Chennai: A global bull rally driven by easy liquidity and shifting capital allocations of the West from China to India has propelled not just inbound private equity-venture capital (PE-VC) investments but also PE-VC exits to record highs.

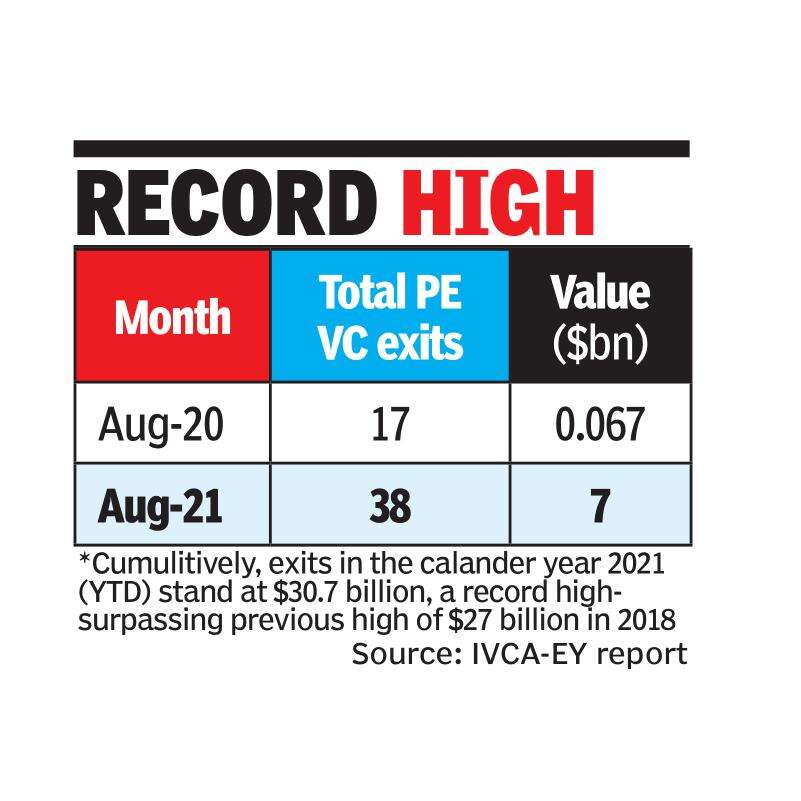

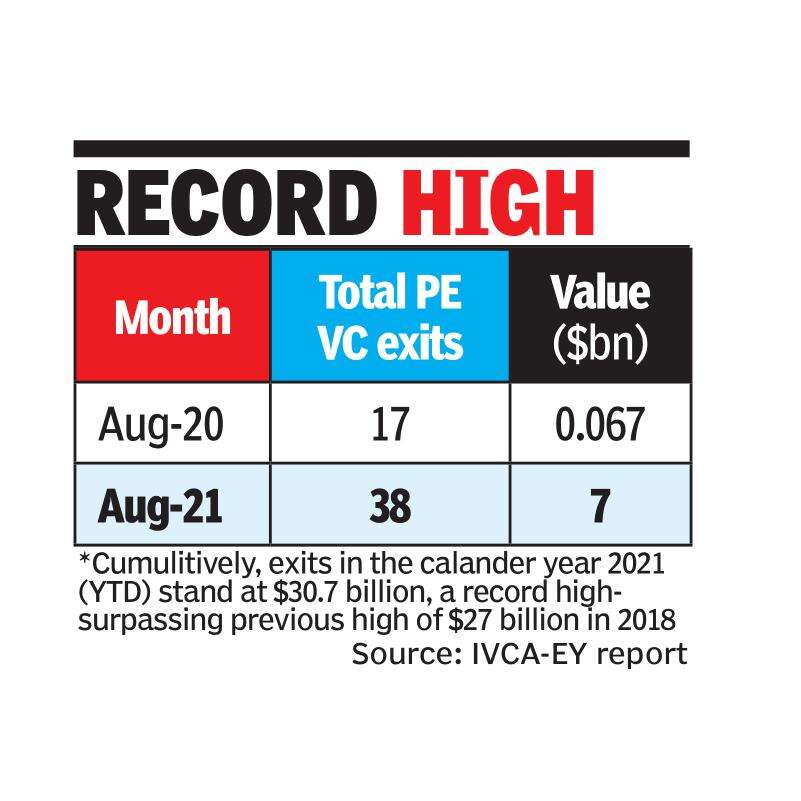

August recorded 38 exits worth $7.3 billion compared to $67 million across 17 deals recorded in August 2020 and $1.2 billion across 25 transactions recorded in July 2021, as per the monthly analysis by IVCA-EY. Cumulatively, exits in the calendar year 2021(YTD) stands at $30.7 billion — a record high surpassing previous high of $27 billion in 2018.

