Highbeam, a New York-based neobank built for people building e-commerce brands on marketplaces like Shopify and Amazon, raised $7 million in seed funding to continue developing banking tools that cater to these entrepreneurs’ needs.

The one-year-old fintech startup, started by Samir Shergill and Gautam Gupta, provides banking features, access to transparent credit and cash management insights. It works with Blue Ridge Bank, N.A. to provide the banking services and debit card and The Currency Cloud Ltd. on payment services.

“We are the financial partner to help e-commerce brands scale,” CEO Shergill told TechCrunch. “Banks need to help with cash management as a company scales, but they also need to be a real financial partner, for example, giving advice on how to access credit. That is our approach.”

Sustainable profit growth has become more important for brands, especially when e-commerce growth exploded during the pandemic and has pulled back some as stores reopened, Shergill said.

Coupled with advertising and privacy changes on social media sites, brands are not able to scale by pouring money into those channels anymore. Instead, scaling is more complicated and Shergill believes it requires tools like Highbeam in order to bridge the gap between selling the business and the entrepreneur figuring it out themselves.

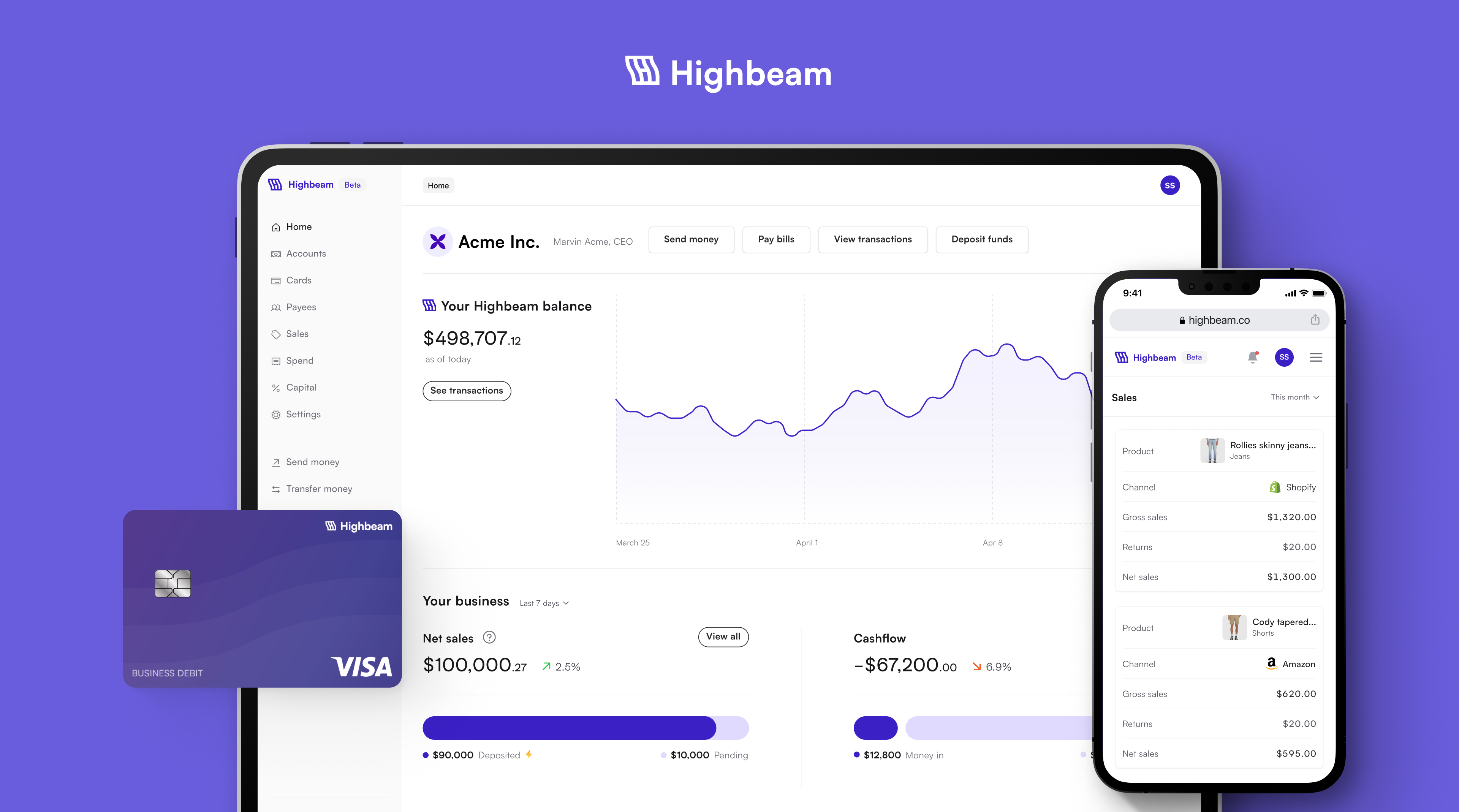

Highbeam’s e-commerce bank product. Image Credits: Highbeam

“Brands are having to do things like go omnichannel much earlier,” he added. “You used to be able to grow just on Shopify, but now you have to look at retail earlier.”

By focusing on e-commerce, Shergill said Highbeam is able to provide a single financial view of the business, where cash is coming in and going out, and help entrepreneurs decide the right credit option and offer insights on common situations. For example, if cash levels go down 10% or supply chain issues continue, what will that mean for the business?

In addition, Highbeam is offering not only those financial insights, but also a software component to collect and analyze data for those that don’t yet have someone in a chief financial officer role.

Highbeam has had dozens of customers switch their bank since it launched its product three months ago and is now managing tens of millions of dollars, Shergill said.

Now the company is ready to scale. The $7 million seed round, closed in May, was co-led by FirstMark and Mayfield, which were joined by a group of individual investors.

Plans for the new capital include bolstering the company’s team of 10 and product development on the core banking side, including investing in better experience and credit offerings. Shergill is also investing in go to market and sales.

“We want to ensure that we can add value to these founders and be a true financial partner as we manage their cash and credit needs,” he added. “We want to build out our technology as we build our relationships with them.”

Credit: Source link

Comments are closed.