Also in this letter:

- Indian venture capitalists put their money on Web3

- Pine Labs in talks to raise $100 million from Falcon Edge

- No specific timeline for Flipkart’s IPO, says Walmart CFO

Tax numbers suggest Indian advertisers are looking beyond Alphabet and Meta

The local units of Alphabet and Meta together paid an equalisation levy of Rs 1,254 crore in FY21, accounting for more than 60% of the tax collected under this category.

India collected a total of Rs 2,057 crore in equalisation levy in FY2, up 85% from the previous fiscal. However, Google India and Facebook India’s share in total collections fell from over 85% in FY20 to 61% in FY21.

- The equalisation levy is a 6% tax on global companies that generate online advertisements from Indian residents, or non-resident companies with a permanent establishment (PE) in India. Last year, the government expanded the scope to include more services.

Twin trends: The numbers indicate two things: that digital media is growing rapidly, and that Alphabet and Meta’s competitors, especially video platforms and ecommerce companies, are getting more attention from advertisers.

When the pandemic struck, Google and Facebook made hay as people spent more time online. Even as other media vehicles struggled, Google and Facebook garnered advertising worth Rs 23,212 crore from Indian advertisers in FY21, a 28.57% increase over the previous year.

Facebook’s gross advertising collections from the Indian market grew 41%, while Google’s grew at 21.37%, albeit on a higher base.

Facebook ended up paying an equalisation levy of Rs 518 crore — 6% of the Rs 8,638.5 crore it spent on buying ad inventory from sister subsidiaries — while Google India paid Rs 736 crore on its Rs 12,262 crore inventory purchase. Facebook India buys ad space from two subsidiaries, Facebook US and Facebook Ireland, while Google’s India unit buys it from Google Singapore.

Pine Labs in talks to raise $100 million from Falcon Edge ahead of 2022 IPO

Pine Labs is on the verge of raising $100 million from Falcon Edge at a valuation of $5-5.5 billion, multiple sources told us. The company is also looking to list in the US in the first half of 2022.

Pine Labs, which is best known for its point-of-sale devices, recently entered the online payments space by launching a payment gateway platform called Plural in October.

The company has also been on a fundraising spree this year. It last picked up $100 million from US-based Invesco in September. Before that, it raked in $600 million across two tranches.

The company plans to focus on four to five areas of growth before it goes public. These include digital QR, merchant commerce, online payments, and consumer payments through Fave, which it recently acquired.

How Falcon got the edge: Co-founded by Rick Gerson, who is based in New York, and Mumbai-born Navroz Udwadia, Falcon Edge invested $400 million in Indian startups in all of 2020 but had picked up the pace this year.

Last week we reported that it was in advanced talks to lead a $250-300 million investment in Cars24, an online platform for selling used cars.

A fortnight ago it co-led an $840-million investment in Dream Sports, the parent company of online fantasy gaming platform Dream11, at a valuation of $8 billion. DST Global, D1 Capital, Tiger Global and Redbird Capital also participated in the round.

In May we reported, citing sources, that Falcon Edge had deployed $800 million to $1 billion in Indian tech startups from January to April.

