Collectible card trading platform Alt raises $75M as it eyes other asset categories and preps its mobile launch – TechCrunch

When we last checked in with Alt back in March, it had just raised $31 million for its alternative asset platform — a platform, thus far, used primarily by those looking to research, trade and securely store high-value sports cards.

Just a few months later, the company has raised a $75 million Series B from a roster of top investors and pro athletes, made big hires and is prepping to launch its mobile app, all while it starts to expand the scope of the alternative assets it covers.

While Alt’s initial focus was sports cards — a category that founder Leore Avidar knows quite well — it has recently expanded to support other types of trading cards. Poke around its exchange and you’ll already find first edition Charizards and Yu-Gi-Oh! cards in the mix with rare Kobe and autographed Kaepernick cards. In time, they’re looking to expand beyond cards and into other alternative assets.

“Our goal is to be in things from sneakers, to watches, to NFTs,” Avidar tells me, referring to sports cards as their “proof point.”

To sell a card on Alt, its condition must first be judged by one of the already well-established grading groups (PSA, BGS or SGC) then sent to Alt’s “Vault” — a light-controlled, temperature-controlled, fire-protected facility that the company casually refers to as “the Fort Knox of cards.” Once there, ownership can be instantly transferred from buyer to buyer (with Alt taking a 1.5% cut on each sale). By default, purchased cards stay in the vault; owners are free to have their cards pulled from the vault and shipped to them, but Avidar tells me that “99%” of cards stay in the vault after a transaction. They’re mostly buying these cards as investments, not to put on display. I’m also told that Alt users have stored over $70 million worth of cards in the vault so far.

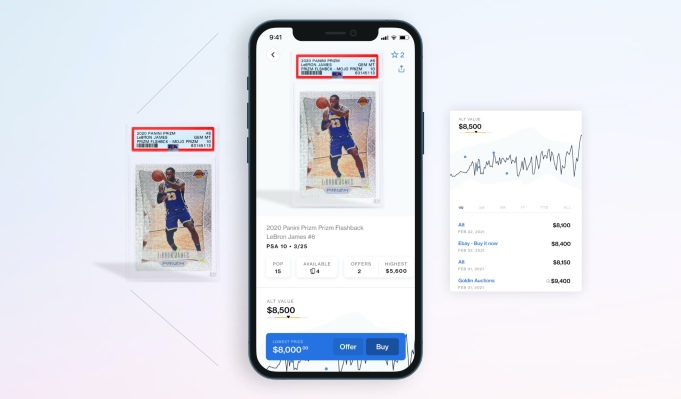

Alt shares much of the data it has on cards; its market trends page charts out which categories have proven most popular in recent weeks, and highlights the players whose cards have seen the biggest shifts in value over the last seven days. Individual listings show the prices a given card has sold for over the last year and offer up an “Alt value” — a Zestimate-style worth estimate based on all of the recent transaction data Alt has access to.

Alt’s team is growing pretty quickly, with Avidar noting that the company currently sits at around 60 employees. Notably, it recently hired Nicole Colombo, previously eBay’s GM of collectibles and trading cards, as its first president.

