More than 1.07 million Australians now own at least one cryptocurrency, according to new research from Roy Morgan

That’s around 5% of the adult population. While Bitcoin and Ethereum are investor favourites, niche coins such as Ripple, Cardano, Dogecoin, Shiba Inu, Solana, Binance Coin, Litecoin, Cronos, Polygon and other are part of the mix, with the research revealing some stark demographic insights.

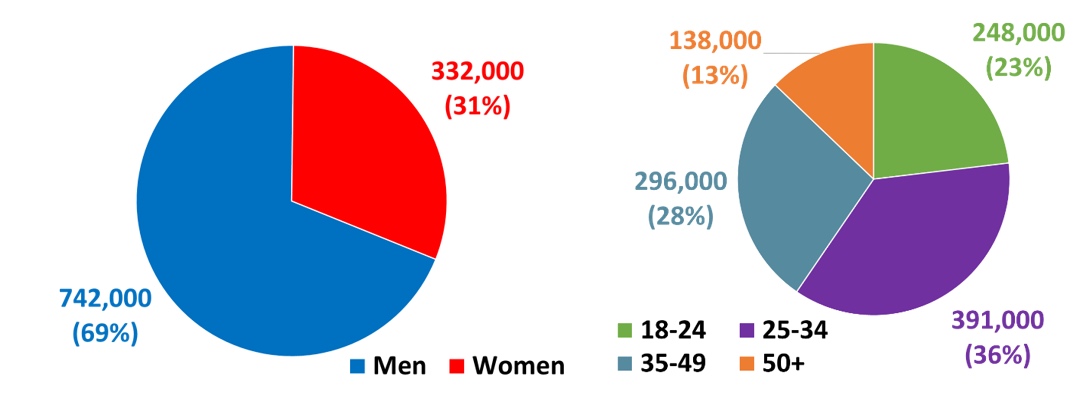

More than two-thirds (69%, 742,000) of crypto investors are men, compared to less than a third (31%, 332,000) who are women.

By age, the under 35s make up the majority of investors (59%). That equates to more than one-in-ten Australians under 35.

Of all crypto holders 391,000 (36%) are aged 25-34 and 248,000 (23%) are aged 18-24.

The remaining 41% of the total investor market comprises of 296,000 aged 35-49 (28%) and 138,000 aged 50+ (13%).

Cryptocurrency investors by Gender & Age: February 2022 Source: Roy Morgan Single Source, December 2021 – February 2022, n=15,989. Base: Australians 18+.

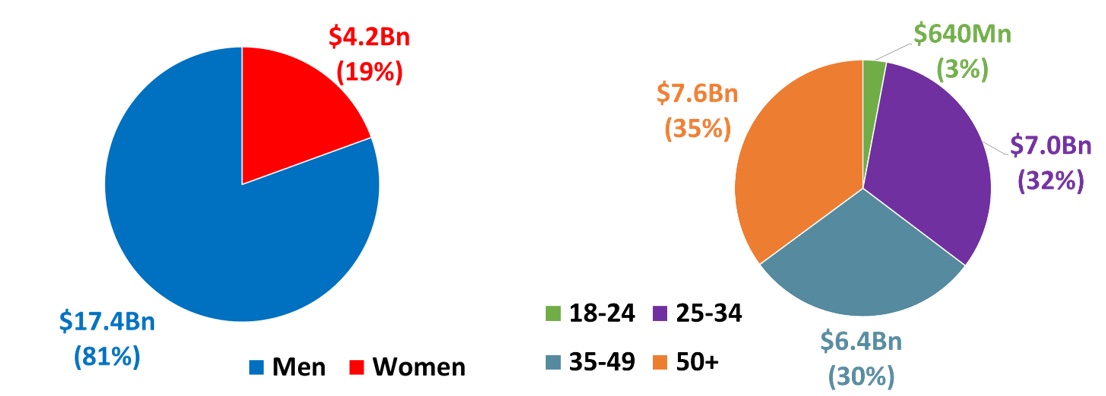

The under 35s are not placing the biggest bets, accounting for just over a third of the market’s total value.

And while they are less likely to be cryptocurrency investors, Australians aged 35 and older have a significant slice of Australia’s cryptocurrency market due to the average size of their investments. The 50+ investors have the biggest average cryptocurrency stake with n average value of around $56,200.

This size of average investment means the value of all cryptocurrency holdings for people aged 50+ is around $7.6 billion – higher than any other age group and over 35% of the total market.

In contrast, although they are most likely to be investors in the market, Australians aged 18-24 have an average cryptocurrency investment of only $2,600 for a total value of all cryptocurrency investments for this age group is only $630 million – about 3% of Australians total cryptocurrency market.

The investment profiles of Australians aged 25-34 and 35-49 are similar. People aged 25-34 have an average cryptocurrency investment of $18,200 while for those aged 35-49 it is slightly higher at $21,600.

Because they are more likely to be investors in cryptocurrency the size of the market for those aged 25-34 is slightly larger at $7 billion (32% of the market) than for those aged 35-49 at $6.4 billion (30%).

Analysis by gender reveals the average investment size for men of $23,400 is nearly twice as high as the average investment for women of $12,800.

This large difference means men hold total cryptocurrency investments of $17.4 billion (81% of the market) compared to only $4.2 billion (19%) for women.

Total value of Cryptocurrency investments by Gender & Age: February 2022

Source: Roy Morgan Single Source, December 2021 – February 2022, n=15,989. Base: Australians 18+.

Roy Morgan Research CEO Michele Levine said last few years have seen a big increase in the number of Australians who have invested into cryptocurrencies.

“The latest research into Australia’s cryptocurrency investors shows over 1 million Australians aged 18+ now have an investment in cryptocurrency – at an average value of just over $20,000,” she said.

“Investing in cryptocurrencies is a novelty for many Australians and as our latest research shows only around 1-in-20 Australians currently hold a cryptocurrency investment. This small penetration of cryptocurrency investors shows there is still the potential for huge growth in the market over the next few years as more Australians become exposed to this form of investing.”

Credit: Source link

Comments are closed.