There’s no magic formula for creating a winning pitch deck, which is why most of the articles we run on this topic continually emphasize the fundamentals.

Venture capitalists are like judges at a gymnastics competition: each pitch will be assessed for its technical quality and difficulty, but execution and artistry is just as important.

If your deck doesn’t give prospective investors a clear idea of how you will put their money to work, you might leave their office with a logo water bottle, but you are not going home with a term sheet.

Full TechCrunch+ articles are only available to members

Use discount code TCPLUSROUNDUP to save 20% off a one- or two-year subscription

Despite its simple purpose, the Ask slide is “almost universally a struggle to get right,” says Haje Jan Kamps, who reviews five reasons why founders frequently miss the mark:

- Forgetting to include the slide altogether.

- Not naming a specific dollar amount you are raising.

- Including a valuation on the slide.

- Omitting what the funds will be used for.

- Listing a specific runway, i.e., “This will keep us running for 18 to 24 months.”

“The whole purpose of doing a fundraising process is to raise money, so you may as well go all-in with a clear ask,” writes Haje.

Thanks for reading,

Walter Thompson

Editorial Manager, TechCrunch+

@yourprotagonist

Twitter Space: Is tech media creating “charismatic” founders?

Image Credits: YK/500px (opens in a new window) / Getty Images

Larger-than-life entrepreneurs are nothing new, but tech has taken that to the next level, often with an assist from news media.

Today at 1:00 p.m. PT/4:00 p.m. ET, Builders VC investor Andrew Chen will join me in a Twitter Space to discuss the role tech reporting plays in shaping ecosystems, narratives and expectations.

This should be a lively conversation, so please bring your comments.

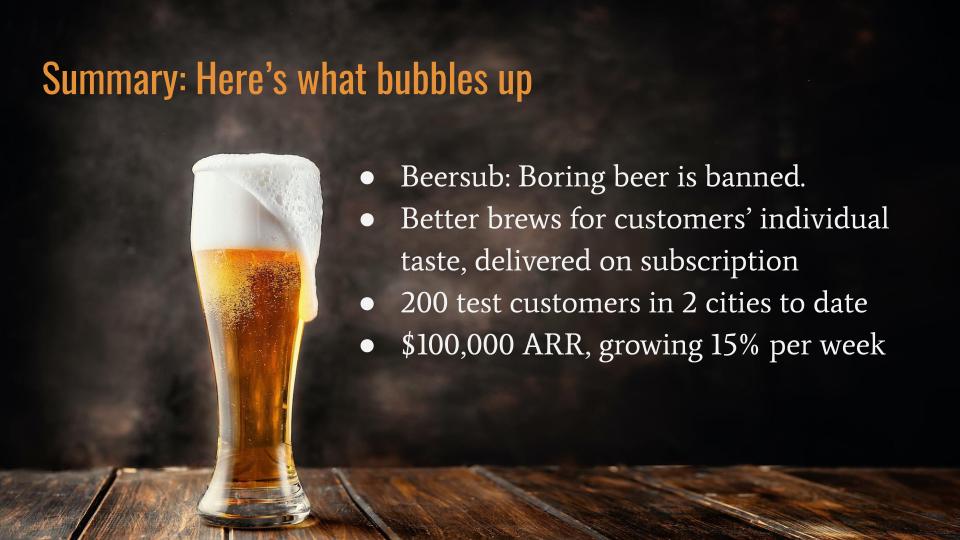

Hook your investors with the perfect summary slide

Image Credits: Haje Jan Kamps

When it comes to the summary slide, founding teams must answer the question “why invest?” by briefly recapping the strongest points from their presentation.

Haje Jan Kamps has curated several summary slides that will “cement your company in time and place by helping investors figure out how much you are raising, what stage your business is in, and well, what the hell your company actually does.”

5 lessons we’ve learned from building a venture fund from scratch

Image Credits: Yaorusheng (opens in a new window) / Getty Images

Emerging managers are under unique pressure to show their prowess when it comes to picking winners, but raising a fund and making investments doesn’t offer instant gratification.

Eric Tarczynski, managing partner and founder of venture fund Contrary Capital, says the early days of his firm were occasionally humbling.

“I once had an LP ask, ‘Have you invested in any startups I’ve heard of?’” he writes in a post that shares some of what he’s learned while raising two funds over the last five years.

“Building a brand, credibility and a track record takes time,” he says. “We’re five years in, and it routinely feels like we’re just getting off the starting line.”

How to implement a video SEO strategy

Image Credits: George (opens in a new window) / Getty Images

For anyone who runs a website, “pivot to video” has become a sour joke.

If your startup is shaping up its video content strategy, a wholesale shift isn’t required: instead, conduct a content audit to identify areas where interactive content can drive growth, such as testimonials, product announcements and webinars.

In a guide for first-timers, SEORadar creator Mark Munroe shares a checklist for preparing a video SEO strategy that boosts traffic and generates leads.

“Getting a sustained jump in web traffic is every SEO strategist’s dream, and video is [a] no-brainer way to do it,” writes Munroe.

3 methods for valuing pre-revenue novel AI startups

Image Credits: Charles Taylor / EyeEm (opens in a new window) / Getty Images

The Berkus Method, scorecard valuation and venture capital are the most-commonly used frameworks for costing pre-revenue startups, but when it comes to AI, are traditional yardsticks still useful?

“AI can scale much faster than other technologies, so what works at the beta or minimum viable product stage may not work when an AI product scales to millions of users,” according to Ryan E. Long, principal attorney of Long & Associates.

Long identifies some of the limitations of using traditional means to value pre-money “prototype or novel AI startups” in an article that identifies regulatory issues and shares tactics designed to “minimize the number of uncertain variables.”

Credit: Source link

Comments are closed.