You’ve heard of SPACs, meme stocks and buy now, pay later, but have you heard of the LTSE, First Women’s Bank and Upsolve?

Through the pandemic, a trove of attention has been paid to new market structures and activity that are deemed short term, risky or speculative. Whether they are and what net outcomes they yield for various stakeholders are useful questions.

But the noise has muted analysis and coverage of other highly ambitious technology ventures — ones that aim to uplift and correct financial markets by encouraging longevity, community and empowerment.

Longevity: More choices to go and stay public

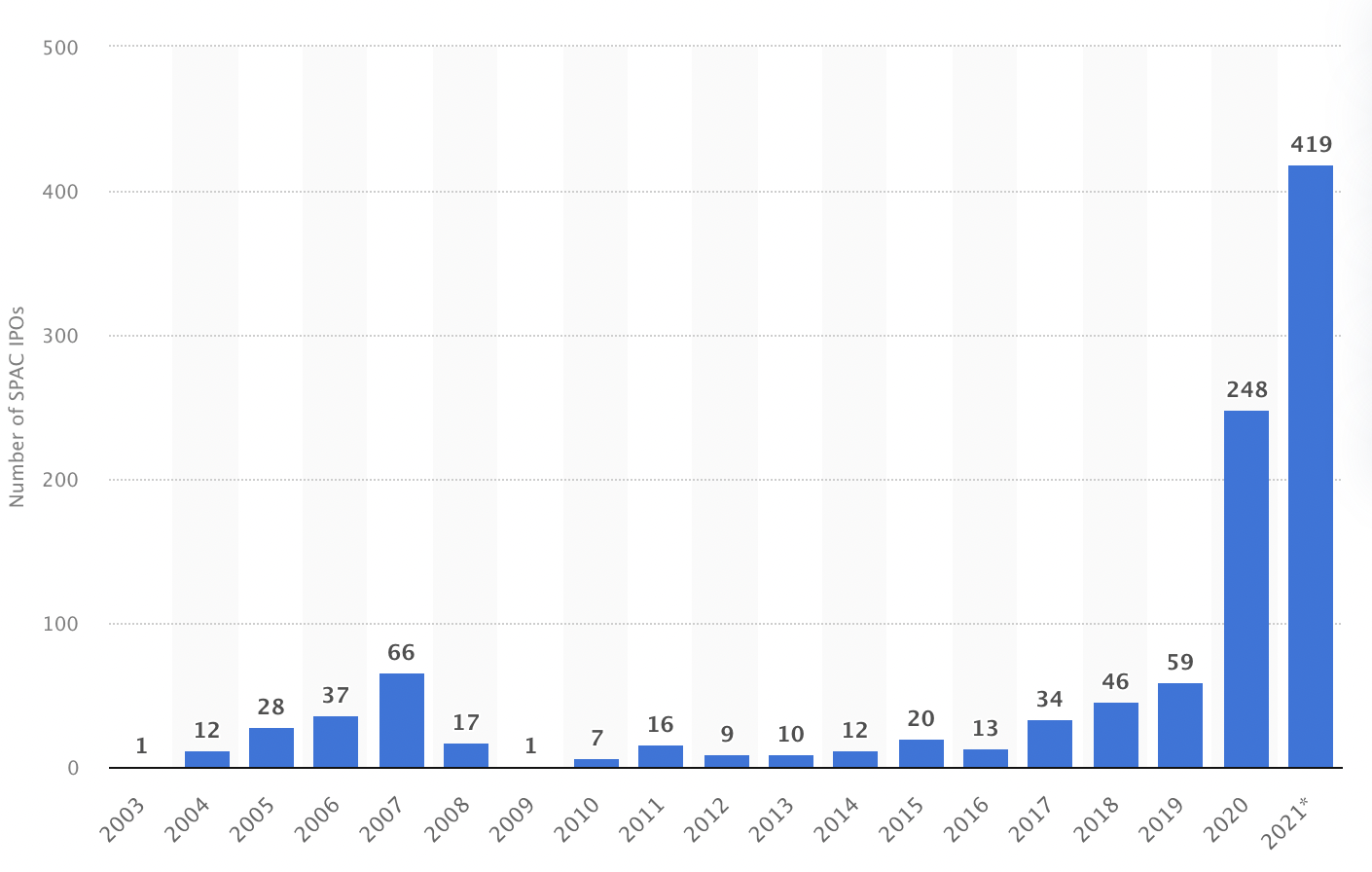

The volume of special purpose acquisition company (SPAC) IPOs we have seen through the pandemic is astounding in historical terms.

Image Credits: Statista (opens in a new window)

Leaving out the sponsors, private market investors and participating startups, reactions to SPACs have been largely negative. The binary views are reminiscent of those we saw during the ICO frenzy in 2018.

Debates on whether the pandemic’s cohort of SPACs or their status as a liquidity structure are net positives or negatives have overshadowed other ambitious initiatives that aim to encourage more long-term planning and participation in markets. One example is the Long-Term Stock Exchange (LTSE).

