The Covid pandemic hit Mexico harder than the rest of North America, laying bare the nation’s woefully inadequate healthcare system. Yet it was during the pandemic that three seasoned Mexican professionals launched Medsi, a startup on a mission to solve Mexico’s healthcare access problem.

A medical emergency is a financial catastrophe for the average Mexican family, and routine medical care is often difficult to afford. Medsi was founded in early 2022 to help Mexicans, few of whom have health insurance or sufficient cash to cover a medical emergency, to pay for healthcare. After just a year or so in business, the three co-founders have already expanded the mission beyond solving the widespread lack of healthcare financing. They learned by listening closely to their first customers that patients have very little information to help them choose doctors or healthcare facilities, and their challenges paying for care are compounded by a deep distrust of traditional banks and health-insurance providers.

Mexicans pay the second-highest out-of-pocket (OOP) cost in the world. A whopping 45 percent of OOP costs are covered directly by patients, making Mexico an outlier even within Latin America. About half (49 percent) of the Mexican population has some form of healthcare coverage, and only five percent have access to private insurance. Because public-sector care is inadequate, patients increasingly seek private healthcare services, fueling a growing need for OOP healthcare spend.

Only about 11 percent of Mexicans have a credit card to help with medical emergencies, essential routine care, or elective care (in Mexico maternity and OB/GYN care are categorized as elective and not covered by health insurance), according to the World Bank. By some estimates more than 60 percent of Mexicans work in the informal sector of the economy. Financial inclusion in Mexico is an abysmal 36.9 percent of the population – far below other countries with comparable GDP per capita, per the Center for Global Development.

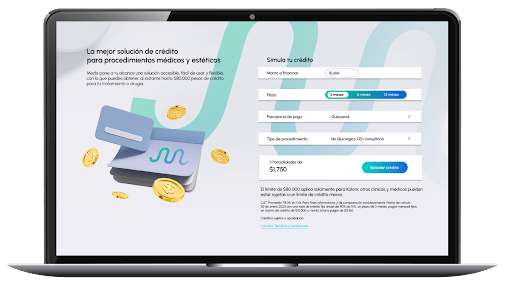

Late last month, Medsi closed USD $10 million in debt financing to accelerate onboarding more than 32,000 current users on the waiting list for new loans via a revolving credit line or innovative, hybrid savings-and-credit solutions via its “health assurance” app. Once approved via an intuitive three-minute application process, users can simply schedule disbursements. Medsi pays the private doctor or clinic directly upon fulfillment via a QR code using the Medsi Credit app, available via Google Play or the App Store, on their smartphones.

Manuel Villalvazo, CEO; Pablo de Cote, Executive Chairman; Pepe Cabrera, COO

To learn more about what sets Medsi apart from other existing approaches, why Mexico’s healthcare sector is so different from its neighbor to the north, and how the startup’s co-founders plan to fast-track the “healthtech meets fintech” super app’s growth in the coming months, Grit Daily recently sat down with the senior executive team behind the Mexico City-based startup:

Grit Daily: After so many years of leadership positions in your respective industries in Mexico, what inspired you to become entrepreneurs and found Medsi in 2022?

Manuel Villalvazo: After reaching the pinnacles of our careers in our respective fields, we decided to put our combined skills to good use by tackling the massive healthcare crisis in Mexico. It is evident for anyone in the country that the system is broken. Today, it’s a highly fragmented market with a lack of access, and no reliable references or review systems to identify quality service-providers. We aim to improve the connectivity between patients and doctors and remove the inefficiencies and information barriers in the Mexican healthcare sector.

We are not your typical co-founding team. Our Executive Chairman Pablo Munoz de Cote has nearly two decades of experience building category-leading pharma brands from the ground up and has already achieved more than 50 successful exits. Our co-founder, Pepe (Jose Cabrera), who serves as Medsi’s COO, has ample hands-on experience operating portfolio companies for some of the largest private equity funds in the country. And I have led the majority of M&A deals in Mexico’s healthcare sector while leading the investment banking arms of B of A Merrill Lynch, Citi, and Deutsche Bank in Mexico during the last two decades.

However, we believe that taking on such a structural and complex challenge requires a leadership team that is highly experienced – which can bring “out-of-the-box” approaches and a multi-faceted skill set. We are all passionate about making the world a better, more equitable place. In Mexico, which is our near-term geographic focus, we estimate there’s already a total addressable market of US$72 billion – so there’s a lot of room for Medsi to grow there.

Grit Daily: Mexico and the U.S. share a long border, but the healthcare systems are worlds apart. What are the challenges you’re addressing in Mexico?

Pablo Munoz de Cote: You are absolutely correct. Even though Mexico and the U.S. border each other, the two healthcare systems are worlds apart. The public healthcare system in Mexico is overwhelmed and underfunded. At the same time, 95 percent of the population does not have private healthcare insurance, and Mexicans are for the most part left to cover their own medical expenses. Today, Mexico has the highest out-of-pocket share of medical expenses than anywhere else in the world today, except for India. This is a big red flag that something’s severely wrong when people need to meet the challenges of paying for healthcare themselves or not getting the care they need.

Concurrently, Mexicans have a deep distrust of traditional financial institutions that do not work for everyday people. Most are unbanked or underbanked, and even those who’ve paid into private insurance have realized that Mexican insurance companies did not perform for them by denying payments for necessary procedures and services. People in Mexico can pay their premiums for years, then have a health event and the insurance companies weasel out of paying them when they need it. Further aggravating the problem, only eleven percent of the Mexican population has a credit card to help with health events or medical emergencies with an average 64.9 percent APR. And annual household savings in Mexico are about USD$800 on average, so it’s not like they can tap their nest egg to face a health event.

