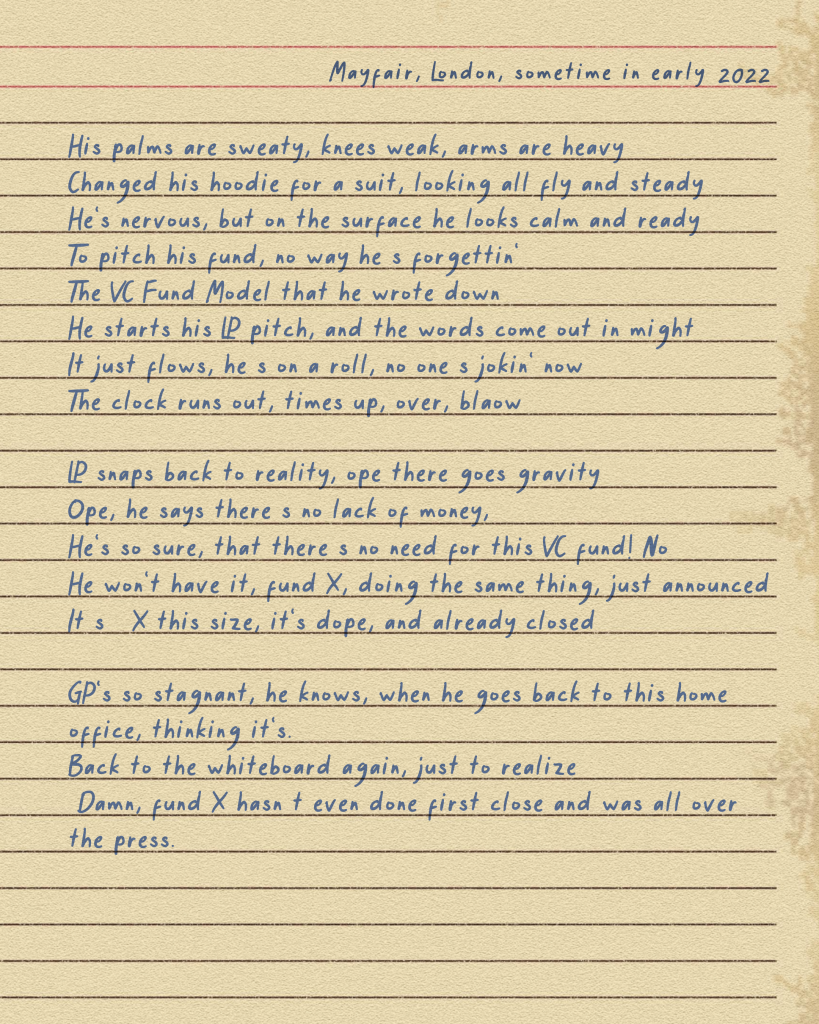

This original take on Eminem’s Lose Yourself was inspired by a real story that happened this year to an emerging European VC fund manager.

All joking aside, the anecdote reveals the worrying state of transparency and clarity in European venture, especially when it comes to misleading announcements of new funds raised.

I’ve seen everything from funds announced in the media that aren’t even incorporated yet, pre-first close funds announcing the target size of the fund as being raised or, to make it a bit more concrete, firms announcing their fund size when they only have like 0.02% of the capital effectively raised.

I love the hustle mindset; truly. But I also love transparency and honesty. And I dare say I love integrity above all.

This behaviour has real consequences on our beloved venture ecosystem — most of them negative. I’ll go into those in detail below, and talk about how we need more clarity around capital raised in Europe, while still staying ambitious.

Founders

Let me start with founders, the atomic unit of the venture ecosystem. Without entrepreneurs, all of us, VCs and LPs alike, wouldn’t exist. The practice of announcing funds that aren’t raised or purposefully inflating what has been raised so far leads to founders wasting their time when reaching out to VCs. And what are founders supposed to think when they see headlines like: “Firm A announces first close of €Xm, targeting a €XXm final close”, “Firm B closes fund of €Ym” or even “Firm C is fundraising a fund with target size of €Zm”.

I cannot count how many stories I’ve heard — in the last month alone! — of founders trying to raise from fund managers just to realise, a couple of months in, that they have no money.

VC Investors

As we move up the venture value chain, more issues arise. As an emerging LP myself, I speak with emerging VC fund managers every day. When I do due diligence on a new VC firm or syndicate, I often ask other GPs (general partners) for their view on the specific fund or team. More than once, VCs have mentioned that they have seen funds in the market speaking about inflated raise figures.

More and more VCs in Europe are following US practices of co-investing and collaborating more. This is great, and a huge opportunity for emerging managers. Announcing funds that do not exist, or inflating the numbers, creates trust issues between parties. We all have very little time, so please don’t waste it.

LPs

Coming back to our opening Eminem segment, this practice also affects LP appetite — something I have witnessed first-hand. A lot could be told about trust and perception towards venture as an asset class; but that’s similar to perspective above.

This of course has implications for the perception of venture as an asset class, but let’s look at it from a different perspective as well. Say I’m raising an early-stage €30m VC fund to back biotech companies, particularly in drug development, in southern Europe. I have a stellar team, and early access to all tech being developed at R&D centres through a right-of-first-refusal agreement in exchange for carry (a cut of the upside) to fund R&D at these often money-strapped organisations.

If another GP announces a €50m fund to do the same, or even something similar, LPs may very well ask if there is enough dealflow for that capital and whether you can get into the best deals. This is all good and fair if it were true. I have seen LPs completely dismiss GPs because they assume these announcements are true.

Impact on the ecosystem

It goes without saying that this short-sighted practice hinders the whole ecosystem and is a disservice to those actually succeeding in raising a VC fund (whether it’s a €5m microfund, or an astonishing €1b fund). It would be easy to point our fingers at some and put the blame on them but, honestly, we are all responsible!

LPs should be held accountable because they should reference check before building any type of conviction. VC investors should be held accountable because they just shouldn’t be doing this! Ecosystem builders (accelerators, incubators, tech event organisers, etc) should be held accountable to cross-check before inviting “pseudo” VCs to their events, pitch days, panels and so on. Media should be held accountable because journalists have a responsibility to interrogate news and not just print whatever is fed to them. Founders should be held accountable because they should publicly call out the VCs who do misrepresent themselves, just as much as they should celebrate the VCs who are doing good work.

Bringing more transparency into VC in Europe

VC’s older brother, private equity, is a good role model for best practice — and I almost hate myself for saying this as I’m quite vocal about the negative aspects of VCs in Europe having such a strong PE background. The whole PE ecosystem understands the dynamics of fund structures better than most stakeholders in the VC/startup ecosystem.

What can we do in our little “cottage” industry to get better? I think we can do, at least, three simple things:

- Educate — All stakeholders who are serious about their involvement in the industry must learn the basics of VC fund structures and their dynamics. There are many free (and paid) programmes out there that do this quite well.

- Do basic due diligence — We can always ask around and request the documentation to prove whatever information is being provided by a VC fund. Remember that VCs operate under tight regulations and there are things VCs can and cannot say. We tend to be very lenient in the industry, but one can ask and request a lot of documentation to check.

- At least freaking ask — It’s the least we can do to start holding everyone accountable so the whole ecosystem gets better. Remember, VCs are regulated and should not be evasive in answering this question. In fact they cannot inflate values when asked directly.

David Cruz e Silva is founder and co-host of The European VC.

Credit: Source link

Comments are closed.