Startup fundraising became much more challenging this year, particularly for companies seeking the outsize rounds that became the norm in 2021.

European mega-rounds—investments above €100 million—totaled €36.8 billion in 2022, according to PitchBook data, 23.2% less than the previous year. And while their share of overall European deal value also declined by 5.2%, their percentage of total deal count remained stable at 1.5% for both 2021 and 2022.

Despite adverse market conditions, Europe has still seen more than a handful of substantial deals. Combined, the top 10 deals were worth roughly €8.8 billion and came from all across the region. Germany and the UK saw the most activity, and fintech dominated, accounting for half of the top 10 rounds.

Celonis

Celonis’ Series D tops the list of this year’s largest European VC deals. The round closed in two stages and comprised a total $1.4 billion in equity and $600 million in debt.

The Qatar Investment Authority led the second tranche, with support from investors including Activant Capital, 83North and Accel. The Series D valued Celonis at nearly $13 billion, making it Germany’s most valuable VC-backed company.

Trade Republic

Another entry from Germany, investing platform Trade Republic’s €250 million Series C extension pushed the round to a total of roughly €1.1 billion—a significant step up from its €62 million Series B.

Sequoia led the first tranche while the Ontario Teachers’ Pension Plan headed the second. The investment gave the company a new price tag of €5 billion.

Northvolt

Lithium-ion battery maker Northvolt secured $1.1 billion in funding in the form of a convertible note—short-term debt that converts into equity at a later date—as major economies push plans to increase electric car usage.

Investors in the round included AMF, Baillie Gifford and Goldman Sachs Asset Management.

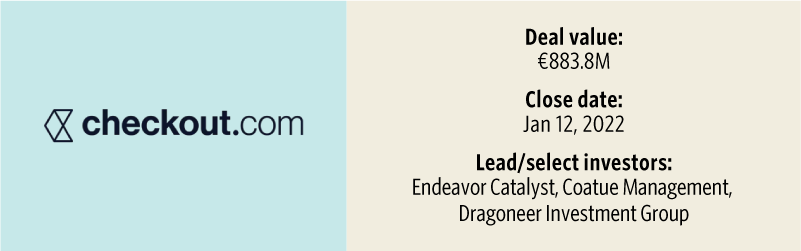

Checkout.com

Currently Europe’s most valuable VC-backed company, payments specialist Checkout.com saw its valuation reach $40 billion with a $1 billion Series D—a valuation increase of 20 times since its first funding round in 2019.

However, the Financial Times reported earlier this month that Checkout.com had cut its internal valuation to around $11 billion due to falling tech stocks and cooling investor sentiment.

Klarna

Perhaps the most talked about round this year, buy now, pay later provider Klarna’s $800 million fundraise led to an 85% drop in its valuation, which fell to $6.7 billion.

Wider market conditions were blamed for the drop, which saw Klarna lose the title of most valuable VC-backed company in Europe. The haircut was also indicative of the challenges facing the buy now, pay later space.

Sequoia, Silver Lake and the Canada Pension Plan Investment Board were among investors in the round.

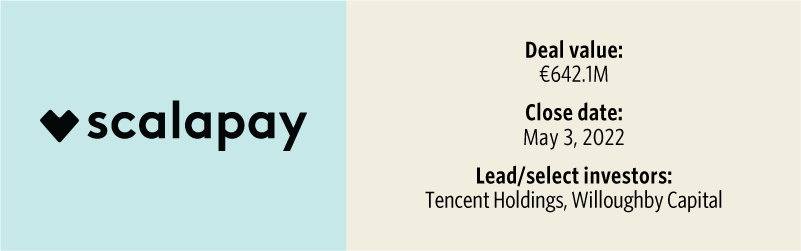

Scalapay

Scalapay, another buy now, pay later startup, had a better year than Klarna, joining Europe’s unicorn club in February with a $497 million round led by Tencent and Willoughby Capital. The company added an additional $27 million to the round in May.

The company became Italy’s only $1 billion-plus business and has since been followed by payment network provider Satispay.

Bolt

Sequoia and Fidelity Management & Research led a €628 million fundraise in Uber rival Bolt at the beginning of the year, pushing its valuation to €7.4 billion. The investment came just five months after Bolt raised €600 million at about a €4 billion valuation.

The funding was intended to bolster Bolt’s e-gorcery offering, a market which suffered a sharp decline in investor interest amid the economic downturn.

SLING Insurance

Israel’s only entrant on the list, SLING Insurance’s roughly $665 million investment gave it a $3.6 billion valuation back in April, according to PitchBook data.

The company provides cyber insurance solutions intended to offer tailor-made insurance policies based on an ongoing risk assessment. Its backers include Maverick Ventures Israel and PEAK6 Strategic Capital.

SumUp

Although not a down round, SumUp’s €590 million round didn’t give the London-based company its desired valuation. The investment valued the business at €8 billion, a significant leap from its €370 million estimated price tag in 2017, but earlier reports suggested that SumUp was seeking a valuation of at least €20 billion.

Bain Capital Tech Opportunities led the round for SumUp, which provides card readers and payments services to small-business owners.

Climeworks

Climate-tech startups attracted significant VC interest this year as the ongoing energy crisis spurred investment in green technologies.

Zurich-based Climeworks was one of the beneficiaries, raising $650 million in a round led by Partners Group and GIC. The company, founded in 2009, offers carbon dioxide removal via direct air capture technology.

Featured image by Wetzkaz Graphics/Shutterstock

Credit: Source link

Comments are closed.