposter syndrome.”

The difficulty in finding a strong network of female investors was a problem that cofounder and CEO of Valla, Danae Shell — which earlier this month raised a £585k pre-seed round — also came up against.

“It’s very hard to break into circles that you don’t have a connection into, and the circle’s almost entirely men,” she tells Sifted.

“We all know how important warm referrals are in the VC world, and I did a huge amount of networking for [Valla’s initial first pre-seed round in 2020],” Shell adds. “My entire job is networking now, because I realised I had a lot to catch up on.”

For Valla’s cap table, Shell’s outreach has paid dividends: it’s now 72% women and 33% people of colour.

In pulling together funds from a diverse group of people, Valla looked beyond the small pool of seasoned investors from underrepresented communities, says Shell, with half of those on the startup’s cap table having never put money into a startup before.

Convincing first timers to part with their cash was also a route Audrey Barbier-Litvak went down when raising a €1m round for her startup, Paris-based Offishal. 60% of its cap table are women — and 80% of them had never invested before.

Barbier-Litvak told Sifted that given the fact that there are so few women entrepreneurs in France, she turned to women who didn’t have investing experience.

“I reached out to a number of smart, powerful and thoughtful women in C-suite roles who I had met over my 20-year career who could commit between €20k and €50k each,” she said. “Little by little, my network of potential investors started to grow.”

Room for improvement

For all the positive movements from these startups on levelling the playing field, there’s still major work to be done — not least on achieving more diverse representation beyond just gender.

“There is a huge issue around ethnic diversity which needs addressing urgently,” says Flexa’s Johnson-Jones. “Poor representation of any minority group in VC has a direct impact on who gets funded, creating a vicious circle whereby some of the best founders and products are overlooked.”

86% of UK angels are white, as are 83% of senior individuals in PE and VC in Europe. Between 2009 and 2019, just 0.24% of venture capital went to teams of Black entrepreneurs.

“If I am to truly serve the diverse needs of my customers, my investors need to reflect that diversity”

“There’s a lot of onus placed on the VC side to make sure they’re investing in diverse founders,” Johnson-Jones tells Sifted. “But founders should be conscious of who they are putting on their cap table, because if you end up a unicorn and exit, they’re the people that will benefit.”

Likewise, Offishal’s Barbier-Litvak told Sifted that her investors are “highly educated white women who come from wealthy backgrounds”.

“While I may have achieved a level of gender diversity unheard of in tech, I didn’t manage to do well on other measures of diversity,” she said.

“If I am to truly serve the diverse needs of my customers, my investors need to reflect that diversity — and that includes things like ethnic, cultural and socioeconomic diversity.”

Kai Nicol-Schwarz is a reporter at Sifted. He covers healthtech and community journalism, and tweets from @NicolSchwarzK

Credit: Source link

Comments are closed.