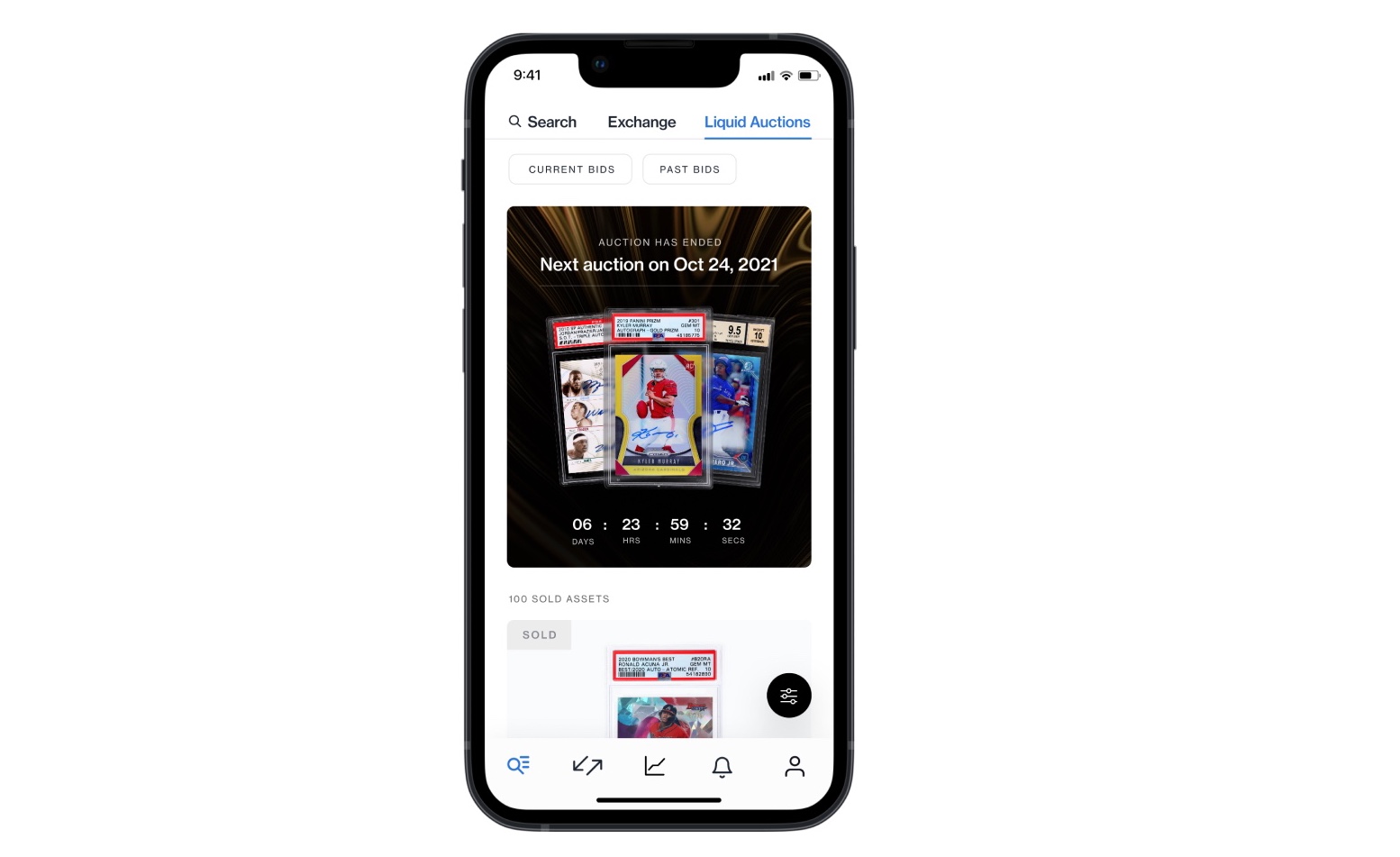

Next up on the company’s roadmap? Launching its mobile app. After spending its life thus far in the browser, Alt says its iOS and Android apps should launch later this month. That’s pictured up top, but here’s another picture of what it’ll look like:

Image Credits: Alt

Meanwhile, the company is quietly exploring a new source of revenue: loaning users money, with loans backed by the cards said user has stored with Alt. Avidar points out that banks generally won’t consider things like sports card collections as “real collateral”; Alt, meanwhile, has a pretty deep understanding of just how much any given card is worth from day to day — and, as the cards are in Alt’s vault, they can assume said cards aren’t going to just disappear or suddenly get damaged. Calling the program “Alt Lending“, the team notes that it’s currently in beta and only open to select users for now.

The company tells me this round was raised at a valuation of “over $325 million.” The round was led by Spearhead (a new type of fund co-created by Jeff Fagnan and Naval Ravikant. We profiled Spearhead here), and backed by Seven Seven Six, Vibe Capital, Breyer Capital, Shrug Capital, Apollo Projects (Max and Sam Altman’s firm, not our new corporate overlords of a similar name), Hyperguap, A* and a number of individual investors — including a few huge names in sports, like Tom Brady, Giannis Antetokounmpo, Alex Morgan, Candace Parker and Marlon Humphrey.

Credit: Source link

Comments are closed.