Consolidation in the financial services sector, as corporates swallow up fintechs, has been a key driver of growth in the fintech sector over the past 12 months according to analysis by KPMG.

The KPMG Fintech Landscape 2021, an annual survey of independent fintechs that are either active and/or headquartered in Australia, reveals there are currently 718 active fintechs, up from 701 in the previous landscape report released in December last year.

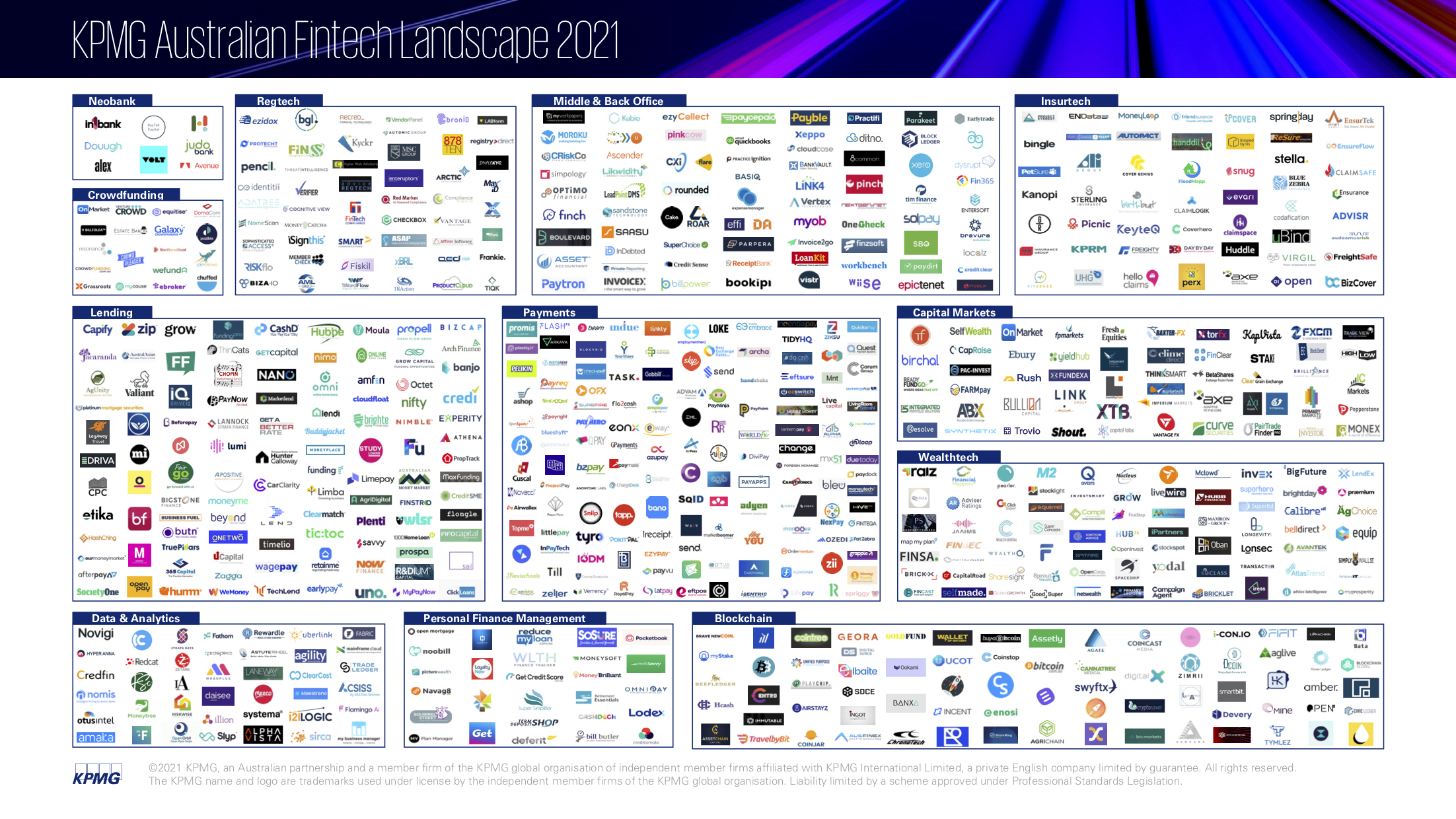

KPMG Australian Fintech Landscape 2021

| Categories | 2021 | 2020 (adjusted) |

Change (#) |

Change (%) |

||

| Blockchain and Crypto Currency | 72 | 81 | (9) | (11.1%) | ||

| Capital Markets | 53 | 53 | – | – | ||

| Crowdfunding | 18 | 20 | (2) | (10.0%) | ||

| Data and Analytics | 40 | 39 | +1 | +2.6% | ||

| Insurtech | 51 | 55 | (4) | (7.3%) | ||

| Lending | 107 | 97 | +10 | +10.3% | ||

| Middle & Back Office | 75 | 62 | +13 | +21.0% | ||

| Neobank | 8 | 10 | (2) | (20.0%) | ||

| Payments | 141 | 140 | +1 | +0.7% | ||

| Personal Finance Management | 27 | 26 | +1 | +3.8% | ||

| Regtech | 51 | 47 | +4 | +8.5% | ||

| Wealthtech | 75 | 71 | +4 | +5.6% | ||

| Total | 718 | 701 | +17 | +2.4% |

Daniel Teper, National Fintech Lead, KPMG Australia, said it had been a year of excitement for Australia’s fintech eco-system, which saw a significant level of M&A activity alongside continued investment in the space.

“The Australian fintech sector has grown up in 2021. Whilst we continue to see early stage opportunities in the overall ecosystem, it’s at the big end of town that things really stepped up – this year we’ve seen record levels of corporate investment in the space, with transactions including NAB’s acquisition of 86 400, Latitude’s acquisition of Symple Loans and of course, the expected acquisiton of Afterpay by the US headquartered Square due to complete later this year,” Teper said.

“To put this in perspective, the Afterpay transaction would represent the largest ever takeover in Australian history, and has put Australian fintech firmly on the global map.”

Teper said the key insights from the KPMG Fintech Landscape 2021 include:

- The number of fintechs solving middle and back office problems increased by more than 20%, driven by the increasing demand for automation and integration from incumbents and innovators alike

- Lending continues to be a hot category, with the number of fintechs in the space up by over 10% led by successful operators in the consumer lending, mortgage and buy-now-pay-later sectors, and supported by low interest rates and availability of investor funding

- The Neobank sector continues to evolve – 2021 saw the acquisition of two of Australia’s founding neobank players (86 400 and Up), whilst challengers continue to progress with the granting of new banking licences (Alex Bank and Avenue Bank)

- Payments remains an active sector, with 15 new fintechs added to the landscape, although this was counterbalanced by acquisitions and a number of fintechs in the category that ceased trading

- Blockchain and Crypto Currency continues to evolve as market participants jockey to understand what the future structure of the category looks like.

Teper said this year delivered record levels of M&A activity involving larger financial institutions and strategic investors.

“Corporate participation has in part been driven by a response to the permanent shift in customer behaviours and preferences towards digital, as well as the need for traditional players to accelerate their own digital transformation agendas,” he said

“It is also the clearest sign yet that parts of the ecosystem are starting to mature and gain relevance in the market, and that the incumbent financial services players are therefore having to take notice of the space.”

The KPMG fintech lead said that activity has further validated the working thesis of many founders and investors: “that successful fintechs can quickly scale and be genuine challengers to incumbent providers – and we expect that this will act as a catalyst for further innovation and investment in the sector across a broad range of categories as fintech continues to become a more mainstream and credible sector.

The full KPMG Fintech Landscape report is here.

The 2021 Fintech Landscape map. Image: KPMG

NOW READ: EY: Australian fintech is now at global levels

Credit: Source link

Comments are closed.