Australia’s fintech ecosystem saw record investor capital, strong job creation and a growing focus on international expansion during the pandemic, according to the 2021 EY FinTech Australia Census.

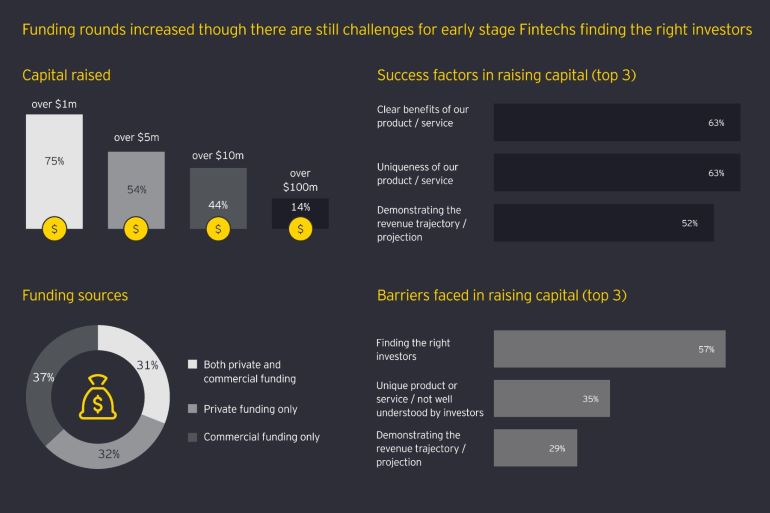

The sixth annual Census, a collaboration between Ernst & Young and FinTech Australia, reveals a dramatic increase in the proportion of fintechs whose capital raising expectations were met or exceeded – up from 57% last year to 82% in 2021 – alongside higher amounts raised.

The negative impact of the Covid-19 pandemic on capital raising has fallen from 72% in 2020 down to just 49% this year, but more than half (57%) of Census respondents looking for funds said they are still struggling to find the right investors.

Australian fintech deals and capital raises are now at a global scale, with 44% of companies having raised more than $10 million to date and 14% raising more than $100 million.

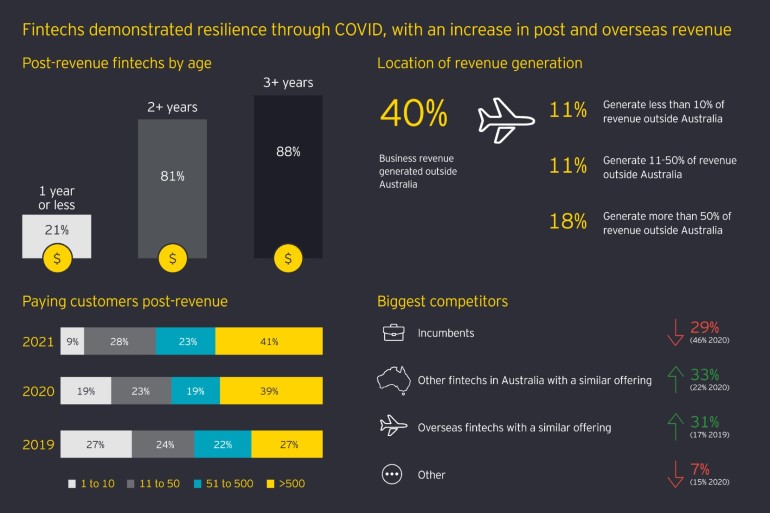

There’s also a corresponding maturity in the sector, with 88% of Australian fintechs three years or older and 81% of fintechs two years or older are now post-revenue.

The sector has also created new jobs during the pandemic, with 67% of companies having more than 10 employees – up from 2020’s 59% – with 21 full-time employees the new median, more than double the 2o2o median of 10.

There’s also been a major rise in Census respondents who said Australian fintechs are now internationally competitive up from 64% in 2019 to 80% this year.

A national export

May Lam, EY Oceania fintech leader, said the value of the sector as a national export is becoming clear as fintechs look to offshore markets.

“It was exciting to find that 72% of fintechs plan on entering or expanding in an overseas market within the next three years and 60% have plans to do so within the next year,” she said.

“To maintain Australia’s status as a rising star on the global fintech stage, and to keep the country’s innovation and talent onshore, we must build meaningful and globally competitive growth pathways for Australia’s startup sector.

“Increased certainty around incentives, better coordinated collaboration and strong moves to drive industry diversity will all help us build a world-class fintech export market and attract the best international tech companies to Australia.”

