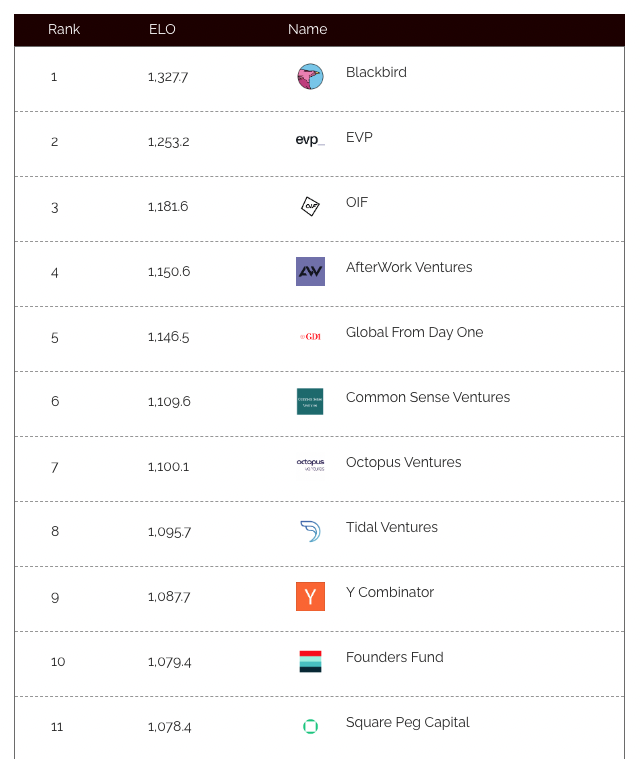

Australia’s biggest venture capital fund, Blackbird Ventures, is the favourite among startup founders according to a new ranking charting how “founder friendly” VCs are.

Like the Hottest 100, Eurovision and GOAT rankings in every sport, the list is bound to spark controversy for the notable absences of some leading names in the top 25, while two in the “big three” – Square Peg and Airtree – failed to make the top 10. Paul Bassett’s fund comes in at 11, with Airtree just scraping in at 25

The “VC Leaderboard” covers Australia and New Zealand and was developed by Joe Patrick and Albert Patajo from challenger fund Astral Ventures in a bid “to be a source of truth showing the best VCs in the eyes of founders”, to address the “rumour and hearsay” they hear about VCs.

They plan to offer more detailed qualitative insights down the track before quantitive rankings, but pledged not to release any raw data.

Ahead of its release overnight, more than 700 submissions were received ranking 150 funds across Australia and New Zealand.

They asked: “Who would you rather have as an investor?”

To vote, founders must have raised with VC funds on the list, and they were verified using LinkedIn and Crunchbase before their details were stripped from the votes.

To compare apples with oranges, so highly active funds such as Blackbird didn’t dominate, an Elo-based algorithm was used to rank the funds in a way that removes bias towards larger more active VCs.

An Elo rating system is normally used to calculate the relative skill levels of players in zero-sum games.

Posting the top 25 list overnight, the Astral site said the were “democratising this information so that founders are more empowered to make decisions regarding their investors”.

New Zealand fund Global from Day One made the top 5, with EVP, OIF and Gen X newcomer Afterwork filling in the 2-4 slots.

Jessy Wu, principal and head of community at Afterwork said: “We’re really happy with our ranking and are very happy to come behind Blackbird, EVP, and OIF – funds we admire deeply”.

The Symington family’s Melbourne family office, which backs early-stage companies with a focus on US expansion, was the quiet achiever coming in at No. 6.

Commonsense has backed startups including car subscription software Loopit, video monitor Atomos, carbon emissions management platform Arvani and mortgage broker client management too Sherlok.

Two Californian funds – Paul Graham’s legendary Y Combinator and Peter Thiel’s Founders Fund made the top 10.

Despite being highly active in the local market in the last few years, prominent US funds such as Tiger Global and Sequoia did not make the cut.

NAB Ventures was the only one of the big four bank VC funds to make the top 25 at No. 20.

Startup Daily contacted more than a dozen of the funds featured in the top 25 for comment. We’ll update this story if and when we hear back from them.

Joe Patrick and Albert Patajo will appear on the Startup Daily show at 2pm on Monday to talk about the VC leaderboard.

The full list, including the other VC funds considered, is available here.

The top 11 on the VC Leaderboard developed by Astral Ventures

Credit: Source link

Comments are closed.