The first mover advantage that turned Block-owned Afterpay enjoyed since its launch nine years ago is about to end, with the world’s most valuable tech company, Apple, set to become Australia’s leading buy-now-play-later (BNPL).

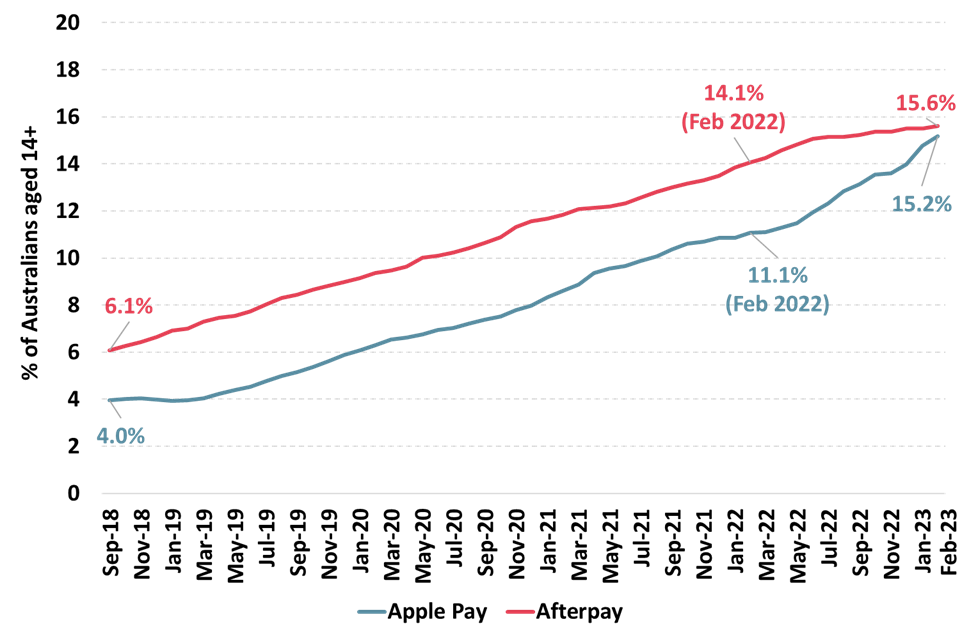

The Roy Morgan Digital Payments Report reveals it’s taken just 7 years for Apple Pay to build its local market penetration, with around 3.2 million Australian users (15.2% of the population), just behind Afterpay at 3.3 million users (15.6%), with the smartphone solution due to overtake the Australian fintech within months.

Apple Pay has grown 4.1% points in 12 months, from 11.1% of Australians in February 2022 to 15.2% a year later, as Afterpay’s growth began to flatline over the last six months, just as Apple Pay’s user growth accelerated. Afterpay grew by 1.5% in the past year from from 14.1% in February 20232 – an increase of 1.5% points in a year.

Roy Morgan CEO Michele Levine said the rapid growth in usage of both Apple Pay and Afterpay sits in contrast to the digital payment service market leaders PayPal and BPAY, which are used by far more Australians, but haven’t seen such rapid growth in recent years.

Just 28 months ago, Afterpay’s Australian user penetration sat at 6.1%, Apple Pay’s at 4%.

Usage in an average 12 months of digital payment services Apple Pay & Afterpay (2018-2023)

Source: Roy Morgan Single Source, October 2018 – February 2023.

Levine said the wide variety of digital payment services available today appeal to very different consumers

“The digital payment services market is a competitive one as we have seen recently with both Latitude Pay and openpay exiting the ‘buy-now-pay-later’ market in recent months as interest rates increased and competition in the market intensified. Latitude Pay was taken off-line just this week,” she said

“Overall awareness of ‘buy-now-pay-later’ services such as Afterpay, Zip and Klarna is high with the sector the most well-known type of digital payment service – now 18 million Australians (84%) say they are aware of these services. However, only 4.3 million Australians (19.9%) have used a ‘buy-now-pay-later’ service in the year to February 2023.

“The usage of ‘buy-now-pay-later’ services still trails well behind more traditional digital payment services such as ‘online payment platforms’ PayPal, Visa Checkout and Masterpass. Nearly half of Australians, 10.2 million (47.5%), used an online payment platform in the year to February 2023 – despite lower overall awareness.”

This week ASX-listed Zip, the leader of a peloton trailing Apple and Afterpay in the BNPL space, announced a deal with US tech-ercise platform Peloton, which dropped its existing BNPL provider, Affirm, for Zip.

Afterpay was acquired in late 2021 by US payments platform Square for A$39 billion. The business subsequently rebranded as Block (ASX: SQ2) in a dual ASX/NYSE listing. Block’s share price has fallen around 43% on the ASX over the last 12 months

The digital payment services Roy Morgan measures include PayPal, BPAY, Afterpay, Humm, Apple Pay, Zip, Google Pay, Post billpay, Visa Checkout, masterpass, Western Union, Klarna, fitbit pay, Garmin Pay, paywear, Samsung Pay, Commbank Tap & Pay, ANZ, NAB Pay, Bankwest Halo and Cryptocurrencies such as Bitcoin, Ethereum, Tether, Ripple and Cardano.

Credit: Source link

Comments are closed.