The number of deals and amount have fallen compared to previous quarter, when the State secured $587 million across 17 deals

The number of deals and amount have fallen compared to previous quarter, when the State secured $587 million across 17 deals

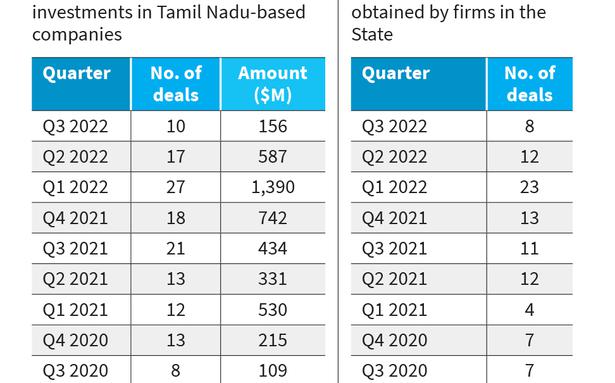

Private equity and venture capital companies invested $156 million across 10 deals in Tamil Nadu-based companies during the third quarter of 2022.

The number of deals and the amount of investment have fallen, compared with the corresponding quarter last year. During the third quarter of 2021, $434 million was invested across 21 deals, according to data provided by Venture Intelligence, a research service focussed on private company financials, transactions and valuations.

The figures include venture capital-type investments, but exclude private equity investments in real estate. The deals and the amount of investment were down from the previous quarter where the State secured $587 million across 17 deals.

This quarter, the biggest investment came into LifeWell Diagnostics, which secured $80 million from OrbiMed, a healthcare-focussed global investment firm. Other firms which got investments during the quarter are Detect Tech ($25 million), Wheelocity ($12 million) and M2P Fintech ($4 million).

The number of angel investments in Tamil Nadu-based companies have also come down this quarter. It stood at 8 as against 11 during the same quarter of 2021.

Even at the national level, the private equity and venture capital deals and investment have slipped this quarter. These firms invested $6.3 billion across 258 transactions in Indian companies during the quarter ended September 2022, a 71% decline from the same period in 2021 when $21.7 billion was invested across 414 deals.

“Given the global macro-economic developments and continued volatility in the public markets, the decline in the private company investment figures, compared to the lofty highs of 2021, was to be expected,” said Arun Natarajan, founder, Venture Intelligence.

“What is heartening, however, is the fact that we are tracking to close the year with investment figures higher than any other year, excepting the now clearly anomalous 2021. Also, investors are now looking at a range of sectors rather than just the digital technology companies that dominated the last two years,” he added.

Credit: Source link

Comments are closed.