VCs are treading water as market tides change.

Québec venture funding cooled off in the second quarter of 2022, and local stakeholders believe newly-enacted legislation could hamper tech sector investment in future quarters.

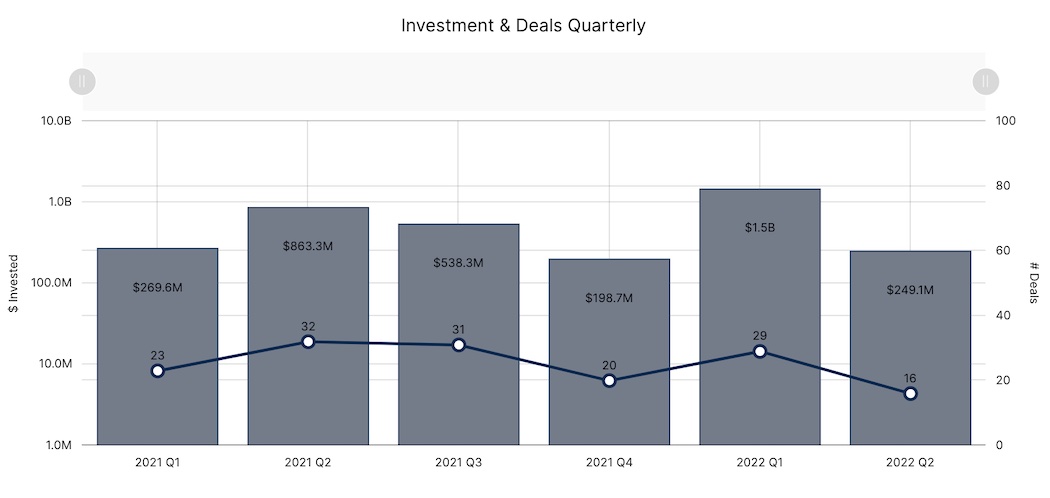

According to a new report from briefed.in, Québec startups raised a total of $249.1 million in Q2 2022, an 83 percent decline quarter-over-quarter and a 71 percent decline year-over-year. While on its face a steep drop in funding, it follows a record-setting first quarter of 2022 for Québec that saw $1.5 billion raised. Q2 funding also surpassed Q4 2021, when investment in the province reached just $198.7 million.

“Yes, we are in a higher-risk environment, and we haven’t seen the public markets bottom out, but that doesn’t mean it’s not possible to raise now.”

– Hugues Lalancette, Inovia Capital

However, with only 16 deals tracked in Q2 2022, deal volume reached a three-year low in Québec, falling 45 percent drop quarter-over-quarter and 50 percent drop year-over-year. Sam Haffar, partner at Montréal-based Real Ventures, said that while many companies are still actively fundraising in the province, deal-making has slowed.

“Some of this is likely due to less pressure to compete on deals with other VCs, and some of this might be the realization that their prior investments are also likely to be impacted by the current market factors, and therefore VCs are [taking] a ‘let’s wait and see’ perspective,” Haffar told BetaKit.

Québec’s recent venture funding performance aligns with activity in Toronto and British Columbia in Q2 2022: both provinces saw notable declines in funding and activity following a series of standout quarters. Many investors and stakeholders in the Canadian tech ecosystem anticipated a decline in venture funding following a similar downturn in public markets earlier this year.

Despite these market conditions, several Québec companies still managed to raise sizable financing rounds in the second quarter of the year. Montréal-headquartered industrial tech startup Vention, for example, raised a $123.7 million Series C funding round in May, the largest venture round tracked in the province during Q2. Potloc’s $35 million Series B financing round and Amilia’s $30 million growth financing round were also among Québec’s largest rounds during the quarter.

Hugues Lalancette, partner at Inovia Capital, said Québec’s Q2 2022 performance reflects that many local companies raised a good deal of capital and extended runways last year, reducing their need for another fundraise in the near term. Even for companies looking for investment in 2022, Lalancette said the venture market has far from disappeared.

“I think it’s important to stay calm and continue to take a long-term perspective,” Lalancette added. “Yes, we are in a higher-risk environment, and we haven’t seen the public markets bottom out, but that doesn’t mean it’s not possible to raise now. A lot of companies will be able to raise in 2022; it’s just a different dynamic [compared to] 2021 when capital was essentially free.”

