It’s not just your imagination — usage-based pricing (UBP) is seemingly everywhere in 2021.

SaaS companies have been ditching traditional subscription pricing in favor of usage-based models that better align with modern buying behavior and the value delivered by their products. UBP, also known as consumption-based pricing, connects how much a customer pays with how much they consume a given product or service.

Usage-based subscriptions can be a way for SaaS companies to test the feasibility of UBP without needing to completely change their business model.

Public cloud observability company New Relic introduced its consumption-based pricing model in July 2020. More recently the company doubled down on the model, deciding to only pay sales reps based on customers’ actual consumption rather than subscription commitments. The decision appears to be paying off, as New Relic has seen a spurt in both account growth and data retention, two leading indicators the company tracks closely.

Similar pricing pivots have been made by startups like Cypress, which introduced consumption-based pricing in March 2021; pre-IPO companies like Kong, which announced a pay-as-you-go pricing tier in May 2021; and even longstanding companies like 40-year-old Autodesk, which introduced pay-as-you-go pricing in September.

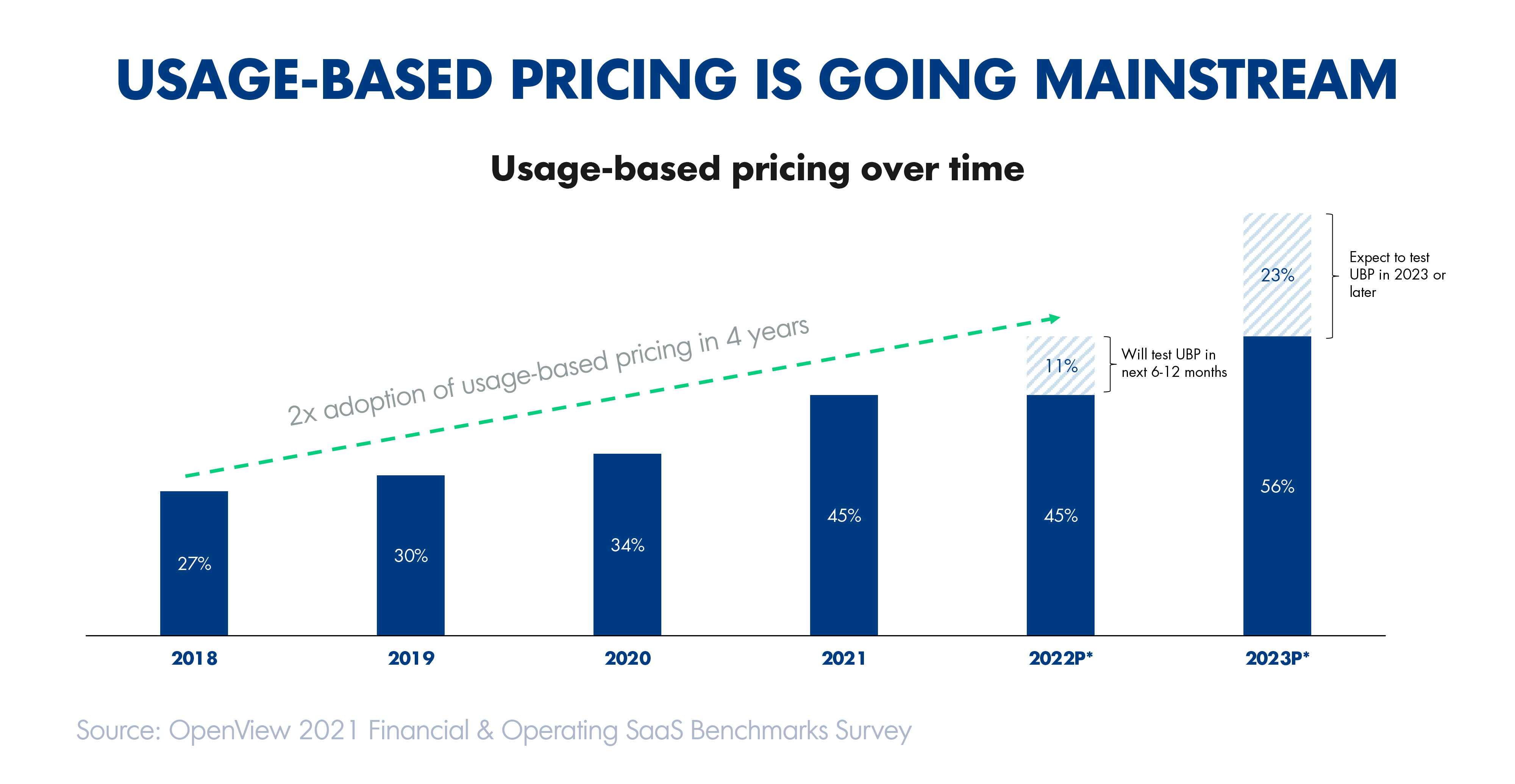

According to our State of Usage-Based Pricing Report, which includes data from nearly 600 participants, 45% of SaaS companies had a UBP model in 2021. This figure is up significantly compared to 34% in 2020 and 30% in 2019.

Image Credits: OpenView Partners

The wave won’t slow down in 2022

A quarter of companies that currently use a UBP model say they introduced it within the last 12 months. This year’s adoption of UBP exceeds that of both 2019 and 2020 combined.

Meanwhile a majority of the UBP holdouts (61%) say they expect to either launch or test usage-based pricing in the near future. If these trends continue, UBP will become the norm, not the exception, as early as 2022.

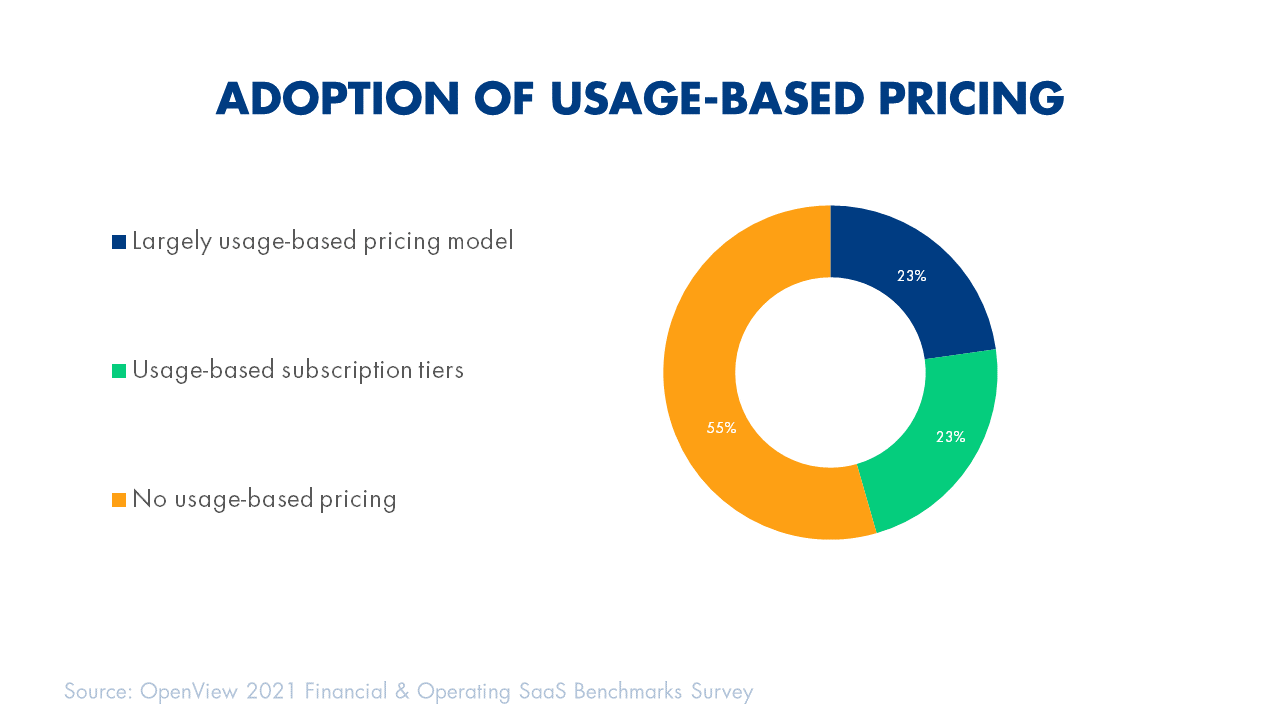

Subscriptions versus UBP isn’t an either-or decision

The data shows that UBP can — and often does — co-exist with traditional subscription pricing. Those with a usage-based model are divided equally between those who offer usage-based subscription tiers (23%) and those with a largely usage-based or pay-as-you-go pricing model (23%).

Image Credits: OpenView Partners

Credit: Source link

Comments are closed.