Rwazi is a market intelligence platform that provides companies with actionable data from developing markets on who is buying what, for how much, from where, when, and why, to help them drive revenue and expand. We utilize a network of qualified mappers spread across urban 40+ countries in Africa and South Asia, to collect data from their localities.

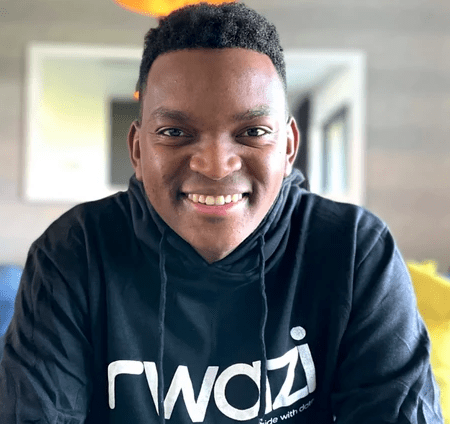

We asked Joseph Rutakangwa, CEO of Rwazi, a few questions about investing in emerging markets.

Grit Daily: I’ve heard that 2022 was a rough year for investing in emerging markets. Is 2023 anticipated to be better?

Joseph Rutakangwa: As the global economy continues to evolve, emerging markets have emerged as a key area of interest for investors. These markets are characterized by rapidly growing populations, rising incomes, and changing consumer preferences, all of which present significant opportunities for investors. However, investing in these markets is not without its challenges and risks, and investors must carefully consider both the opportunities and risks before making any significant commitments.

Looking back at 2022, it was indeed a difficult year for investing in emerging markets, with widespread inflation and supply chain disruptions affecting many of these markets. However, many analysts are optimistic that 2023 will be a better year for investing in emerging markets. This is due to several factors, including the expectation that central banks in developed markets will relax their monetary policies, which could ease some of the tensions experienced by emerging market currencies. Additionally, the reopening of China after the COVID-19 pandemic is expected to create new opportunities for emerging markets in East Asia.

Despite the expected improvements in 2023, investors in emerging markets should be thinking longer term than just the ups and downs of any particular year. Investing in emerging markets requires a long-term perspective, as these markets are inherently volatile and subject to significant economic, political, and social changes. In this article, we will explore some of the reasons why investors in emerging markets should be thinking longer term, as well as the challenges and risks associated with investing in these markets.

Grit Daily: Shouldn’t inventors in emerging markets be thinking longer term than the ups and downs of any particular year?

Joseph Rutakangwa: There are several benefits to taking a long-term approach to investing in emerging markets. First, investing in emerging markets can provide significant diversification benefits for investors’ portfolios. Emerging markets are often less correlated with developed markets, which means that they can provide a source of diversification that can help to mitigate risk and enhance returns.

Second, investing in emerging markets can provide significant growth opportunities for investors. As we have seen, emerging markets are characterized by rapidly growing populations, rising incomes, and changing consumer preferences, all of which present significant opportunities for investors to capture growth and generate higher returns.

Third, taking a long-term approach to investing in emerging markets can help investors to avoid the pitfalls of short-term thinking. In emerging markets, short-term volatility and uncertainty can create significant risks for investors who are not prepared to weather the ups and downs of the market. By taking a long-term view, investors can better manage their risk and avoid making hasty investment decisions based on short-term fluctuations in the market.

Grit Daily: Emerging markets are exciting because of the huge growth potential, but what are the risks?

Joseph Rutakangwa: Despite the potential benefits of investing in emerging markets, there are also significant challenges and risks associated with these markets. One of the key challenges of investing in emerging markets is the lack of transparency and reliable data. In many emerging markets, there is a lack of reliable data on economic and financial indicators, which can make it difficult for investors to accurately assess the risks and opportunities associated with these markets.

Investing in emerging markets is not without its challenges and risks, but for investors who are willing to take a long-term perspective, these markets can provide significant growth opportunities and diversification benefits.

Grit Daily: Let’s take a long-term perspective. What are some emerging market success stories?

Joseph Rutakangwa: The longer-term view can be seen from the various success stories in emerging markets that have arisen over the past few decades. Brazil, for example, has transformed from an economy that was heavily reliant on exporting raw materials to one that has developed a diverse range of industries and a large consumer market. China, similarly, has become the second-largest economy in the world with a massive and growing middle class, driving consumption patterns in both China and globally.

For investors, the key to success in emerging markets is patience and a long-term outlook. While short-term fluctuations can cause volatility and concern, a well-diversified portfolio with exposure to emerging markets can provide significant growth opportunities over the long term. Investing in emerging markets should be viewed as a strategic decision, rather than a tactical one.

Grit Daily: Please list a few key factors investors who are considering investing in emerging markets should focus on when evaluating the potential opportunities and risks?

Joseph Rutakangwa: Economic growth potential: Emerging markets are often characterized by high economic growth potential, driven by factors such as a growing population, increasing urbanization, and rising disposable income. Investors should evaluate the macroeconomic factors in the market, such as the stability of the political environment, the level of infrastructure development, and the depth and breadth of the domestic capital markets.

Demographic trends: Demographic trends are an important driver of economic growth in emerging markets. As the middle class grows, consumption patterns evolve and new markets are created. Investors should evaluate the demographics of the market, including the size of the population, the age distribution, and the level of education and skill development.

Industry trends: Industry trends can provide insight into the potential opportunities in a market. Investors should look for industries that are poised for growth, such as technology, healthcare, and consumer goods. They should also evaluate the level of competition in the market and the regulatory environment.

Political and regulatory environment: The political and regulatory environment can have a significant impact on investment opportunities and risks in emerging markets. Investors should evaluate the stability of the government and the regulatory framework in the market, as well as any potential risks related to corruption or nationalization.

Access to information: Access to information is a critical factor in evaluating investment opportunities and risks in emerging markets. Investors should ensure that they have access to reliable and timely information on the market and the companies they are considering investing in. They should also be aware of any potential challenges related to a lack of transparency or difficulty in obtaining accurate and up-to-date information.

In summary, while short-term fluctuations in emerging markets can be concerning, investors should take a long-term view when evaluating opportunities and risks.

Grit Daily: It doesn’t sound like investing in emerging markets is for everyone.

Joseph Rutakangwa: Emerging markets offer significant growth potential for investors who are patient and strategic in their approach. By focusing on key factors such as economic growth potential, demographic trends, industry trends, the political and regulatory environment, and access to information, investors can make informed decisions and capture the potential opportunities of investing in emerging markets.

Peter Page is the Contributions Editor at Grit Daily. Formerly at Entrepreneur.com, he began his journalism career as a newspaper reporter long before print journalism had even heard of the internet, much less realized it would demolish the industry. The years he worked a police reporter are a big influence on his world view to this day. Page has some degree of expertise in environmental policy, the energy economy, ecosystem dynamics, the anthropology of urban gangs, the workings of civil and criminal courts, politics, the machinations of government, and the art of crystallizing thought in writing.

Credit: Source link

Comments are closed.