Learn key takeaways from CertiK’s expert about how to maintain financial integrity as a Web3 entity.

Criminals have always found efficient ways to launder the proceeds of their crimes and avoid increasingly stringent anti-money laundering regulations. One such technique, uncovered by CertiK, poses a direct threat to Web3 projects. Criminal organizations are using this scheme to transform their illegal funds into seemingly-legitimate Web3 startups and reap high returns. In this article, CertiK’s former law enforcement investigators share their observations and provide practical takeaways on how to maintain the financial integrity of Web3 ventures.

Venture-Based Money Laundering (VBML) in Web3 is the manipulation of the venture seed funding ecosystem to convert crime proceeds into legitimate businesses and revenue streams through seed investment in early-stage ventures.

How does Venture-Based Money Laundering (VBML) work in Web3?

Our investigation team at CertiK conducted a study on 272 blockchain and Web3 startups and discovered the ways in which certain criminals use the VBML scheme to infiltrate the Web3 industry.

When an individual or organization commits a crime and accumulates illicit profits, they need to use a scheme to launder their funds in order to use the money freely without raising suspicions. VBML is one such scheme. Applied to the Web3 context, VBML consists of criminals seed-funding a new crypto project with “dirty” funds. This initial seed funding is used to hire developers, invest in marketing, and launch the project. The criminals spend the entirety of the illegal funds on these expenses and in return, own or co-own a productive Web3 project. From here, they can obtain “clean money” that is easily justifiable because they have a publicly known business to show as the origin of the funds. The “clean money” can be extracted multiple times throughout the life cycle of the project, such as during following fundraising rounds, token or NFT sales, payments for salaries, expenses, dividends, and when the criminals sell their project ownership.

Scope

This criminological study on the risk of money laundering in Web3 ventures was conducted on a sample of 272 Web3 crypto projects launched in 2022, in order to help criminal investigators understand the money laundering tactics currently used by career criminals. The researchers specifically focused on the risk of illegal proceeds being injected as initial equity in new crypto ventures. The “founding” or seed funding round is particularly appealing to criminal operators because it is generally considered “personal investment” and is subject to less scrutiny, controls, and anti-money laundering (AML) regulations, making it less likely to be detected by law enforcement. Additionally, this round has the potential for a very attractive return on investment. The research did not evaluate the risk of illegal proceeds being injected in subsequent rounds of fundraising as these rounds are typically sourced from larger, specialized venture capital firms which are subject to more thorough due diligence, accountability, and controls and are less accessible to core criminal operators.

Methodology

In addition to the risk of external attacks, the Web3 industry also faces the risk of scams by malicious project teams and legitimate projects being compromised by insider threats. To address this, CertiK created the KYC Badge program, which focuses on verifying and vetting the teams behind projects. Only project teams that agree to undergo a thorough background investigation are granted the badge. This distinguishes the verified, transparent, and accountable teams from other projects.

During the enhanced due diligence process and thorough audit of the team and project management, the investigators were able to detect and identify certain projects with hidden issues pertaining to the origin of their seed-funding. This risk was repeatedly detected through an analysis of discrepancies, a proprietary dataset of risk-signals, and a dataset of known malicious Web3 operators. CertiK’s investigators, who have previous experience in large-scale money laundering investigations, further assessed these issues through direct conversations with the applicants identified as highly exposed to this risk.

In some instances, the investigations revealed that the real project founders and owners were using deceptive tactics to hide behind a front team and were directly linked to criminal activities such as previous exit scams, various crypto scams, and even international drug trafficking. The results of this research are presented below.