Tweet of the day

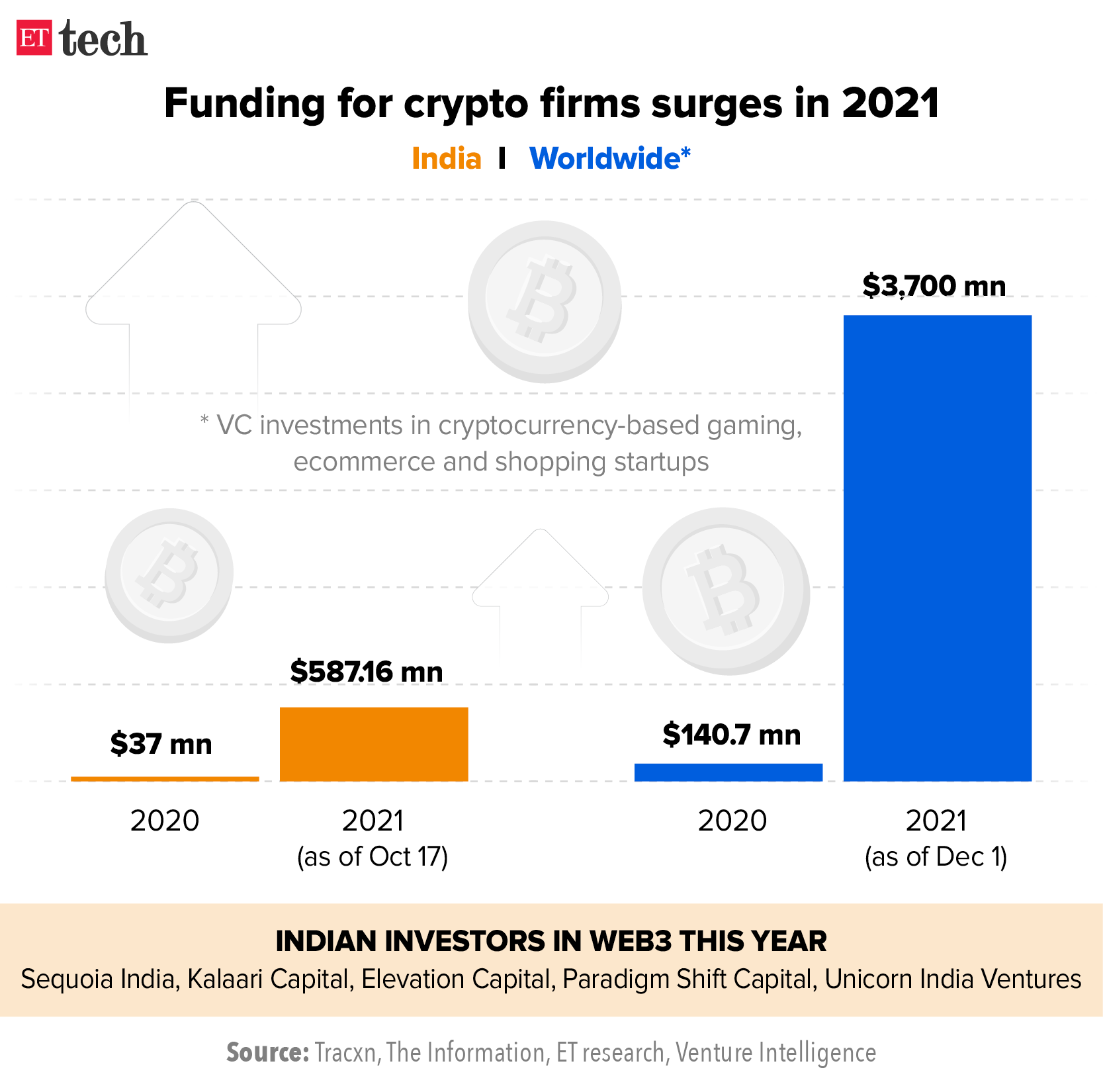

Despite crypto uncertainty, Indian VCs put their money on Web3

Indian venture capital firms are betting big on Web3 startups, in the belief that these companies are building products for the next stage of the internet.

What is Web3? Web3 refers to a decentralised online ecosystem based on blockchain technology. Apps and platforms built on Web3 won’t be owned by a single gatekeeper. They will instead be owned by the users themselves. In its current form, Web3 encompasses categories such as cryptocurrencies, non-fungible tokens (NFT), decentralised finance (DeFi), and decentralised autonomous organisations (DAO).

Getting in on the ground floor: Early-stage VC Antler India has committed to investing in 25-30 startups in the blockchain and Web3 space in the next two to three years.

It has plans to deploy $100 million to $150 million in more than 100 Indian startups over the next three years, including $50 million in Web3 companies.

Sequoia India has made about 20 investments in Web3 startups, including Betafinance, Clearpool, Coinshift and Faze. Before 2021, it had invested in only two Web3 startups.

Risky business: The investments continue despite regulatory uncertainty in India, with the cryptocurrency bill expected to be tabled in the ongoing session of Parliament.

Investments in the space have been dominated by international funds such as Jump Capital, Pantera Capital, Coinbase Ventures, which have been scooping up early winners. International funds have invested over $500 million this year in India’s startup and blockchain ecosystem.

“There is still regulatory risk,” said Sharma. “We are making a commitment officially not because we think the regulations are necessarily going to be 100% positive but because we think there is a long-term story here.”

