Ignition Lane’s Wrap: the state of Cloud, VC advice, Tiger stripes, cattle class crypto, M&A fires up

Welcome to Ignition Lane’s Tech Wrap, where they cut through the noise to bring you their favourite insights from the technology and startup world.

Ignition Lane works with ambitious business leaders to apply the Startup Mindset to their technology, product and commercialisation problems.

This wrap goes out free to subscribers on Saturdays. Don’t forget you can catch Gavin Appel every fortnight on the Startup Daily show on Ausbiz Mondays at 2pm (because of Anzac Day he’s on this Tuesday). If you miss it, you can catch up on the week’s shows here.

Here’s their review of all the big news in tech.

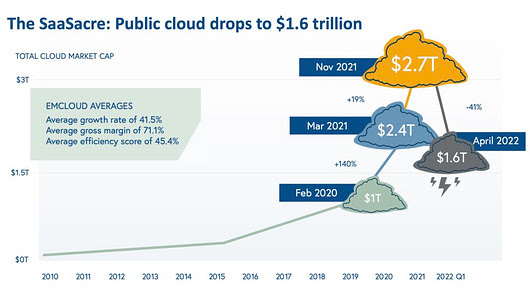

State of the Cloud: Don’t be scared of the ‘SaaSacre’

Bessemer Venture Partners (BVP – a VC that has been investing in private cloud companies for 20 years) released its annual State of the Cloud report for 2022.

The gist? Despite the value of publicly traded cloud companies plummeting 40% or US$1.1tr in the five months to April, a.k.a. the ‘SaaSacre,’ there’s plenty of potential in the global cloud economy.

|

Trends and opportunities on BVP’s radar:

To differentiate, startups are thinking about indirect monetisation from day one, e.g. card issuing, banking, insurance. Every company will be a fintech.

Cloud software is critical in improving global productivity, e.g. supply chain issues, The Great Resignation and future of work.

Cloud adoption is rising: Early adopters are moving more sensitive data to the cloud, e.g. security logs; Deploying SaaS products inside a customer’s virtual private cloud (VPC) is now much easier; and Middleware platforms now bring the power of the cloud to data anywhere, e.g. fintech infrastructure and legacy banking systems.

Cloud squared: Cloud marketplaces are becoming increasingly critical as a sales and fulfilment channel for enterprise software.

Count Centaurs (revenue), not Unicorns (valuation): Finally, BVP sets a new goalpost to measure exceptional SaaS companies: the Centaur – a business that reaches US$100 million of annual recurring revenue (ARR).

The unicorn-or-bust mentality has unfortunately driven many startups and investors to focus on valuation as their primary goal, instead of building a great business… tracking Centaur growth offers a more accurate pulse on the overall health of the cloud ecosystem.

Agreed. But for those of you just starting out (or not chasing VC money), don’t let that target overwhelm you. $1m, $5m or $10m ARR is nothing to sneeze at.

|

Around the world (really, just the USA)

VCs doll out advice for a down market: Reevaluate your valuation (Andreessen Horowitz offers a methodology), understand your burn multiples, and build scenario plans (Meritech recommends preparing for a reduction in growth as well as opex).

Perhaps the best summary of this VC advice (h/t Benedict Evans):

Related: Andreessen Horowitz launched a new $600m fund for games investments.

Has Tiger lost his stripes? The Financial Times reported that Tiger Global’s hedge fund has lost about US$17bn, which marks one of the biggest dollar declines for a hedge fund in history. Eep. Tiger recently sold its entire stake in public consumer tech companies Bumble, Airbnb and Didi, and significantly reduced its exposure to Robinhood and Peloton. Meanwhile Tiger continues to write big cheques in Australia in recent weeks, investing in Stake’s $50m Series A top up, Shippit’s $65m Series B extension and Carma’s $75m Series A.

The future of streaming is… TV! Netflix subscribers fell for the first time. Worse still, it expects to lose more this quarter. Shares tanked, jobs and costs are being cut, and in an effort to increase revenue, Netflix is now exploring an ads model and is getting strict on password-sharing.

Not-so-stablecoin. Algorithmic stablecoin TerraUSD (also known as UST) and the crypto token that backed it, LUNA, collapsed last week – losing over US$40bn in value combined. UST was designed to be pegged to the US dollar, but was undercollateralised. So there was nothing propping up the price aaand a death spiral ensued.

