Blackbird’s Rick Baker explains how the VC values startups and why it matters even more in testing times

Last week we completed our end of financial year valuations for the Blackbird portfolio and communicated them to our investors.

They’re down as you would expect in light of the public markets but with this blog post, we wanted to share in greater detail the process that we used to come to the valuations.

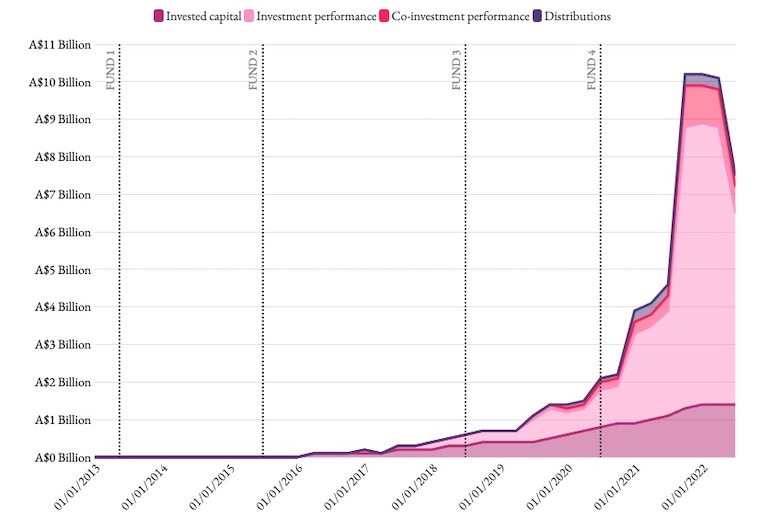

The details of our returns have been updated on our website to reflect the latest valuations. In aggregate, a dollar invested in all of our funds has earned an IRR of 56% and more importantly for us a net multiple of invested capital (TVPI) of 4.4x.

The Markets

It’s been brutal for technology companies out there in the public markets. After a decade of strong support for technology companies, culminating in a huge surge of valuation increases in 2021, the last six months have seen this unwind. The Bessemer Cloud Index is down 54% from its peak and we’re starting to see the effects of this ripple through the venture capital ecosystem.

More importantly, the current market situation has tested our valuation methodology. The tried and tested model of relying on last round valuation has not held up as it did before. In response, we’ve made changes to strengthen our valuation process.

Venture capital has had a reputation of being a black box, but this is never something we wanted at Blackbird and so this blog is all about our valuation methodology and how we’ve changed it to take into account the current market situation.

Why is the valuation process important?

Blackbird is a long term holder of our portfolio companies. Our sole focus is to create exceptional returns by the time we are ready to exit our investments in the years to come. The interim quarterly valuations do not affect this eventual outcome.

The quarterly valuations also don’t have any direct economic effect on us at Blackbird. Of course they give us bragging rights, but we don’t get paid fees based on the value of our portfolio, nor do we get any performance fees until we have sold the assets and handed the capital back to our investors. As Charlie Munger famously quipped: “Show me the incentive and I’ll show you the outcome”. We love that there are no such incentives in this process.

Despite all this, our quarterly valuations are very important to our investors.

The majority of the capital we manage comes from Australian superannuation funds, which use our valuations as an input to set their unit prices. Unit prices are calculated daily and affect the contributions of millions of their members who buy into a superannuation fund each time they receive their pay. So the super funds and APRA (the financial system regulator) are rightly focused on ensuring that valuations reflect a fair market value.

Venture Capital Valuation Methodology

Setting the valuation of venture capital portfolios is generally based on a tried and tested valuation methodology: the last funding round where third-party sophisticated investors set the price to invest capital into a company.

This isn’t anything new – ‘last round’ pricing is the most accepted measure of the fair value of a private tech company from San Francisco to Stockholm. It is based on the International Private Equity and Venture Capital Valuation (IPEV) standards, endorsed by the Australian Investment Council and scrutinised by our investors, their advisors and our auditors.

The venture capital world ended up adopting this norm because it’s objective, easily observable and frankly because it’s hard to find anything superior. Discounted cash flow models end up relying on heroic assumptions 10 years into the future. There’s no public markets comparable to a company with $500K of annualised recurring revenue that is tripling year on year off the back of a product that is improving and iterating rapidly, with a roadmap that is changing by the day.

