There are plenty of VCs keen to impart their knowledge on how to get funded, but what if you could gain insights from investors who have first-hand knowledge of seeing investment?

At this year’s TNW Conference, three VC partners who’d previously made the jump from successful founder to investor presented a panel on the crucial efforts they learned along the way.

The panelists were:

- Bryony Cooper, Managing Partner, Arkley Brinc VC: The company encompasses and hardware VC Fund and an acceleration program with the goal of investment.

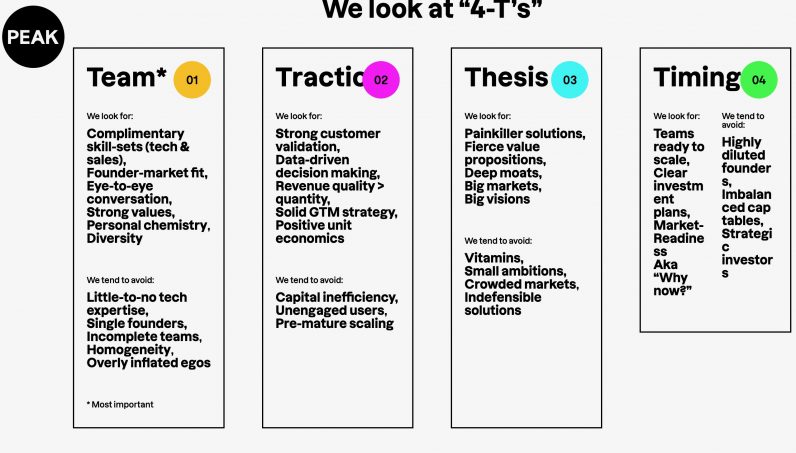

- Johan van Mil, Co-founder and Managing Partner, PEAK. The company invests in a broad range of marketplace, platform, and SaaS companies across a range of verticals.

- Jan Miczaika, Partner, HV Capital: HV’s funds invest early with initial tickets between € 500k and € 5m. The company focuses on transportation, logistics, supply chain, and storage.

During the session, the panelists not only provided an insight into their journey from founder to investor, but offered great insider perspectives, with a whole lot of tangible takeaways for startups looking to get their company funded.

What are the biggest differences between the experience of a founder and an investor?

The roles of founder and investor are vastly different. Miczaika described an investor’s experience as being “one step removed.” The position requires you to have a broad market view, and there’s plenty of time spent talking to interesting people, but you “don’t really do anything anymore.”

Van Mil described the experience of a founder and investor as having fundamentally different energy and work prioritization. Startups have sprinting marathons, while “as an investor, it’s more like a marathon where you also have to sprint.”

Here’s what startup founders get wrong in seeking funding from VCs:

The panelists have collectively connected with hundreds, if not thousands, of startups seeking funding. They shared some of the most common things that startups get wrong:

1. Not doing homework

Your pitch deck is a vital tool for promoting your startup and the investment opportunity. Miczaika gets at least four-pitch decks daily by email. So you need to compete for his attention.

Details matter, according to Van Mil and Cooper. Investors are busy people, and much like when you complete a job application, you need to provide all the necessary information in a compelling way.

Van Mil asserted that using MailChimp to send investors the same mass email is bad, especially when you get their name wrong.

Cooper advises companies seeking funding to be well-prepared with up to date documentation. Your financials and desired milestones should be documented and organized. “Otherwise, as you grow, things get really messy really fast.”

In most VC companies, different team members focus on specific verticals. So, reaching out to the investor whose interests represent your company is important. Otherwise, as van Mil notes, “it’s a wasted step in the journey that could have been faster.”

2. Selling your idea but not your company to VCs

Van Mil shared that you should not just seeking funding but collaboration with the VC fund most suited to your business and industry. Think about where the VC stands in your timeline: “Ask them what their successes are. For example, is their focus early-stage or more established companies?”

3. Not understanding your market or product community

Part of doing your homework is understanding what you are trying to achieve and where it sits compared to existing and up-and-coming tech. Miczaika asserted, “We want to invest in groundbreaking ideas. Is there traction? Is there someone willing to pay?”

Building community is also vital. For example, in the case of software, getting developers already using your software and providing feedback. The more evidence you have that there is a market for your product, the better.

4. Lacking people skills

One of the most important attributes a founder can have is people skills.

Fundersare investing in people, not just an idea, and in many sectors, investors may introduce you to your very first clients, especially in the B2B space.

Cooper stressed the importance of emotional intelligence over IQ, discussing the need for good communication skills to convince customers and partners to come on board. A strong sense of entitlement or ego won’t endear you to anyone. As she shared:

“If you can’t convince me in fine minutes that you are likable, you won’t convince people to buy your product.”

What about the impact economic downturn on investing?

After a bull market, it’s a difficult time for many startups. The pandemic, invasion of Ukraine, increases in energy prices, and supply chain woes have left some sectors in a downtime.

However, Cooper stressed: “The downturn is not in all sectors. There’s never the right time to make any life-changing decisions, whether having a baby or starting a new business. What are the needs of my company in this market?” She notes that venture investment is not the only option, with companies at different stages having success with crowd and angel investing.

Seeking investment means going all in

Sourcing money is time-consuming, and challenging. It can be a tricky balance between being charismatic and being your authentic self. Everyone you meet might be a potential investor or in a position to provide you with a warm introduction to one.

But it’s also an opportunity to get feedback on your business idea, connect with people in your industry, and potentially gain board members and advisors.

Many industries are in a state of flux right now or even downsizing. Therefore, building relationships with people investing or focused on your industry, especially with people with first-hand experience weathering capable situations, is more valuable than ever. It should be a top priority in taking your company to the next step.

Credit: Source link

Comments are closed.