Prevalence of VBML In The Crypto Industry

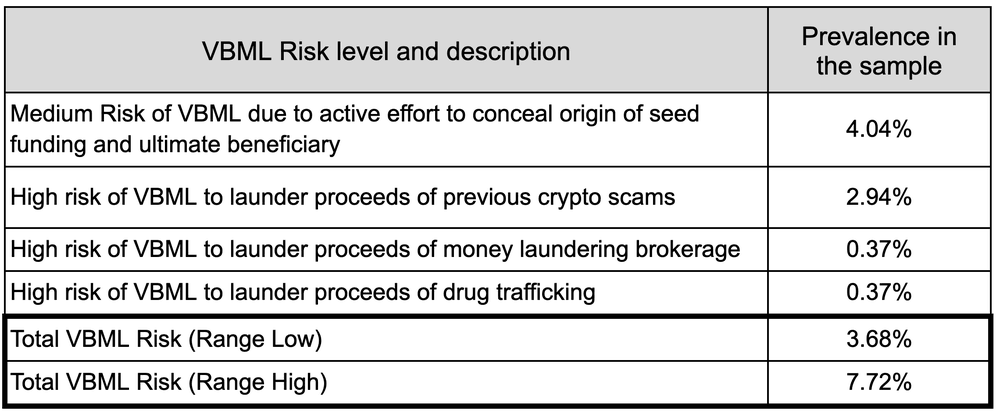

In this anonymized sample of 272 projects, an estimated 3.68% to 7.72% of crypto projects were identified as exposed to a risk of VBML. This suggests that 3 to 7% of new crypto projects could be seed-funded by criminal proceeds.

If we extrapolate this risk to the 1,500 most well-funded crypto projects in 2022 and estimate that a crypto venture needs at least 150K USD of seed funding for initial development and marketing expenses, the VBML risk would amount to 8 to 17 million USD a year.

It’s important to note that this projection is specific to seed funding and does not include other funding rounds in which venture capitalists invest around 20 billion USD a year. Additionally, this projection does not include other known money laundering schemes.

Comparison with Global Money Laundering Estimates

It is important to recognize the magnitude of global money laundering, which is proportionate to the amount of cash generated by crime worldwide. The United Nations Office on Drugs and Crime (UNODC) estimates that the aggregate amount of money laundered globally every year is equivalent to 2 to 5% of the global GDP, which suggests that criminals currently launder $1.9 to 4.8 trillion USD of criminal proceeds a year.

In comparison, crypto crime proceeds are estimated at $3.7 billion USD a year (approximately 0.15% of global crime proceeds), and the VBML scheme studied here is estimated to launder approximately 8 to 17 million USD a year. Our field observations suggest that VBML offers a very efficient, lucrative, and comparatively low-risk technique to launder criminal proceeds via new Web3 ventures. However, the relatively small size of initial seed funding and the limited number of such venture opportunities make it not scalable enough to satisfy the demand for global money laundering.

(Note: This figure should not be confused with the yearly measurement of non-compliant crypto-transfers, estimated at $20.1 billion USD in 2022.)

A Never-Ending Game of Cat and Mouse?

Money laundering (ML) and Anti-Money Laundering (AML) are criminological concepts that progressively developed during the course of the 20th century. Initially, money laundering was not considered an autonomous crime, but rather as a strategy to disrupt criminal activities such as drug trafficking, bank robberies, and corruption. Targeting the criminal’s wealth can be more effective than prosecuting their original criminal activities. This strategy was widely adopted and the activity of money laundering became a crime in itself, based on its potential negative effects. In the short term, ignoring incoming crime money can have positive effects, such as bringing much-needed capital to businesses, cities, and countries. But in the long term, it has negative effects on countries and economies. When left unchecked for a long time, laundered funds increase corruption and organized crime, decrease goodwill, productivity, and competitiveness of businesses, undermine trust in law and institutions, and threaten societal stability.

Regulators Deploy Systematic AML Restrictions

Authorities attempt to reduce crime and corruption through systematic AML measures. In addition to targeting criminals who launder their proceeds, there is now a second level of AML that targets anyone, even non-criminals, who participate in systems that could help criminals launder their money. This additional layer of AML regulations means that when scammers and fraudsters are arrested, they can be charged and convicted not only for their original crimes, but also for not complying with AML regulations. This layered AML approach is costly and burdensome for honest people and organizations, but it does facilitate criminal prosecutions.