The other thing about the ‘last round’ methodology is that we don’t revalue our companies between funding rounds unless there’s a deterioration in the company’s performance, which would see us writing down the company value.

We don’t mark up companies as they grow and we definitely don’t mark them up as public markets rally. This means that as a company grows, its valuation multiples automatically decline, until another third party funding round is completed to reset the price.

This methodology has served us really well for a decade. In a normal market, it means our valuations usually lag public markets, ensuring valuations are generally conservative.

Testing Times

As we prepared for our June 2022 valuation process, this had changed. Holding valuations at last year’s prices wasn’t conservative anymore, and it became clear that we needed to review our valuation methodology.

The first quarter decline in public technology companies was cushioned by the conservatism outlined above as most companies had grown into lower multiples. However, the relentless falling prices in the second quarter resulted in a material difference between ‘last round’ carrying values and public comparables. It was clear changes were required.

For a fund manager like Blackbird, it is a big thing to change your valuation methodology. As one wise investor said to us, “make sure any changes you make are well thought through, repeatable year after year and built to last”. Regularly adjusting valuation policies is not going to build trust.

So the changes to our valuation policy have been well thought out after consultation with all of our stakeholders: the superannuation funds and our other investors, our auditors and of course our portfolio companies, who are also concerned that valuations are fairly set.

Our New Valuation Policy

The new valuation policy splits the portfolio in two: (a) a basket of our later stage portfolio companies, whose progress can be compared against listed peers and (b) a basket of earlier stage companies that are still inherently difficult to compare to public markets.

The Blackbird partners: Robyn Denholm, Nick Crocker, Alex Apoifis, Rick Baker, Niki Scevak & Samantha Wong. Photo: AnnaKucera

For the later stage companies, we will no longer just use the ‘last round’ methodology. Instead we’ll mark them to listed markets using market comparables. To check our working, we’ll also have them independently valued by an external valuer at each end of each financial year.

While it might sound like a small change, it will have a big effect on the valuations of our portfolio. The power law of venture capital (a small number of companies produce most of the returns) means that the later stage companies tend to be the majority of the portfolio value. It will mean that our valuations fluctuate more than before in response to listed market movements and it will result in a more accurate reflection of fair market value.

For the rest of the portfolio, the early stage companies that aren’t easily compared to the public markets, we still think the ‘last round’ valuation method is best. But as a one-off, for the June 2022 quarter, we took an additional step. In light of the extreme market conditions, we have created a provision against this part of the portfolio. This was a more blunt instrument: we looked at those valuations at risk of being too high and took a provision against them based on the decline of public markets over the last nine months.

Both of these actions have now been completed for our 30 June valuations, which were released to our investors over the period of 21st-29th July and have now flowed through the superannuation funds’ unit pricing systems.

We feel our portfolio valuations now reflect the decline in listed technology company multiples in a fair and transparent way and our new policy sets us up to better deal with volatility in the listed markets.

Looking Forward

All this has resulted in the total valuation of our portfolio falling from $10B at the end of 2021 to $7.2B at the end of June 2022. While valuations are down from the March quarter, they are still strong returns overall.

We’re sanguine about this decline. The reduction in holding values reflects the market’s change in valuation metrics, not a reduction in our enthusiasm for the future of our portfolio companies.

In aggregate, a dollar invested in all of our funds has earned an IRR of 56% and more importantly for us a net multiple of invested capital (TVPI) of 4.4x. It’s not time to pat ourselves on the back – the vast majority of this is still unrealised, so it’s a progress mark at this point in time rather than the end result for our funds. Given the growth forecasts of our top companies we don’t have to look too far into the future to see that total valuation climbing back above the $10B mark and beyond.

Whilst a lot has changed in the last 12 months, we’re still investing in generational companies from the very beginning and earning the right to support the best founders for decades. Market conditions will change, prices will go up and down but a generational company last year is still a generational company today and we won’t stop searching for those companies.

We still remain boundlessly optimistic about founders in Australia and New Zealand. If you have a great business, please get in touch. We invest right from the beginning (we backed Canva at idea stage) so nothing is too early and no investment is too small.

* This post first appeared on the Blackbird blog. You can read the original here.

Credit: Source link

Comments are closed.