This August, Eric Ries’ LTSE listed its first two companies, Asana and Twilio. Companies that list on the exchange must adhere to its five principles, which aim to maximize diversity and inclusion, environmental and social impact, employee welfare and long-term conviction.

The LTSE emphasizes a focus on transparency — for instance, when an LTSE user searches for information on Asana, they’ll first find information about the company’s values, long-term principles and growth metrics.

Screenshot of a search for Asana on the LTSE. Image Credits: LTSE

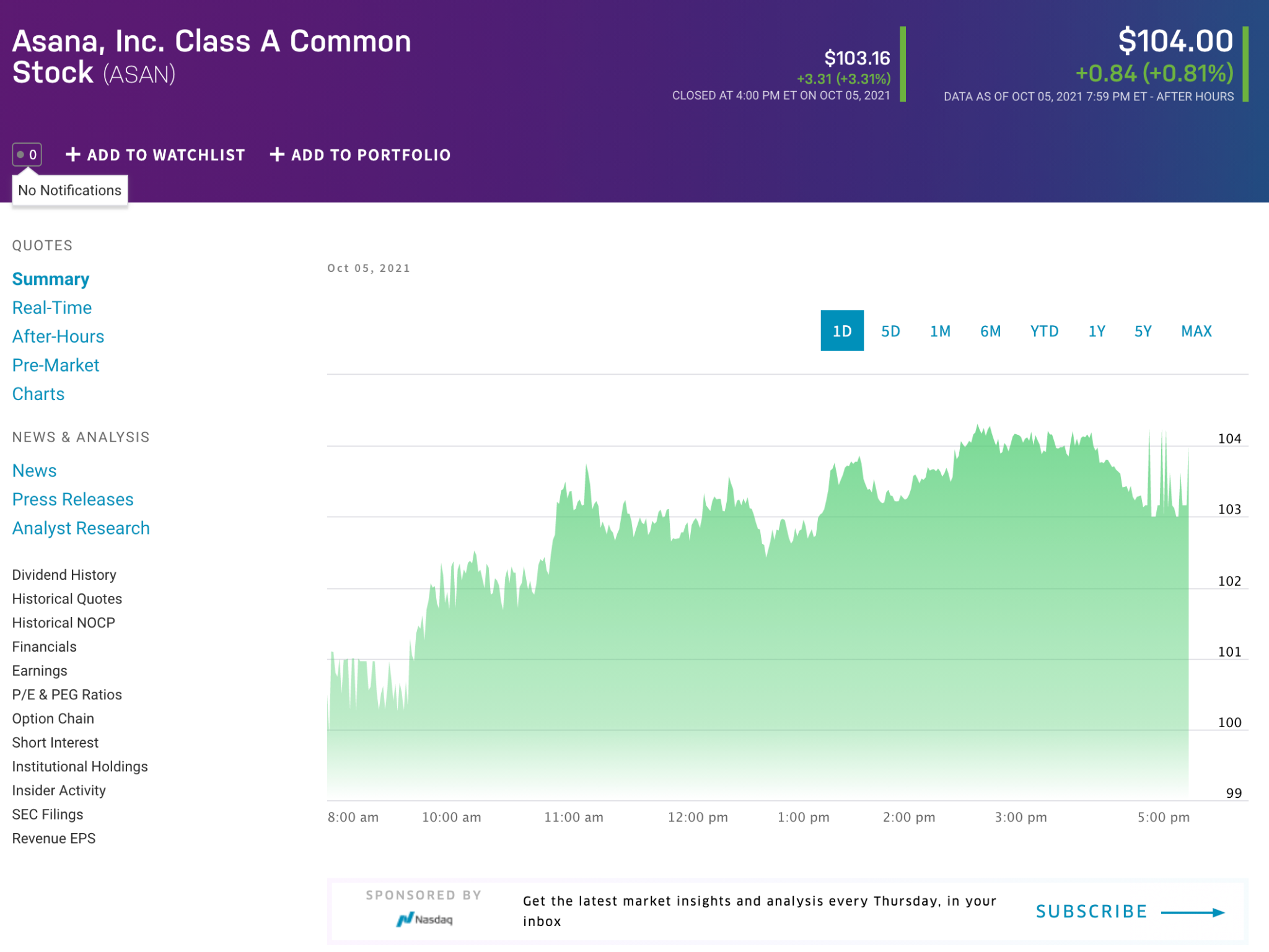

Search for Asana on the Nasdaq, in contrast, and a user will find an emphasis on price performance over various time horizons, as well as prompts to subscribe to the exchange’s media.

Screenshot of a search for Asana on Nasdaq. Image Credits: Nasdaq

The LTSE wasn’t the only exchange to launch during the pandemic. The Members Exchange (MEMX), backed by a consortium of financial conglomerates like JP Morgan and BlackRock, recently celebrated its first anniversary and capture of 4% market share.

Credit: Source link

Comments are closed.