Welcome to Ignition Lane’s Weekly Wrap, where they cut through the noise to bring you their favourite insights from the technology and startup world. Ignition Lane works with ambitious business leaders to apply the Startup Mindset to their technology, product and commercialisation problems.

This wrap goes out free to subscribers every Saturday. Don’t forget you can catch Gavin Appel discussing the week on the Startup Daily show on Ausbiz every Monday at 2pm. If you miss it, you can catch up on the week’s shows here.

Here’s their review of the week.

Aussie’s Technouveau Riche

Move over Gina Rinehart, there’s a new rich guard in town.

Atlassian cofounders Mike Cannon-Brookes and Scott Farquhar are now at the top of The Australian’s Rich List. Canva’s cofounder couple Melanie Perkins and Cliff Obrecht have moved up 35 places to 7th place. And fellow cofounder Cameron Adams is up 118 places to 20th – perched above James Packer.

How, what, why?

Canva is worth US$40bn

No doubt your newsfeed is full of stories on Canva’s latest US$200m raise at a US$40bn valuation – a figure that surpassed even our highest guestimates. For context, it is now worth more than Telstra and Woolworths, and is probably Australia’s most valuable private company.

This is mega news for Australia’s startup world. For one, Canva—with a revenue run rate of $1b (and growing) and 2,000 employees (and growing)—is the perfect poster child to splash in the face of government to urge better policies for startups and tech.

And while we wait a decade or five for that policy to change…

The deal makes a lot of people very, very wealthy (on paper), including a host of local investors. In turn, that wealth will fuel the Australian startup ecosystem for years to come.

So @blackbirdvc is the VC equivalent of a unicorn with a broad ESOP. Unlike most VC funds, it had nearly 100 LPs in its 1st fund, mostly local and not insto, which anchored @canva’s seed round. Expect to see an angel investment spring for #startupaus.

Many don’t realise this.

— Alfred Lo™️ 🇦🇺😷🧼💉🙏 (@apglo) September 15, 2021

Then there’s the impact to greater society. Cofounders Melanie Perkins and Cliff Obrecht now have a net wealth of A$16.4bn. But rather than spending their riches on superyachts and Mexican resort homes, the couple plan to give away the vast majority of their shares to philanthropy.

|

Atlassian’s market cap hit US$100bn

You only have to look to Atlassian, whose market cap hit US$100bn this week, to get a flavour of what’s to come from Canva’s wealth creation.

|

Although Atlassian was bootstrapped and a higher concentration of wealth remained in the cofounders’ pockets rather than local investors and employees, millions if not billions has poured back into local tech and innovation.

Atlassian’s army of alumni have gone on to found and back oodles of ventures that are on a mission to change the way we live. Just to name a few – Tidal Ventures, Skip Capital, Grok Ventures, Blackbird, Canva, Who Gives A Crap, SunDrive, Fable Foods, Zoox, Fleet Space, Goterra, Pyn, Dovetail, Brighte and Spaceship.

The ripples of Canva and Atlassian will be felt for decades to come. It’s an exciting time to be a founder. And as MCB reminds us (in response to Gav going semi-viral): you build success one day at a time.

One day at a time 👊🏻

— Mike Cannon-Brookes 👨🏼💻🧢🇦🇺 (@mcannonbrookes) September 17, 2021

The biggest month in Aussie venture history

If you thought June and July were big months, you ain’t seen nothing yet! Around a billion dollars of fundraising has been announced by Aussie startups in the first half of September.

This week:

SiteMinder raised over $100m led by Fidelity ahead of an IPO. SiteMinder provides tools for hotels, including a channel manager allowing hotels to list on several different booking sites and a booking engine.

Mable raised $100m led by General Atlantic for its disability and aged care marketplace.

Immutable raised $82m co-led by Sydney’s King River Capital and San Francisco’s BITKRAFT Ventures. Immutable uses NFTs to help monetise games. It is also the creator of the Gods Unchained NFT-based collectible card game.

Five V Capital took a $80m stake in Automic Group – a share registry platform.

Prospection raised $45m led by Ellerston Capital for its healthcare data analytics software.

Who Gives A Crap* raised $41.5m – its first equity round in 10 years. The toilet paper scaleup donates half of its profits – nearly $11m to date.

Alex raised $20m, valuing the neobank at more than $120m.

Superhero raised $15m for its low fee share trading platform.

Delegate Connect raised $10m from AirTree and Skip Capital for its hybrid/virtual event platform.

Rush Gold raised $3m for its digital gold platform.

Vexev announced that it had raised $1.5m and came out of stealth mode. The founders have developed a device that automates ultrasound procedures and can produce 3D images just like a CT scan or MRI.

Domain is acquiring Insight Data Solutions (IDS), in a deal worth $60m, plus $100m in earn outs. IDS provides land and property valuation, insights and analytics.

Technnouveau riche and other worldly things

Mailchimp’s two riche. Mailchimp is being acquired by Intuit for $12bn. This is the biggest-ever deal for a bootstrapped company and Intuit’s biggest acquisition.

Intuit (known for its SMB accounting tool, QuickBooks) wants Mailchimp to strengthen its SMB and ecommerce play. Email marketing platform Mailchimp has around 13 million users and 800k paying customers bringing in $800m in sales last year (growing at about 20%), and EBITDA of ~$300m.

The deal has sparked debate about whether Mailchimp employees should be entitled to a greater chunk of the pie. Rather than giving employees equity, the company has been operating under a profit share bonus arrangement, with “generous” pay – the equality of which is disputed. That makes sense for a profitable bootstrapped business with no ambitions of exit (Envato in Australia operates under the same mantra). But everyone has their price, and now the two founders are walking away as two of the richest people in the US.

|

Pinterest’s never riche. A woman is suing two of Pinterest’s three cofounders, alleging she co-created the company and was not compensated or given any stock. She argues that Pinterest’s founders had verbally agreed to compensate her many times for her ideas, which were “core organizing concepts,” such as organising images on boards and enabling ecommerce.

