Nasdaq-listed Australian software giant Atlassian has seen its shares fall more than 10% in after hours trade following the release of its December quarter results, which posted a US$99.2 million loss.

The loss compares to a rare profit of $23 million 12 months earlier. Now in its 21st year of operations, Atlassian has yet to close out a year in the black.

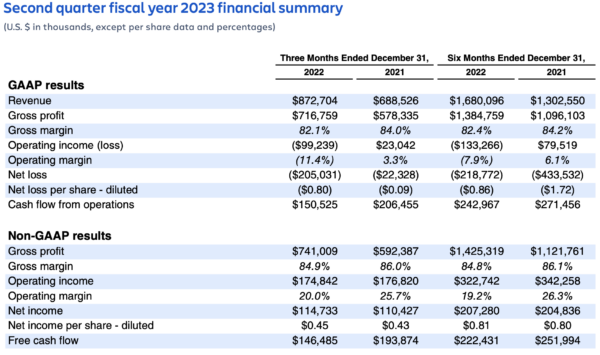

The company beat analysis revenue expectations with Q2 FY23 still growing by 27%, year-on-year, to US$872.7 million. The operating margin was (11)% for the quarter, compared with 3% for Q2 FY22.

The net loss was US$205 million for the December quarter, compared with a net loss of $22.3 million for the same quarter 12 months ago.

But it’s clear that tech industry layoffs, with tens of thousands of jobs going, are slowing customer growth for the collaboration software business, with the the company saying these “two macro-induced headwinds became more pronounced in Q2”.

Atlassian ended the 2022 calendar year with 253,177 active customers, up 4,004 net new customers for the quarter.

Existing customers are expanding their paid seats at a slower pace, and while there’s strong growth in free editions of its cloud products, they’re not converting to the paid version.

An unpredictable year

Announcing the results, cofounder and co-CEO Scott Farquhar said they are “proud of everything we have accomplished in yet another unpredictable year”, with subscription revenue growth up 40%.

“2023 will be all about helping our customers navigate these challenging times, absorbing the macro-driven impacts on our business, and setting Atlassian up for long-term success,” he said.

His co-CEO Mike Cannon-Brookes said they’ll “keep playing offense across our three large markets while being pragmatic” amid a series of headwinds.

“Our track record of making smart investment decisions in the service of long-term payoffs continues to yield results as we recently surpassed 45,000 Jira Service Management customers, making it one of our fastest-growing products,” he said.

As always, the pair included an Australia colloquialism in their shareholder letter, saying: “We’ve positioned ourselves for success in a challenging environment, and we’re ready to get after it. (As we say in Australia, ‘we’re not here to #@!% spiders.’)”

The company is predicting revenue in the range of $890-910 million for Q3, with another loss of the cards – an operating operating margin of around (14%) on a GAAP basis.

That guidance is below analyst forecasts, adding to the pressure on the company’s share price.

Total revenue growth year-over-year is expected to be around 25%, with cloud revenue growth up 35-40%. The operating margin is expected to be approximately (11%) on a GAAP basis.

“We’re rebalancing our talent and resources to put increased focus on our largest growth opportunities: cloud migrations, the IT service management market, and serving enterprise customers. Atlassian is well positioned in these areas with significant momentum that can help us power through the turbulence ahead,” Cannon-Brookes and Faruqhar said in the shareholder letter.

“Over our seven years as a public company, you’ve consistently seen us play the long game while being incredibly capital efficient. That’s a winning strategy and we’re sticking with it.”

Last month, the board signed off on the repurchase up to US$1 billion of Atlassian’s Class A Common Stock.

The balance sheet ended the quarter at US$1.7 billion in cash and cash equivalents plus short-term investments.

Atlassian’s share price is down around 40% on 12 months ago closing at US$182.41 on Thursday trade, but has recovered to start 2023, up 44%. It’s fallen 13% to around US$170 after hours.

Atlassian’s Q2 FY23 earnings. Source: Atlassian

Disappointing results

Stake markets analyst Megan Stals said January’s growth was primarily driven by signs of cooling inflation rather than company fundamentals.

“For Atlassian investors, today’s results will be disappointing, and could suggest the recent tech rebound was premature,” she said.

Atlassian beat earnings per share estimates, but the rate of customer growth continues to decline and the company is struggling to convert free users into paying customers. Given the recent tech industry layoffs, it is not surprising that its JIRA product, which primarily helps tech teams to collaborate, has struggled.”

Stals said enterprise software revenues are usually more robust during economic downturns, but for unprofitable companies that rely on continuous growth this is often not enough.

“In a negative near-term signal for enterprise tech, Amazon’s cloud arm, AWS, also missed estimates last quarter. Growth in the cloud segment has slowed across the industry and Atlassian again lowered expectations for 2023,” she said.

“The big theme for tech firms during this earnings season has been efficiency, and Atlassian is no exception, expressing a plan to reduce ‘lower priority endeavours’ in its shareholder letter. But it has a relatively high R&D spend, mostly due to salaries. As one of the few tech companies that hasn’t announced layoffs, it may eventually come under pressure to reduce headcount.”

The Stake analyst said Atlassian’s status as one Australia’s few homegrown tech success stories means it still has significant influence on the local market and the drop in its share price in after hours trading, could dampen sentiment for ASX-listed techn stocks such as Xero and Appen.

Credit: Source link

Comments are closed.