“Exits by their very nature come in spurts but this year has seen a more democratic rise as it is made up of a series of large exits compared to 2018 when the Flipkart-Walmart deal singularly helped exits value zoom,” Vivek Soni, Partner and National Leader Private Equity Services, EY, told TOI. “There is a time to buy and time to sell and given how the markets currently are it is looking like a good time to both buy and sell,” he said.

PE/VC investments in the month stood at $10.7 billion- almost five times the value recorded in August last year.

The mega buyout of Billdesk by Prosus in the month saw General Atlantic, TA Associates, Temasek and other early investors sell their stakes worth around $2.9 billion. Partners Group selling its stake in SPI Global to Baring PE Asia for US$800 million was another large deal pushing up exits. The month also recorded the first ever SPAC listing by an Indian company wherein ReNew Power listed on the Nasdaq via a merger with RMG Acquisition Corp II, a blank cheque special purpose acquisition company (SPAC).

Exits via strategic sale were the highest in terms of value and volume in August at $3.2 billion across 13 deals followed by exits via secondary sale worth US$2.3 billion across six deals.

There were seven PE-backed IPOs in August — the highest number of PE-backed IPOs in a month — which saw investors cash out $881 million through offer-for-sale. The year 2021 has overall recorded 22 PE/VC backed IPO’s year-to-date- the highest number in over a decade, as per EY’s analysis.

With Nykaa, Grofers, Flipkart, Pepperfry and others looking to go public, the pipeline of IPO bound startups is quite strong and is likely to help exits zoom further this year. “We estimate that in the short-term , in this calendar year, the exit rally will continue and we may close the year at around $40-45 bn in total exits,” Soni added.

A possible pandemic resurgence of a new strain of the virus and any hawkish action by the US Federal Reserve to contain inflation are among the downside risks to this rally.

August recorded 38 exits worth $7.3 billion compared to $67 million across 17 deals recorded in August 2020 and $1.2 billion across 25 transactions recorded in July 2021, as per the monthly analysis by IVCA-EY. Cumulatively, exits in the calendar year 2021(YTD) stands at $30.7 billion — a record high surpassing previous high of $27 billion in 2018.

“Exits by their very nature come in spurts but this year has seen a more democratic rise as it is made up of a series of large exits compared to 2018 when the Flipkart-Walmart deal singularly helped exits value zoom,” Vivek Soni, Partner and National Leader Private Equity Services, EY, told TOI. “There is a time to buy and time to sell and given how the markets currently are it is looking like a good time to both buy and sell,” he said.

PE/VC investments in the month stood at $10.7 billion- almost five times the value recorded in August last year.

The mega buyout of Billdesk by Prosus in the month saw General Atlantic, TA Associates, Temasek and other early investors sell their stakes worth around $2.9 billion. Partners Group selling its stake in SPI Global to Baring PE Asia for US$800 million was another large deal pushing up exits. The month also recorded the first ever SPAC listing by an Indian company wherein ReNew Power listed on the Nasdaq via a merger with RMG Acquisition Corp II, a blank cheque special purpose acquisition company (SPAC).

Exits via strategic sale were the highest in terms of value and volume in August at $3.2 billion across 13 deals followed by exits via secondary sale worth US$2.3 billion across six deals.

There were seven PE-backed IPOs in August — the highest number of PE-backed IPOs in a month — which saw investors cash out $881 million through offer-for-sale. The year 2021 has overall recorded 22 PE/VC backed IPO’s year-to-date- the highest number in over a decade, as per EY’s analysis.

With Nykaa, Grofers, Flipkart, Pepperfry and others looking to go public, the pipeline of IPO bound startups is quite strong and is likely to help exits zoom further this year. “We estimate that in the short-term , in this calendar year, the exit rally will continue and we may close the year at around $40-45 bn in total exits,” Soni added.

A possible pandemic resurgence of a new strain of the virus and any hawkish action by the US Federal Reserve to contain inflation are among the downside risks to this rally.

Related Posts

Credit: Source link

Comments are closed.