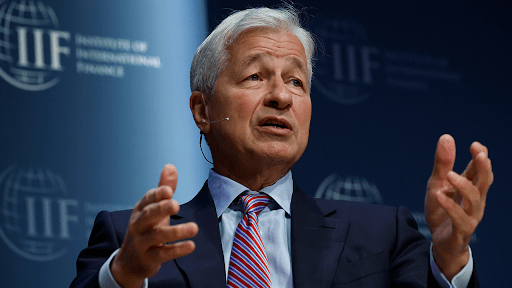

Jamie Dimon, longtime CEO of JPMorgan Chase, warned in his recent annual letter to shareholders that the collapse of Silicon Valley Bank will have long term economic consequences but, on the upside, “recent events are nothing like what occurred during the 2008 global financial crisis.”

While the SVB fiasco has largely faded from news coverage, outside of industry specific outlets, “The current crisis is not yet over, and even when it is behind us, there will be repercussions from it for years to come,” Dimon wrote

Silicon Valley Bank was closed by regulators on March 10 after depositors withdrew billions of dollars from the bank, which had been a mainstay of the Silicon Valley startup ecosystem. Two days after Silicon Valley Bank was closed, Signature Bank was closed by New York state banking regulators, while Swiss regulators brokered a purchase of Credit Suisse by UBS.

JPMorgan partnered with other large banks to deposit $30 billion at First Republic, another regional lender that teetered on the precipice but has since stabilized.

Since the twin failures of regional banks in March, worried depositors have moved billions of dollars to banks deemed “too big to fail”, but Dimon said JPMorgan wants to strengthen the smaller banks for the benefit of the whole financial system.

“Any crisis that damages Americans’ trust in their banks damages all banks – a fact that was known even before this crisis. While it is true that this bank crisis ‘benefited’ larger banks due to the inflow of deposits they received from smaller institutions, the notion that this meltdown was good for them in any way is absurd,” Dimon wrote.

Risks ‘hiding in plain sight’

Dimon noted that most of the risks facing Silicon Valley Bank, including the potential losses from held-to-maturity bonds, were “hiding in plain sight.” The unknown variable was the interconnected network of SVB’s deposit, he said.

“The recent failures of Silicon Valley Bank (SVB) in the United States and Credit Suisse in Europe, and the related stress in the banking system, underscore that simply satisfying regulatory requirements is not sufficient. Risks are abundant, and managing those risks requires constant and vigilant scrutiny as the world evolves,” Dimon wrote.

He urged regulators to be “less academic, more collaborative,” noting that the held-to-maturity bonds now a problem for many banks are actually highly rated government debt that scores well under current rules but that recent stress tests did not game out a rapid rise in interest rates.

“This is not to absolve bank management – it’s just to make clear that this wasn’t the finest hour for many players. All of these colliding factors became critically important when the marketplace, rating agencies and depositors focused on them,” Dimon wrote.

He cautioned policymakers to avoid new rules that unintentionally push some financial services to nonbanks and so-called shadow banks.

Peter Page is the Contributions Editor at Grit Daily. Formerly at Entrepreneur.com, he began his journalism career as a newspaper reporter long before print journalism had even heard of the internet, much less realized it would demolish the industry. The years he worked a police reporter are a big influence on his world view to this day. Page has some degree of expertise in environmental policy, the energy economy, ecosystem dynamics, the anthropology of urban gangs, the workings of civil and criminal courts, politics, the machinations of government, and the art of crystallizing thought in writing.

Credit: Source link

Comments are closed.