Other key numbers in the Fintech Census include 41% of post-revenue fintechs reporting they have more than 500 customers.

Talent concerns

But the sector is hoping for additional government support and has ongoing concerns around attracting talent.

A third of fintechs said they are finding it more challenging to attract qualified or suitable talent in Australia and 78% want easier access to skilled migration visas.

In line with previous years, the companies said people with engineering and software skills are the most difficult for fintechs to attract (62%), followed by product management (31%) and data engineering/data science (30%).

EY’s May Lam said both governments and startups need to think more strategically about attracting talent.

“There’s no doubt that in the post-pandemic rebound race, skilled visa programs and employee retention schemes would help Australian fintechs to grow and attract new talent,” she said.

“But there are other issues around diversity and inclusion that will also need to be addressed for the sector to remain attractive in an increasingly competitive talent environment.”

More reforms needed

EY Private Oceania startup and entrepreneurship leader said Malia Forner said it’s a pivotal time to support structural modernisation of the economy and increase investment into innovation with business and investor incentives that help to attract talent, innovation and capital.

“Australia has long supported programs targeting private capital and innovation investment by businesses, their founders and investors through specific tax incentives,” she said.

“The Government has introduced a range of incentives, stimulus and cash grants to help sustain and attract investment, innovation and jobs. But beyond the pandemic crisis period, we need policies and programs consistent with their intent to support founders, innovation and encourage further private capital investment for jobs growth.”

Forner said the sector is aware of launchpads for startups in regions such as Singapore and New Zealand focused on overtly attracting more innovation and jobs.

“In fact, around two-thirds of Australian fintechs considering expanding internationally said help understanding the regulatory environment [69%] and government support and funding to expand overseas [61%] are the main types of support they would value,” she said.

“Additionally, almost three-quarters [72%] of Australian fintechs surveyed strongly supporting increased access and grant assistance to a greater diversity of overseas launchpads.”

When it comes to government support, 42% of fintechs have successfully applied for the R&D Tax Incentive (RDTI), while 11% are in the process of applying.

The program’s importance is revealed in 78% saying access to the RDTI influences their decision to undertake R&D in Australia, with 80% of respondents saying making the RDTI more accessible would help improve the sustainability and growth of their business.

New Zealand also offers a clear path. The country recently doubled down on its R&D incentives, and consequently, has now jumped to the top of the list of preferred markets for international expansion for the first time.

Fintechs are also looking for more reforms with 39% saying that changes to Early Stage Innovation Company (ESIC) and/or Early Stage Venture Capital Limited Partnership (EVCLP) policy settings and tax incentives would allow greater capital flow into the sector.

Forner said: “Local entrepreneur and investor confidence hinges on maintaining stable, globally competitive regulatory, tax and incentive frameworks, where the sector has greater certainty over administration and access.”

A vital role for all business

FinTech Australia CEO Rebecca Schot-Guppy said the sector has a vital role to play in helping rebuild the economy.

“Not just through job creation and innovation, but in supporting SMEs with digital finance solutions and faster access to payments,” she said.

“The Covid-19 pandemic has accelerated the need for companies to embrace digital models and driven consumers’ relationships with their finances online, accelerating fintech innovation. Today, every consumer-facing business needs a digital payment capability, and this has created an increase in the addressable market for fintechs.”

Schot-Guppy said recent regulatory changes, such as open banking, are positively impacting the sector.

“While only 7% of fintechs surveyed are already Accredited Data Recipients (ADRs), a further 25% intend to follow suit, with more planning to connect via an intermediary,” she said.

“This will support greater industry convergence and more collaboration with established financial services institutions, big techs, retailers and other non traditional players.”

The Fintech Australia boss said it was encouraging to see the improvement in gender diversity among fintechs.

More than a third (35%) of all employees now female – up from 29% in 2020.

“Importantly, the Census also found that 26% of leadership positions are now occupied by women. These are positive results, but we still have work to do as a sector to foster even greater diversity and build a truly inclusive sector,” she said.

“Almost a third of survey respondents could not provide an estimate of their diversity profile but, those who could reported an average of 25% of employees from a culturally and linguistically diverse background. To drive innovation, we need to continue to build and amplify a supportive ecosystem that encourages participation from a diverse talent pool.”

The EY FinTech Australia Census 2021 report is available here.

Credit: Source link

Comments are closed.