Crypto bros yesterday vs. Crypto bros today #welcomeaboard pic.twitter.com/w7gSUE1DJI

— Ryanair (@Ryanair) May 13, 2022

The next Blockhead. Jack Dorsey, the Twitter cofounder and Block (Square) CEO, has changed his title to “Block Head and Chairperson.”

|

Local celebrations & commiserations

If you prefer video, we also cover this news in a vlog – Part 1, Part 2.

Xero’s billions. Xero reported a 29% increase in revenue to NZ$1.1bn and a 28% jump in annualised monthly recurring revenue (AMRR) to NZ$1.2bn. Total subscribers grew across all markets to 3.3 million. However EBITDA only grew by 11% to $212.7m. The market wasn’t super impressed – shares dropped 12% following release of the results.

Spoils in the delivery wars. Less than 12 months after it launched, 10-minute grocery delivery service Send has been placed in voluntary administration. With 300 employees, 13 dark grocery stores and bases, the Send network covered 50+ suburbs across Sydney and Melbourne – all amounting to a costly burn rate reported to be up to $1.5m/month. Another two hour delivery startup, Quicko, has also shut down operations. That leaves Tiger Global-backed Milkrun as well as Sequoia Capital-backed Voly still in the instant grocery race. But will the unit economics ever stack up?

Uber goober. Uber agreed to a $26m fine for misleading Australians. Under Uber’s policies, you have five minutes from the time a driver has accepted a ride to cancel it at no charge. But the app warned “you may be charged a small fee since your driver is already on their way.” Tsk tsk. The ACCC is also taking Uber to court over its Uber Taxi ride option, saying it overinflated the estimated cost.

Hurrah! You can finally afford* an $8 chai. Square integrated with Afterpay. That opens up Afterpay to a whole new world of smaller merchants, e.g. cafes. Meanwhile pressure to regulate BNPL continues to mount around the world.

*we provide no guarantee you can actually afford the repayments

Accelerating philanthropy. AirTree founding partner Daniel Petre is launching StartUpGiving – a “concierge service” to make it easy for founders and startup execs to donate their unrealised wealth. Philanthropy bigwigs Bill Gates and Peter Singer (a famous ethicist) will join the advisory board.

VC news

- NZ-based VC Global from Day 1 (GD1) launched the country’s first dedicated fund in the crypto, blockchain and web3 space – a $5m fund.

- Elaine Stead (former Blue Sky MD) is joining Alan Jones and Emily Rich as a general partner at M8 Ventures. The team are raising a $5m pre-seed fund.

- Archangel Ventures is raising a new pre-seed and seed fund, with $12m already committed.

Local M&A galore

Woolworths has proposed to acquire 80% of homewares marketplace MyDeal for $218m, which is $1.05/share or a 62.8% premium on the previous day’s closing price. That’s a very attractive offer in today’s environment.

Advanced Navigation acquired Vai Photonics, which is in talks with NASA to use its navigation technology on the next moon landing.

myDNA acquired Batchelor star Sam Wood’s online diet and fitness program in $71m deal.

Airtasker plans to acquire tasks outsourcing competitor Oneflare in a $10m deal, subject to the ACCC’s tick of approval. That’s a massive drop in value – in 2016 Domain Group purchased a 35% share in Oneflare for $15m.

Australia’s “Airbnb of the alternate asset space” (parking, storage, warehousing) Spacer Technologies acquired Toronto-based parking marketplace WhereiPark.

Accounting, business & bookkeeping software firm Reckon Accountants Group is being acquired by UK-based The Access Group in a $100m deal. This will be the 10th AsiaPac acquisition for Access in the last three years.

Restaurant ordering startup Mr Yum made its first major acquisition – marketing automation and events management tool MyGuestlist.

Smart metering and energy data business Intellihub acquired GreenSync. GreenSync’s DeX solution enables tradable energy services and expands the reach of existing virtual power plants.

eCommerce gift and flower startup LVLY was acquired by Malaysian tech firm Limitless Technology, for $35m.

In PE land: Accel-KKR acquired a majority stake in Humanforce (workforce management) for $60m. IFM Investors acquired a majority stake in Render Networks (construction management).

I bid you all adieu

The new CNN+ streaming subscription service has been canned, just a month after launch.

Amazon shut down one of the oldest staples on the internet, Alexa.com (not the voice assistant). Alexa provided web traffic analysis but its most popular feature was Global Rank, which listed the most popular websites around the world based on their traffic stats.

21 years after the first ever iPod was launched, Apple has discontinued the last remaining iPod model. This was once 40% of Apple’s revenue!

That’s a wrap! We hope you enjoyed it.

Bex, Gavin and the team at Ignition Lane

Credit: Source link

Comments are closed.