Early-stage activity stays consistent…ly low

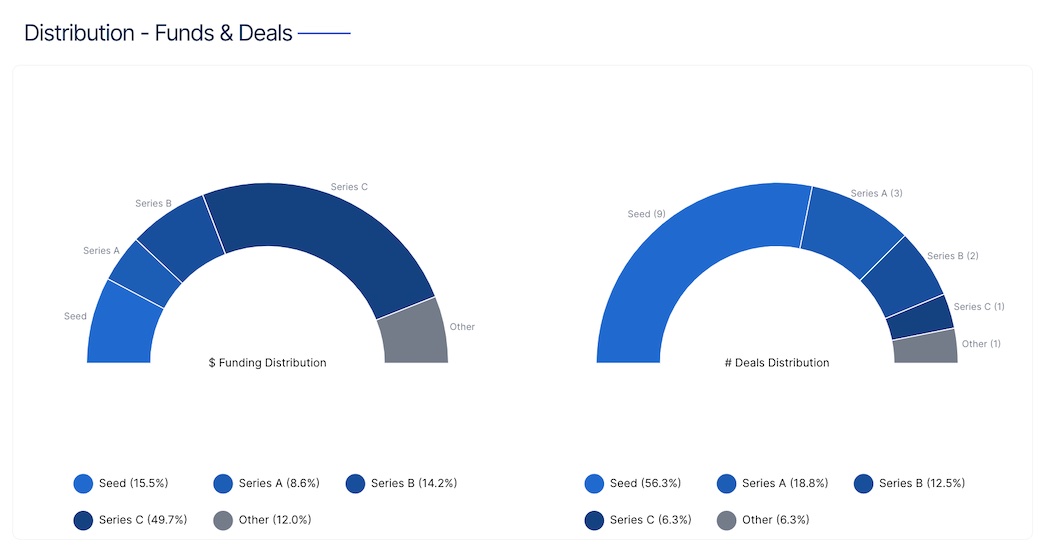

briefed.in tracked nine seed-stage deals and no pre-seed deals in Québec over the second quarter of 2022. Significant early-stage rounds included designstripe’s $10 million seed funding round, Lighthouse’s $9.1 million seed funding round, and Tengiva’s $5 million seed funding round.

Seed-stage deal volume in Québec has not budged over the last two quarters and has generally sat between nine and thirteen each quarter since Q1 2019. The early-stage ecosystem might look stable, but Haffar believes Québec’s pool of capital for early-stage firms is “consistently too small to sustain long-term success,” adding that the province should be seeing at least triple the early-stage deal volume than it is currently.

Haffar said the success of many of Québec’s later-stage companies, such as Lightspeed, Sonder, Dialogue, and Alayacare, may have created “an illusion in the market that the ecosystem is self-sustaining” and no longer requires substantially more investment in the pre-seed and seed stages.

“Thus, we’re seeing that the total amount of investments and dollars deployed in these stages are stagnant and not nearly at the level they need to be to create a healthy long-term ecosystem for the region,” Haffar added.

Early-stage funding in Québec in the second quarter was comparable to Alberta’s, which saw seven early-stage deals in Q2 2022. Alberta is home to a younger and smaller (but quickly growing) tech ecosystem compared to more established ecosystems like British Columbia, Toronto and Québec. “Longer term, this deal deficit at seed will create another illusion, one that [Québec] has too few fundable later-stage companies in five years’ time,” Haffar added.

Québec tech startups need to watch their language

Like the rest of Canada, Québec-based startups face several economic headwinds in the coming quarters, including rising interest rates, record inflation, and less-than-favourable valuation resets. However, Québec may also face a unique obstacle: the fallout of Bill 96.

Passed in Québec’s National Assembly in May, Bill 96 introduced new requirements around the use of the French language, including on websites, in marketing materials, and in contracts. The bill also requires government officials to speak exclusively in French with Québec immigrants six months after their arrival in the province.

Tech leaders from across the province have expressed concern over how the new requirements will impact tech companies and their ability to onboard talent and scale, with the Canadian Council of Innovators recently penning a letter to warn the province this legislation could “do enormous damage to the province’s economy.”

“Bill 96 is creating some level of fear and uncertainty among talent and CEOs,” Haffar added. “It may also create less appetite for US investors to lead rounds in companies headquartered in Québec down the road due to the potential restrictions in operating.”

In light of the many economic obstacles ahead, Lalancette said it’s important that Québec startups embrace the new reality, make hard decisions sooner rather than later, and maintain a long-term perspective.

“It’s likely that the recovery will take a while, I don’t know how long, but the key for entrepreneurs is to create optionality,” Lalancette added. “I do think many category-defining businesses are being built and will punch through whatever is coming at us.”

BetaKit is a briefed.in Tech Report media partner.

Credit: Source link

Comments are closed.