In recent weeks, crypto token prices have taken a beating.

The two major coins, Bitcoin and Ethereum, are off ~5% in the last month and alt coins in many cases are off by 25% or more (e.g ImmutableX is down 17% in the last 30 days, Polygon is off by more than 25%, and Optimism is down 31%).

Given the moves are more or less in sync with each other and not connected to specific company news, it is likely these declines are being driven largely by the increasingly assertive and antagonistic approach being taken by the United States government towards the sector.

For example, the SEC recently sued Binance and Coinbase for operating illegal exchanges in the US as well as listing and permitting retail investors to trade unregistered securities on their exchanges. While these actions have cast a pall on the sector, they obscure a powerful set of larger global trends that are at work beneath the surface.

What is lost in the noise of these negative headlines, is that the core drivers that form the foundation for global digital asset adoption, remain as robust and compelling as they were during the bull market.

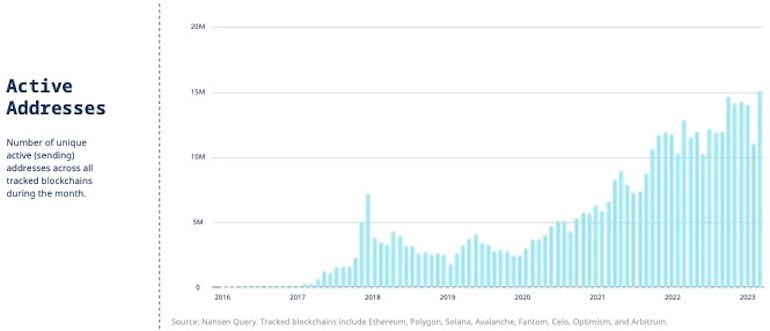

And user growth, after dipping briefly in the wake of the Terra Luna and then FTX collapses, continues despite the current negative media narrative, as shown by blockchains now registering 15 million unique addresses and growing. (See chart, below)

The main difference from the bull market cycle that began in 2020 is that the mania and hype that obscured the underlying drivers on the upswing have all subsided, replaced with the clouds of fear, uncertainty and doubt.

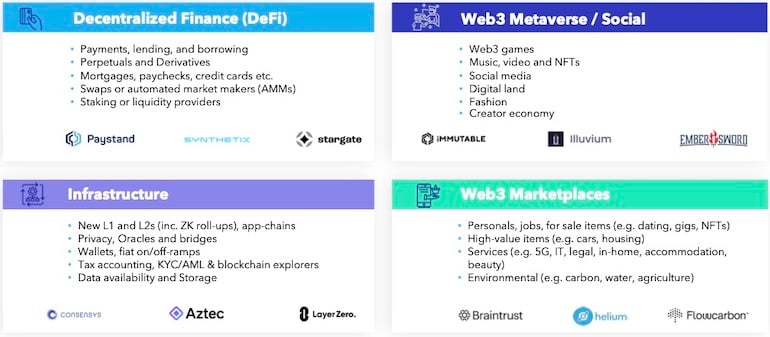

Yet these drivers of digital asset transformation remain. The four areas where we are seeing the most transformative and exciting development continue include:

1) Blockchain-based finance (aka DeFi): Crypto infrastructure offers banking, currency and investment services that are often 10-100x better as compared to existing offerings.

2) Web3 Metaverse (aka “Digital Campfires”): The experience of social media, games (and UGC generally) are greatly enhanced through the integration of blockchain elements such as digital asset ownership (NFTs), the disenfranchisement of incumbent players, advertising-driven UGC monopolies. Web3 instead seeks to empower consumers.

3) Web3 Marketplaces (aka “P2P Platforms”): New digital marketplaces can offer a fairer, lower cost and better service with crypto underpinnings through the use of decentralization and web3 tokenomics, potentially displacing businesses from Uber to eBay to Upwork.

4) Infrastructure (aka “Web3 network architecture): The tooling and platforms to make all this work is still at the early stages of being deployed—enormous companies will be built solving the many key problems remaining to be solved such as secure wallets, privacy, blockchain bridging, scaling solutions and regulatory compliance. [link to my other article expanding on these themes?]