OpenSea’s faux riche. OpenSea’s (the biggest NFT trading marketplace) Head of Product flipped NFTs using insider information.

“Yesterday we learned that one of our employees purchased items that they knew were set to display on our front page before they appeared there publicly.”

All transactions are permanently recorded on a public ledger, so users were able to follow the money trail leading back to Nate Chastain’s publicly known account. He has since resigned.

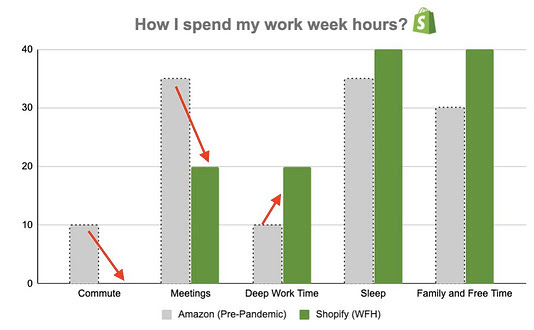

Family time riche. An ex-Amazon Data Science Manager (now Shopify Director Data Science) crunched the numbers on why he felt burnt out at Amazon, but not at Shopify. The main takeaways to prevent burnout:

- Have a day with no meetings to allow for more time on deep work

- Excessive report writing is draining and uninspiring. The law of diminishing returns surely must apply, too?

- Commuting far every day is a giant waste of time

- Set the cultural expectation that you don’t send emails after hours

- Respecting free time leads to employees having more time to spend on what they love, making them happier and more productive.

|

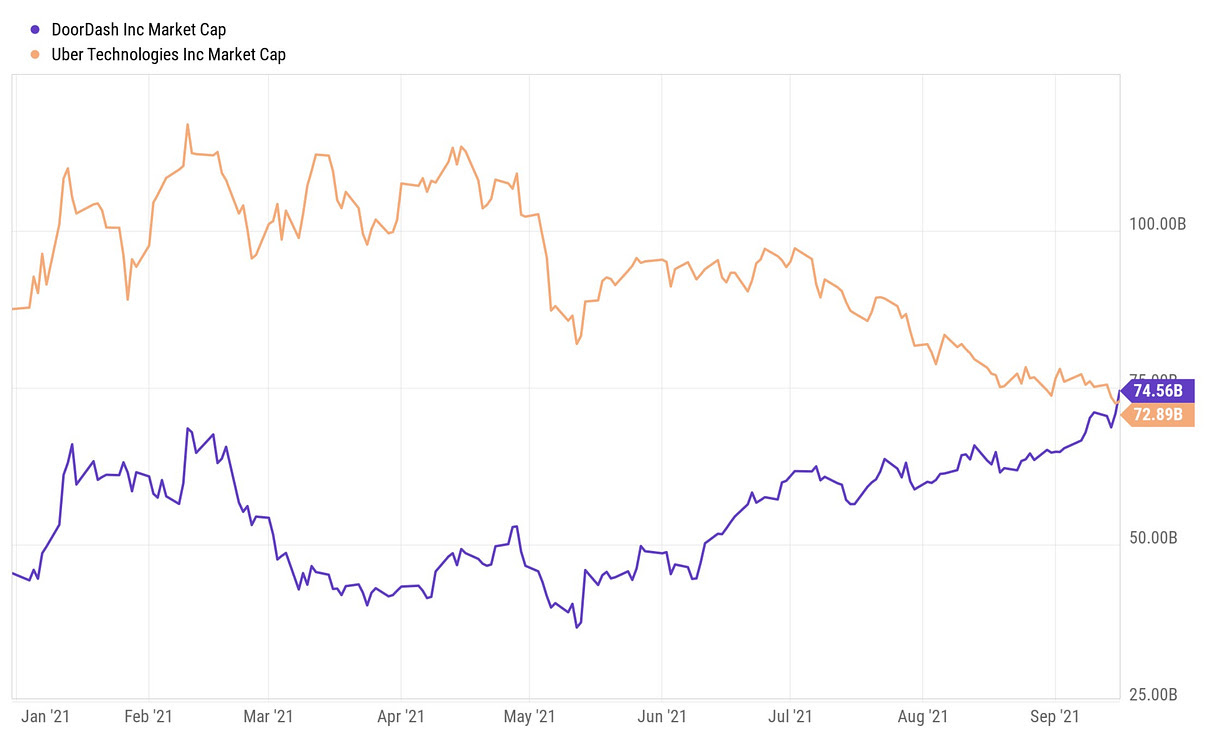

Delivery nouveau riche. DoorDash’s market cap ($75.33bn) surpassed Uber’s ($74.9bn). Who would have thought? Uber is a much bigger and more diversified business, but perhaps investors are more excited about deliveries than ride-sharing in a Covid world.

|

Apple & Epic’s loss = Stripe’s riche. It’s been over a year since we last mentioned the Apple v Epic lawsuit. It has finally come to a head. Maybe (Epic is appealing). The judge ruled that Apple wasn’t unfairly monopolising the mobile app space. BUT Apple must remove its policies that ban developers from telling users about alternatives to Apple’s in-app purchase system. That opens the door to third-party payments, like those Stripe’s payment processing enables. Coincidentally, rumours began circulating that Stripe might list next year.

Stripe investors right now pic.twitter.com/WlEdnRoj2G

— Alex Heath (@alexeheath) September 10, 2021

That’s a wrap! We hope you enjoyed it.

Bex, Gavin and the team at Ignition Lane

Credit: Source link

Comments are closed.