Due to all these issues: out-of-pocket payor dynamics, a deep distrust of insurance, and an ongoing lag in financial inclusion, medical emergencies in Mexico are often catastrophic events for a household’s finances. People are forced to rely on their extended family to cover pressing needs or turn to informal or predatory lending. Most often, Mexicans will go untreated and put off care until they’re forced to do it – and, oftentimes, those patients’ outcomes will suffer.

Grit Daily: What are the first offerings you’ve already rolled out since starting commercial operations in late summer 2022? How do they compare with other options on the market?

Jose “Pepe” Cabrera: Our first healthcare-finance offering, which launched last September, is a revolving line of credit that can be used by the whole family. Once approved, users simply schedule disbursements and Medsi pays their doctor or clinic directly upon fulfillment via a QR code using the app on their smartphones. With that, we currently lend up to US $4,000 at a 40% APR that’s due back within up to twelve months, so payments for the services or procedures may be spread out over a longer period of time.

Just last month, we launched a new offering – a combination of savings and credit – that is available to a much broader range of the Mexican population who have not built a history of credit as they’re part of the informal sector, or they don’t have access to a bank account. For this option, the Medsi user pays four bi-monthly payments in advance, and then has access up to 10x that amount in their savings account in the form of fully automated, on-demand loans.

For the 95 percent of Mexicans who don’t have healthcare insurance today, Medsi’s line of credit is becoming a lifeline for families during health events, and a de facto alternative to insurance – in fact, we are the “anti-insurance” because our customers have full control over where their hard-earned money is spent. In addition to essential services, Medsi provides a pathway for “skip the line” procedures that are not prioritized by the public system, and elective procedures that are not covered by health insurance in Mexico – including maternity & OBGYN, one of most popular medical specialties amongst Medsi patients, in addition to orthopedics, ophthalmology, dentistry, dermatology, and cosmetic procedures, among others.

Grit Daily: Why do you think the world needs a “fintech meets healthcare” super app, and why start in Mexico?

Manuel Villalvazo: Medsi is differentiated from other options on the market today because of its holistic approach that benefits patients and private doctors/clinics, addresses the broad distrust of Mexicans towards insurance companies, traditional financing sources and medical practitioners, and its mobile technology that reduces friction and automates processes.

Private healthcare in Mexico is fragmented, the quality is unpredictable, and the total potential cost of a procedure is not transparent. To overcome these and other challenges, Medsi’s 24/7 Medical Concierge services support patients throughout their entire healthcare journey by providing expert advice and ‘hand-holding’ customers to ensure they get the best care.

Unlike some fintech and insurtech startups focused on piecemeal, partial solutions to the wide gap in access to healthcare in Mexico, Medsi is combining the best aspects of healthtech and fintech innovation to address the current crisis. In comparison, Medsi is based on a completely different model because we’re an alternative to insurance. Instead of insurance, Medsi provides assurance that Mexicans will have access to money for healthcare costs they can control themselves.

Another important point is pre-existing conditions such as diabetes are often not covered by health insurance. Mexico has one of the world’s highest rates of diabetes in the world. One in six Mexican adults are living with diabetes and another half of people living with diabetes in Mexico are undiagnosed. Even for those with healthcare insurance, Medsi is supplementary because we let Mexicans cover a copay or deductible many people don’t have the funds to cover, or to proceed on elective procedures or treatments that are not covered by insurance.

Grit Daily: What is the bigger, long-term vision for Medsi?

Pablo Munoz de Cote: As we continue to rapidly evolve and build our user base, Medsi will be squarely focused on solving the connectivity between doctors and patients in numerous ways, including becoming a first point of contact for patient education, leveraging telehealth solutions for primary care and diagnosis, compiling a healthcare directory of private doctors and clinics filled with ratings and reviews from real users, automating appointment bookings with transparent, all-in quotes, and all while handholding the patient throughout their journey and solving the constraints related to financing. Beyond Mexico, there are plenty of other markets in the Americas that urgently need healthcare assurance.

Grit Daily: Beyond the initial USD $10M in debt-financing, how do you plan on financing the scaling of Medsi’s business in Mexico and beyond? How tough is it pitching your seed round?

Jose “Pepe” Cabrera: We are currently shopping for our seed equity round as the US $10 million debt-financing round we just closed is wholly earmarked for underwriting and focused on onboarding our first 32,000+ Medsi users who are currently on a waiting list. While the market for venture capital has certainly changed since 2019 to 2021, there is a good deal of interest in early-stage startups with first-of-kind offerings that are focused on addressing massive societal challenges. And based on the demand we’re seeing from potential Medsi customers, which has far outpaced our initial projections, we’re very confident that we’re on the right track for the fast growth and adoption of Medsi to help deliver health assurance for the masses in the long term.

Peter Page is the Contributions Editor at Grit Daily. Formerly at Entrepreneur.com, he began his journalism career as a newspaper reporter long before print journalism had even heard of the internet, much less realized it would demolish the industry. The years he worked a police reporter are a big influence on his world view to this day. Page has some degree of expertise in environmental policy, the energy economy, ecosystem dynamics, the anthropology of urban gangs, the workings of civil and criminal courts, politics, the machinations of government, and the art of crystallizing thought in writing.

Credit: Source link

Comments are closed.