Source: King River Capital

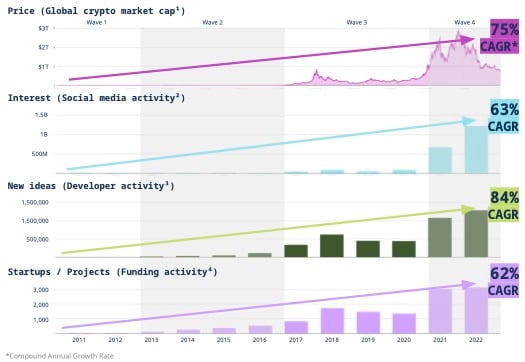

Anecdotally, digital asset startup activity remains robust, including across the Australian-based market leaders such as Immutable and Illuvium. And the data from 2022 bears this out as the charts below show.

Source: Coinmarketcap, Twitter, GitHub, Pitchbook, A16Z

Company founders and other VC funds we speak with are adapting to the new reality not by stopping innovation or ceasing to fund great young companies. Rather they are migrating their businesses to jurisdictions that have regulatory clarity and support.

Three examples outside the US, include:

Europe

In 2022 the EU announced a regulatory regime (called MiCA) to provide crypto asset issuers and service providers a framework within which to operate. It aims to protect investors, clarify which regulatory bodies supervise which parts of crypto, all while allowing for continued investment and innovation by private players.

For example, the rules explicitly state which activities require registration or approval (e.g. operating as a token or stablecoin exchange) and which do not (e.g. NFTs).

Japan

Japan was early to recognise digital assets as a potential boon for their economy. The Japanese government recognised bitcoin as a currency in 2017 then shortly afterwards issue formal operating licences to crypto exchanges.

They followed that in 2022 with a law to permit banks to issue stablecoins. Earlier this year (in March of 2023), three Japanese banks announced plans to develop a payment system that integrates their stablecoins on a public blockchain while satisfying legal requirements.

And, most recently, last month (June) Japan’s largest bank announced plans to issue stablecoins that would interconnect with the major blockchains (e.g. Ethereum, Polygon, Cosmos, and Avalanche)

China

After banning crypto in 2021, the Chinese government has done an about-face. In May 2023, Hong Kong’s Securities and Futures Commission announced that retail investors could trade crypto as part of a larger drive to position the city as a digital asset hub for the region.

Virtual asset businesses now have a licensing regime which protects consumers through a knowledge test for consumers, there are new disclosure requirements for crypto companies, limits on individual exposure to the asset class and similar safeguards.

A different story in the US

Similar moves towards clarity and support are also being announced in the UK, Dubai and Singapore.

Australia is also moving in the right direction, with its Digital Assets Bill 2023, although we risk being bogged down in bureaucracy.

While the industry isn’t seeing exactly the regulations they want in every case, and generally would like more freedom to operate than they are receiving, the important points are that they know what the ground rules are, they aren’t being demonised, and consumers feel protected.

The US is a different story. To begin with, while the US does have a need for crypto, the financial system works reasonably well without it already.

Yes, the dollar is likely to continue to be devalued, nearly half of B2B payments are still made with paper cheques, and the country may see more bank failures on the back of a potential commercial real estate crunch. But the rules based system that governs payments and securities and investment works well (enough) already. Therefore, the need for next generation financial tools is not as great as it is across most of the world.

Most of the world doesn’t work that way. Inflation can be persistently high. Bank collapses are more frequent. Savings aren’t secure. Payments are unreliable or very expensive. Corruption can be endemic. And so on. Thus, similar to the way many developing economies skipped the build out of a land line infrastructure and went straight to mobile phones, we are seeing a banking and payments market collectively amounting to billions of people migrating straight to crypto [charts from Jambo].

Alongside these drivers from the retail and business side, from a (non-US) government perspective, anything that diminishes the global dominance of the US dollar may be perceived as a good thing. This may be part of what is driving these other nations to be so supportive of digital assets.

Being known as a safe and well regulated place for digital asset companies also has the added benefit of attracting the financial and intellectual capital to their jurisdictions at the expense, currently anyway, of the US.

The current actions by the US government is the result of policy that was set in motion when FTX collapsed late last year, or possibly even when Terra Luna collapsed over a year ago. Both of which were due to human error and greed and not the fault of the technology.

As US policymakers watch major companies, promising startups, and VC capital (e.g. A16Z‘s expansion to the UK) respond to their policies by moving offshore in increasingly large numbers, they will recognise the error of their ways. But that will take time.

And so, while we are optimistic that the US will ultimately awaken to the power of this transformative new technology, for the moment the action lies in other jurisdictions.

Credit: Source link

Comments are closed.