Criminal Organizations Systematically Adapt Laundering Techniques

Despite an estimated $274 billion USD annual cost of worldwide AML financial compliance and the heavy restrictions imposed on honest retail users and legitimate organizations, organized crime continues to adapt and combine creative laundering tactics. Criminals are still able to launder an estimated $1.9 to 4.8 trillion of crime proceeds per year. According to the Financial Action Task Force, Trade-Based Money Laundering (TBML) is one of the most frequently used methods of money laundering, easily concealed in the massive global trade market of $28.5 trillion per year. Real-estate-based money laundering is also very appealing to criminals, because it is legitimate, safe, lucrative, and is by far the biggest store of wealth with a total market size estimated at $326 trillion. The following infographic shows the variety of money laundering schemes used by criminals.

How to Preserve the Financial Integrity of Web3 Ventures

The risk of VBML in Web3 may seem relatively small compared to other wide-spread typologies of money laundering, such as TBML, and Real-Estate-Based Money Laundering (REBML). However, it is still a serious threat to Web3 ventures because it exposes contaminated projects to critical operational, reputational, and legal risks. The theory of money laundering suggests that economic systems that turn a blind eye to criminal proceeds benefit in the short term, but will suffer severe adverse effects in the long run.

Beyond abiding with the law, the economic health of the Web3 and crypto industry depends on its efforts toward financial integrity. Our research confirms that crypto projects that are secretly seed-funded with stolen funds are the highest risk projects for their users and investors, resulting in higher rates of subsequent failures, fraud and scams.

Here are three takeaways on money laundering in Web3, from an investigative perspective:

– Do not fall for money laundering misconceptions. Soft money laundering, such as transferring legitimately-earned money without following AML regulations, is a serious compliance issue but it should not be conflated with hard money laundering. Dangerous criminals such as drug traffickers, thieves, and corrupt officials have no difficulty laundering large amounts of criminal proceeds, while honest individuals may be unfairly targeted for transferring legitimate funds. It’s important to note that crypto-related crime proceeds (at $3.7 billion in 2022) only account for a tiny fraction (0.15%) of global money laundering (estimated at $1.9 to 4.8 trillion annually), while international trade and real estate remain the favored instruments for money laundering.

– Blockchain is not the problem, it’s the solution. Blockchains and cryptocurrencies are often accused of facilitating crime and money laundering, but blockchain technology offers transparency and traceability that can help ensure the integrity of economic and political systems. When widely adopted, it can aid in detecting and investigating money laundering and fraud, as well as directly prevent and combat core criminal activities. For example, blockchain can facilitate monitoring of how taxes are used by government officials, increasing accountability while reducing corruption, abuse, and waste.

– Due diligence is crucial for Web3 financial integrity. As the industry is relatively new, there are fewer standards and guidelines than in other industries, leading some operators to underestimate the importance of due diligence and compromising the security and integrity of their projects. To reduce the risk of Venture-Based Money Laundering in Web3 ventures, experts recommend conducting risk-based due diligence on key investors, core team members, and owners of new crypto projects. Criminal operators often hide behind intermediaries, so detecting their involvement requires a thorough background investigation.

Using a third-party security auditor to conduct due diligence assessments and investigations can significantly enhance the security and integrity of Web3 projects. Security experts with specialized training and experience in criminal and background investigations are adept at detecting fraud and efficiently assessing criminal risk. The team of professional investigators at CertiK come from diverse intelligence and law enforcement agencies and utilize a comprehensive background investigation and risk assessment process. They also have access to a proprietary dataset of repeat Web3 fraudsters and tailored risk signals to aid in fraud detection. Organizations seeking to ensure the integrity of their blockchain ventures can contact CertiK’s Technology and Risk Advisory Team. Meanwhile, projects experiencing an immediate security incident can reach out to the CertiK 24/7 Incident Response Team for consultation with their investigators.

Credit: Source link

Comments are closed.