I recently took part in a one-day workshop on business strategy.

Run by Harvard Business School professor Felix Oberholzer-Gee, he outlined a framework for how companies can achieve more by doing less and argues whether you’re a large business with multiple product lines or a startup that’s chasing a burgeoning market opportunity, by following a series of simple rules, they’re able to select the key activities that will successfully differentiate them against their competitors.

Oberholzer-Gee presented a framework called value-based strategy as a method to assess strategic initiatives. He argues that businesses who achieve sustained financial success must create value for their customers, employees and suppliers.

Creating value for customers

Customers are more willing to pay (WTP) where businesses innovate or improve on existing products. A service that delivers ice cream to your home increases WTP compared with driving 10 minutes to an ice creamery that serves the same flavours, for example. Luxury vehicle brands like Rolls Royce increase WTP thanks to their exclusivity and quality.

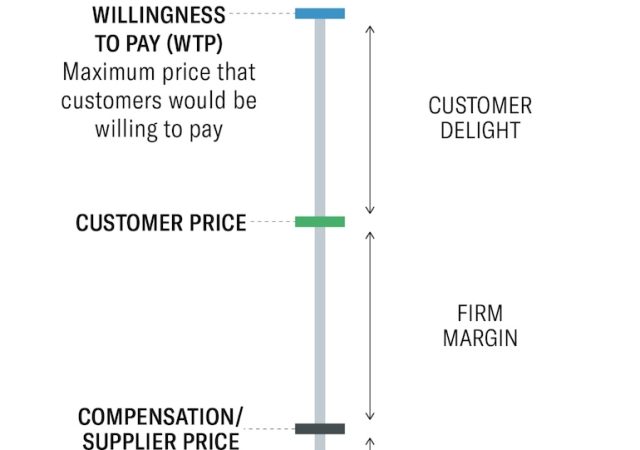

WTP is the most a customer would be prepared to pay for a product or service. If Rolls Royce were to charge a dollar more, their customer would not purchase, but if they innovated or improved their product, perhaps with a mobile hot tub, they could increase WTP.

WTP should not be confused with price. WTP is the value a customer ascribes to a product. Price is how much the product is sold for. The gap between WTP and price is the level of customer delight associated with the product.

Value-based businesses focus on increasing a customer’s WTP. They’re working out how to get their customers to be raving fans of their business, identifying ways to generate customer trust and loyalty, and creating benefits for customers who introduce like-minded customers to the brand.

This contrasts with a growth-oriented focus which revolves around increasing transaction volume.

Amazon increased a customer’s WTP in the competitive e-reader market in the 2000s.

Sony was the first major consumer electronics company to offer an e-reader with electronic ink and captured significant market share. Amazon, the world’s largest seller of physical books, was keen to enter the market and won because a significant innovation: wireless access.

While Sony’s customers had to download books to their computers and transfer them to the e-reader, Amazon’s Kindle had internet access built-in, allowing customers to instantly purchase books. The Kindle sold out and became the leader e-reader.

Tesla increased a customer’s WTP through its creation of a complementary product, its Superchargers.

Although many Tesla drivers charge their vehicles at home, they can take advantage of the company’s charging network, especially when travelling far from home. This has increased the WTP, specifically for Tesla, as other electric vehicles can’t benefit from their charging network.

Businesses that build network effects can increase WTP by connecting users through their platform. eBay’s success is due to the number of buyers and sellers on its platform. As more buyers were attracted to their platform, sellers benefited.

Similarly, as more sellers were attracted to their platform, buyers benefited. While marketplace businesses are notorious for capital consumption, once embedded, they can be very difficult to displace.

Creating value for employees

Businesses that make work stimulating, challenging and flexible can attract great talent even if they don’t provide the highest remuneration.

While it’s important to pay employees appropriately, businesses can create value by offering better jobs, which lowers the minimum remuneration required to attract employees, otherwise known as an employee’s willingness-to-sell (WTS).

Businesses that make a job offer below a potential employee’s WTS will receive a rejection. Like the relationship between WTP and price, WTS shouldn’t be confused with remuneration.

Value-based businesses focus on the needs of their employees to drive WTS. Job satisfaction can be improved by implementing technology or policies to make it easier for staff to do their jobs, creating training and career development opportunities so staff can grow their skills and benefit from a greater level of variety in the work, and providing greater levels of autonomy where teams self-organise and come up with solutions to achieve clear goals.

The growth of the gig economy illustrates how WTS has changed. Uber provides its drivers with high degrees of flexibility on start and finish times. Unlike a normal taxi service where drivers work eight- or 12-hour shifts, Uber drivers can choose what days and the hours they work.

If an Uber driver is having a quiet evening at home, they can decide to get in their car, drive and earn money.

Studies have shown that in certain markets, Ubers drivers are prepared to earn less on a per hour basis than taxi drivers due to flexibility!

Creating value for suppliers

Suppliers are like employees in expecting minimum levels of compensation. Businesses create value for their suppliers by lifting their productivity. As the costs of a supplier decrease, the lowest price they’re willing to accept (WTS) also decreases.

For instance, if a business were to purchase ten widgets from a supplier, the cost per widget may be $100. If the business were to purchase 10,000 widgets, the cost per widget might be $40! This is economies-of-scale at work.

Value-based businesses get to know their suppliers. They understand the supplier’s pain points, opportunities and cost to supply curve.

Sustained success

Value-based businesses consider all their moves using a value creation perspective. Does the change create value for customers, employees or suppliers? Unless the WTP or WTS changes, it shouldn’t move. A chart, called a value stick, provides a way of identifying the two key elements involved in value creation and improved financial success: a customer’s willingness-to-pay, and the employee’s (or supplier’s) willingness-to-sell their services (or products) to the business.

- Benjamin Chong is a partner at venture capital firm Right Click Capital, investors in bold and visionary tech founders.

Credit: Source link

Comments are closed.