The year will come to end in a span of just three weeks where this is the period when most of the activity slows down and trend is very visible in the amount of venture capital funding into Indian startups.

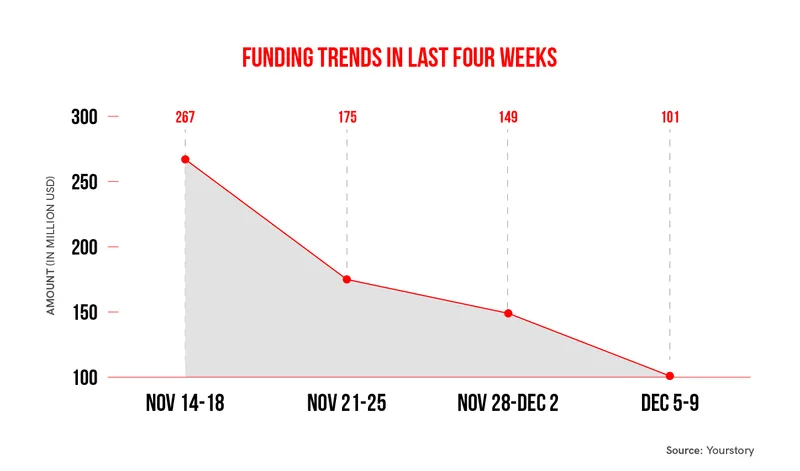

The second week of December saw total startup funding of $101 million cutting across 18 deals. In comparison, for the previous week the number stood at $149 million.

As the year comes to a close, it is time to take stock of the funding landscape of a slowdown in funding and it is very unlikely that there would be any change in the situation soon.

A recent report by data company Tracxn said in 2022, Indian startups have raised a total of $24.7 billion in funds to date, which is 35 percent lower compared to the same period in the previous year ($37.2 billion). The significant drop in funding is attributed to a decline in late stage investments, which fell by 45 percent from $29.3 billion in Jan-Nov 2021 to $16.1 billion for the same period in 2022. Seed stage rounds are currently also experiencing a contraction and have dropped by 38% as compared to the previous year.

The key point here being at both ends of the funding spectrum i.e, late and seed stages, there has been a contraction. This reveals the cautious sentiment of the investors who would not like to participate at a nascent stage of a startup nor are they keen to make a larger bet when these companies achieved a certain size.

Though there is hope that things would turn out for the better next year as there is enough capital that has already been raised by various venture capital firms.

Transactions

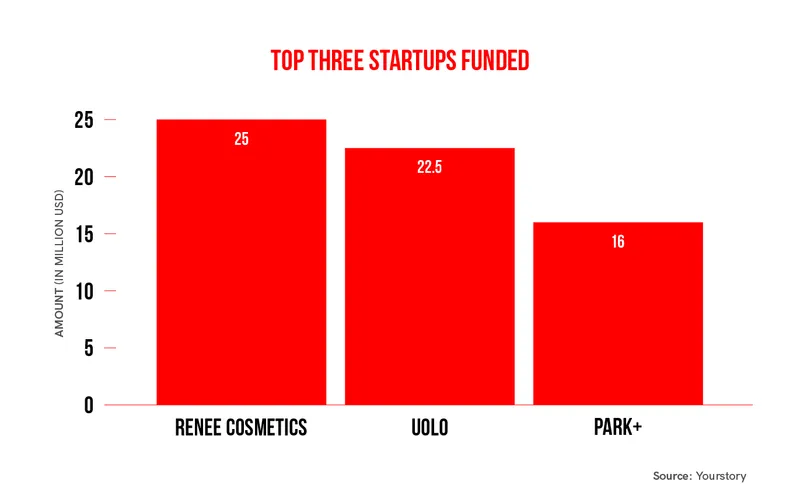

Renee Cosmetics raised $25 million from Evolvence India, Edelweiss Group, Equanimity and 9Unicorns.

Parking solutions startup Park+ raised $16 million from Eqip Capital, Matrix Partners and Sequoia Capital India.

Awfis Space Solutions, a tech-enabled workspace solutions platform raised $1.8 million led by existing investor Bisque Limited.

Credit: Source link

Comments are closed.