Meet ‘MotionsCloud’, A Munich-based Startup that is using Computer Vision to Analyze Car and Property Damage for Insurance Companies

Pitch your startup story at [email protected] Please don't forget to join our ML Subreddit

According to Accenture, the insurance industry has one of the lowest levels of customer satisfaction, with 83 percent of consumers dissatisfied with the claim handling procedure preparing to transfer insurers. Furthermore, due to great staff and sophisticated, lengthy, manual processes, insurance businesses’ claims processing costs can account for up to 15% of total insurance claims paid out annually (processing costs up to €20 billion globally and annually).

In response to these issues, the Munich-based startup MotionsCloud founded in 2016, has claimed to build a secure AI-driven deep learning insurance claims automation engine, which it says saves insurance firms time and money while also improving customer experience. Its technology provides claimants and inspection teams with an automated tool that cuts the claims cycle from ten days to three hours and saves up to 75% on processing costs.

The features of the automation engine, as claimed by the company, include:

Without installing an app on the phone during or after FNOL, policyholders/claimants can easily record photographs, documents, or videos using MotionsCloud’s mobile web app.

- White-labeled personal branding

With specific workflows, typography, style guide, and branding, the mobile web app is claimed to be adaptable, personalized, and white-labeled for insurance businesses.

- AR user experience (Augmented Reality)

According to the company, mobile users can also effortlessly record pictures/videos at the optimal angle, focus, distance, and view using Augmented Reality (AR).

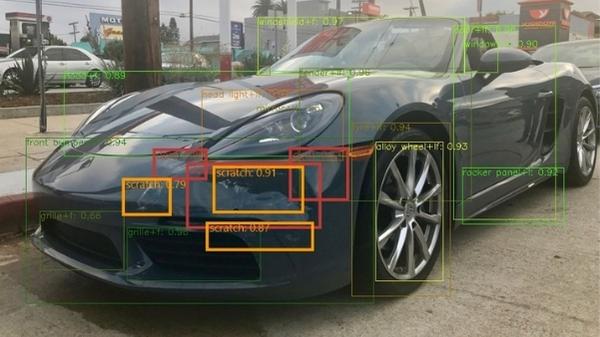

- Analysis of vehicle components

MotionsCloud’s AI engine, powered by Artificial Intelligence (AI) computer vision technology, can detect car parts, positions, and areas through photos and videos.

- Analysis of damage types and severity

The AI engine of MotionsCloud then proceeds to study the car, identifying any damages, their categories, and the severity of the damages with a confidence percentage level.

- Recommendation for treatment

If the damaged parts can be replaced or fixed, the AI engine gives treatment recommendations once the damages and severity are determined. The treatment recommendations’ mechanism and logic are adaptable and customized to individual application scenarios.

During the video chat, the claim manager can use the Augmented Reality (AR) sketching capability to communicate and cooperate with claimants and policyholders in real-time. Both sides can draw on the image, highlight the damaged area, add notes, etc. They can use the toolbar to select from various settings to enhance engagement.

By making the insurance claims process quick, fair, and digital for claimants and policyholders, this app claims to change the entire landscape. LeX Tan, CEO of MotionsCloud, said, “At MotionsCloud, we leverage augmented reality (AR) and computer vision (AI) technologies to fill the gap in vehicle and property claims/inspections processes…

Recently, the company raised $2 million in a funding round. According to the business, the money will be used to assist MotionsCloud in expanding further. Insurance firms could also possibly use MotionsCloud’s automated property and vehicle inspection to make the process go faster and more efficiently. The startup, based in Germany, has claimed to collaborate with companies from Europe, the United States, and Asia.

References:

- https://www.crunchbase.com/organization/motionscloud

- https://motionscloud.com/

- https://member.fintech.global/2022/04/29/motionscloud-rakes-in-2m/

- https://tech.eu/2022/04/28/munichs-motionscloud-minimises-insurance-claims-migraines-manifests-2-million

- https://coverager.com/motionscloud-raises-2-million/

Credit: Source link

Comments are closed.