Alex Cyriac recalls his mother, who had a bone marrow transplant, stopped taking medication because she didn’t have enough money for the co-pay. His friend, Shobin Uralil, and his wife had similar medical issues with their first baby.

Though they knew each other in India, they bonded in the United States going through these personal experiences that were associated with the costs of healthcare.

They recognized health savings accounts as a powerful utility to save on healthcare costs, but thought the way those were run — largely by banks offering the service as an afterthought, according to Cyriac — were not putting the consumer first.

“We saw an opportunity to approach it differently and put the consumer first,” he added.

CEO Cyriac and Uralil started Lively in 2016 to be a modern take on the HSA for employers and individuals. Their early decision to build their own record-keeping technology stack means that the company can make its products free for individuals, who can set up recurring or one-time transactions and also don’t have to fill out forms for each claim.

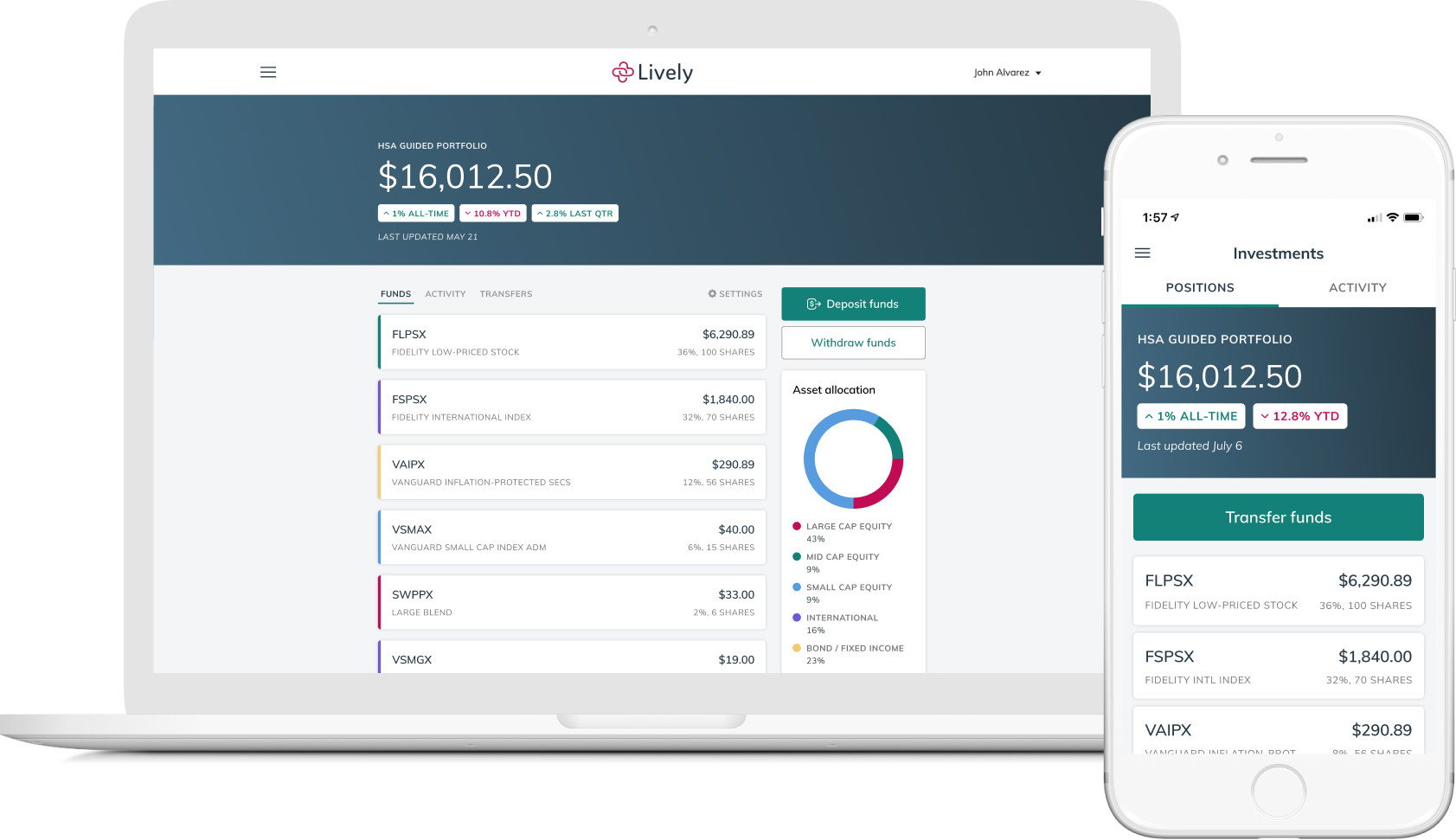

Lively investments. Image Credits: Lively

Today, the San Francisco-based company announced an $80 million Series C led by B Capital Group, which included Telstra Ventures and existing investor Costanoa Ventures. The latest funding round brings Lively’s total funding to over $120 million.

The new funding enables the company to build more consumer tools, scale its team and expand its offerings to financial institutions and employers. Lively started out direct-to-consumer and is now pushing into business-to-business.

Over the past 18 to 24 months, it built out that focus and saw its users double last year and then more than double this year, Cyriac said. This year, Lively partnered with BMO Harris to be the HSA provider for its members.

Market research firm Devenir showed that in 2020, HSA assets were estimated to be $77.8 billion held in over 30 million accounts, a figure that has doubled in the last three years. Similarly, HSA adoption has propelled Lively to $500 million in assets under management, Cyriac added. That’s after doubling its AUM every 11 months over the past few years. He expects to top $1 billion in assets early in 2022, which he said will make the company the fastest HSA provider to reach that milestone.

With costs rising year over year, there are fewer options for saving for long-term healthcare, and to open and fund an HSA, an individual has to be on a high-deductible health plan. Uralil says the average deductible on all health plans is now greater — nearly $5,000 per year — than the Internal Revenue Service definition of a high-deductible health plan.

“It’s a function of what is happening in healthcare, consumer-driven health, with more people responsible for the financial aspects of healthcare,” Cyriac said. “Every year, more people are eligible for HSA because of the rising costs and fast adoption of healthcare plans. Lively is providing tools to make more informed decisions on how to spend that money.”

Credit: Source link

Comments are closed.