No specific timeline for Flipkart’s IPO, says Walmart CFO

There is no specific timeline to Flipkart’s initial public offering even as the online retailer is on its path to profitability, according to Walmart chief financial officer Brett Biggs.

Quote: “The (Flipkart) business is performing almost exactly like we thought it would. An IPO is still very much on the cards for that business. Just like everything else, it’s the timing. Is the business exactly where you want? Is the market right? All those things have to figure into what you do with an IPO,” Biggs said at the Morgan Stanley Global Consumer & Retail Conference last week.

In July, the Bengaluru-based ecommerce major was valued at $37.6 billion after it mopped up $3.6 billion from the likes of Canada Pension Plan Investment Board, Singapore’s sovereign wealth fund GIC, and Japan’s SoftBank Vision Fund II, along with its largest shareholder Walmart.

Last week we reported that Flipkart cofounder Binny Bansal had sold a part of his shareholding amounting to $200-$250 million when the ecommerce major last raised funds in July. Bansal, who cofounded Flipkart with Sachin Bansal in 2007, sold shares to existing investor Tencent Holdings.

Online retail boom: The Indian ecommerce market is the largest opportunity in the local internet ecosystem. It is expected to reach $133 billion by 2025 from $24 billion in 2018. Flipkart is a leader in categories such as clothes, where it is twice the size of its nearest rival. Amazon, however, leads in mobiles and consumer electronics while Reliance has used its offline footprint to build early leadership by order volumes in the online groceries.

Spinny rides into unicorn club with $283 million funding

Spinny founder Niraj Singh

Spinny, an online used car marketplace, has raised $283 million in its Series E funding round led by ADQ, Tiger Global and Avenir Growth.

The round gives the company a valuation of around $1.8 billion and marks Spinny’s entry into the unicorn club – startups valued at $1 billion or more. It is the 38th unicorn minted in India this year. Spinny was valued at $740 million when it raised $108 million from Tiger Global and others in July.

Deal details: ADQ and Tiger Global invested $100 million each, while Avenir Growth put in $50 million and Feroz Dewan’s Arena Holdings infused $25 million, a source told us.

The fundraise also includes a $35 million secondary sale component in which some existing investors have partly or fully cashed out.

How’s business? Founded in 2015 by Niraj Singh, Mohit Gupta, and Ramanshu Mahaur, Spinny currently sells more than 3,000 used cars every month, three times what it did in January. It competes Cars24, Cardekho and Droom, all of which have raised large rounds this year.

According to industry estimates, about 4.5 million used cars were sold in India in 2019 and the market is growing at a 12% compounded annual growth rate.

Other done deals

■ Thrasio-style ecommerce venture Goat Brand Labs has bought lifestyle brand Pepe’s stake in its India business, which was housed under Pepe Jeans Innerfashion Pvt Ltd – a joint venture between Kolkata-based Dollar Industries and Pepe. Dollar Industries and Goat Brand will now run Pepe Jeans Innerfashion. The JV entity has the Pepe licence for categories such innerwear, loungewear, socks and sleepwear. Goat Brand plans to acquire more brands in the space and will thus change the name of the JV entity, said Rishi Vasudev, cofounder and CEO.

■ Agritech startup AgroStar has raised $70 million in a Series D funding round led by Evolvence, global asset manager Schroders Capital, Hero Enterprise, and UK’s development finance institution CDC. The round also saw participation from existing investors Aavishkaar Capital, Accel, Bertelsmann, Chiratae Ventures, and Rabo Frontier Ventures.

■ Customer engagement platform MoEngage has raised $30 million, led by Steadview Capital. Existing investors Multiples Alternate Asset Management, Eight Roads Ventures, F-Prime Capital, and Matrix Partners also participated in the round. The company has raised $100 million so far.

■ LenDenClub on Tuesday said it has raised $10 million (about Rs 75.3 crore) in a funding round from a clutch of investors, including Tuscan Ventures, Ohm Stock Brokers, Artha Venture Fund and others, valuing the peer-to-peer (P2P) lending platform at more than $51 million.

■ CloudSEK, a cybersecurity startup headquartered in Singapore and that has most of its operations and engineering based in India, has raised $7 million in Series A funding, its largest round yet. This round, led by MassMutual Ventures, increases the total amount raised by CloudSEK to around $10 million.

Other Top Stories By Our Reporters

Credit: Source link

Comments are closed.