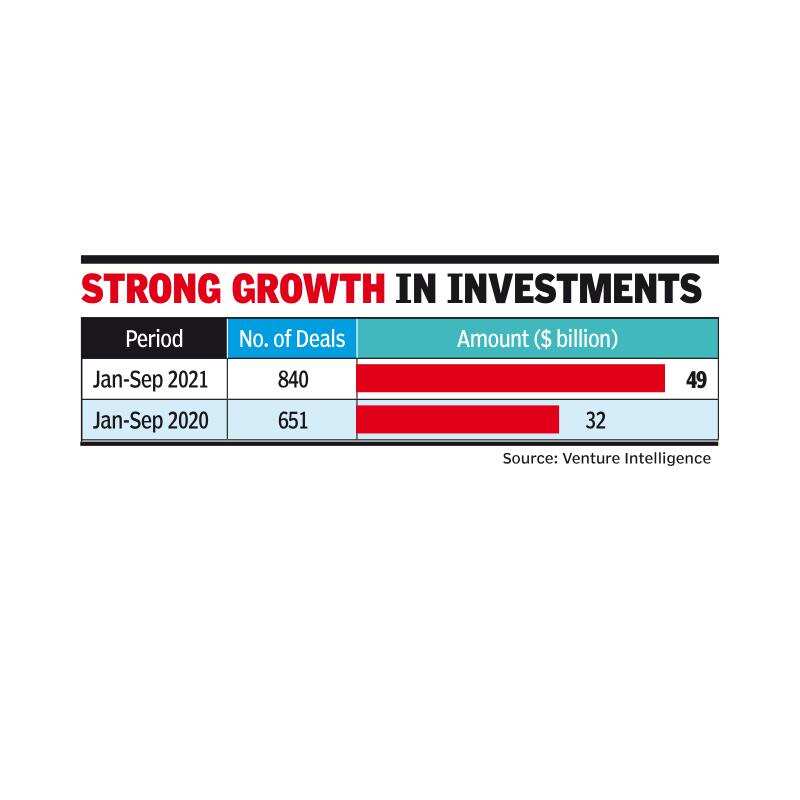

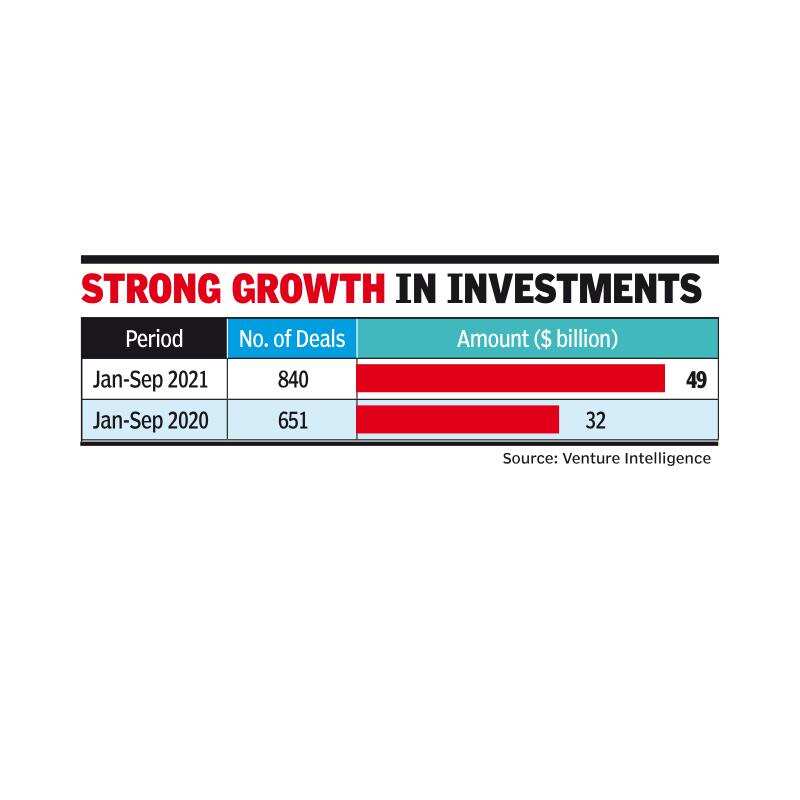

Chennai: Private Equity-Venture Capital (PE-VC) investments continue their upswing as tally of transactions in the first nine months of 2021 reached record high of $49 billion- up 52% over the same nine-month period last year and already exceeding the full year 2020 investment figure of $39.5 billion. Calendar year 2021 has also seen broad-based growth as PE-VC investments in both early-stage and late stage companies posted strong growth. The deal count in January to September 2021 has already reached 840 deals compared to 892 deals in the complete year 2020 and 651 deals in Jan-Sep 2020, data from Venture Intelligence shows. This tally excludes PE investments in real estate. The number of large sized deals (over $100 million in size) stood at over 100 in the nine months of 2021 compared to just 41 in the same period of 2020. Similarly, seed stage deals grew over 30% from 190 to 249 deals. Around $422 million worth seed stage investments were made by VCs in Indian startups this year compared to $216 mn last year. “While it is heartening to see the record pace of PE-VC investments in India sustaining, the highlight of the latest quarter was the successful IPOs of the Indian consumer market focused Zomato and the global enterprise SaaS focused Freshworks,” Arun Natarajan, founder, Venture Intelligence, said. “Such exemplary liquidity events will expand the share of the asset allocation pie that PE-VC investing in India commands from both domestic and foreign investors,” he added.

PE-VC investments in the July-September quarter stood at $20.1 billion across 368 deals — up 35% sequentially from the previous quarter and 69% compared to the same period last year.

The investments in unicorns totalled to over $20 billion and accounted for close to 41% of the value pie in 2021 thus far. The July-September quarter saw over $10 billion (across 28 deals) being invested in such companies.

With the pandemic bringing about rapid digitisation, the IT & ITeS industry accounted for $28.1 billion (70%) of the total investment pie during the first nine months of 2021. The sector also saw 58 mega deals ($100M+ deals) during the period and three billion dollar deals.

E-commerce giant Flipkart’s $3.6 billion Pre-IPO fundraise bringing Japan’s SoftBank Corp back to its cap table, BPO firm Hinduja Global Solutions’ sale of its healthcare services business to Baring Private Equity Asia for $1.2 Billion, and Blackstone acquiring stake in wealth management focused ASK Group for $1 billion, were the top deals in July-September.

PE-VC investments in the July-September quarter stood at $20.1 billion across 368 deals — up 35% sequentially from the previous quarter and 69% compared to the same period last year.

The investments in unicorns totalled to over $20 billion and accounted for close to 41% of the value pie in 2021 thus far. The July-September quarter saw over $10 billion (across 28 deals) being invested in such companies.

With the pandemic bringing about rapid digitisation, the IT & ITeS industry accounted for $28.1 billion (70%) of the total investment pie during the first nine months of 2021. The sector also saw 58 mega deals ($100M+ deals) during the period and three billion dollar deals.

E-commerce giant Flipkart’s $3.6 billion Pre-IPO fundraise bringing Japan’s SoftBank Corp back to its cap table, BPO firm Hinduja Global Solutions’ sale of its healthcare services business to Baring Private Equity Asia for $1.2 Billion, and Blackstone acquiring stake in wealth management focused ASK Group for $1 billion, were the top deals in July-September.

Related Posts

Credit: Source link

Comments are closed.