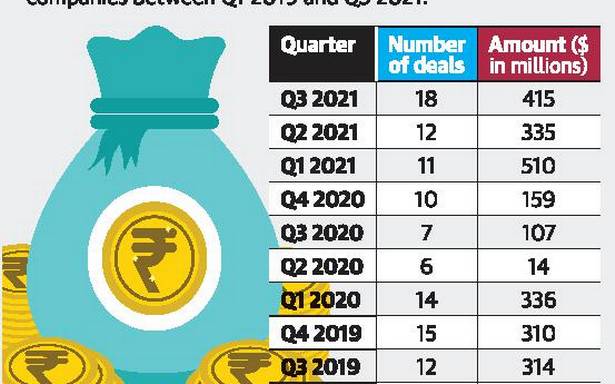

Private equity and venture capital (PE-VC) firms invested $415 million across 18 deals in Tamil Nadu-based firms during the third quarter of this year, shows data from Venture Intelligence, a research service .

The top PE-VC investments for the quarter, which ended on September 30, came into TVS Supply Chain Solutions ($136 million) followed by CredAvenue, the subsidiary of Vivriti Capital, which connects institutions, investors, small enterprises and individuals, who lack access to financial services in India ($90 million). Ki Mobility Solution raised $51 million from a fund managed by Exor, one of Europe’s leading holding companies.

In terms of angel investments, during the third quarter of 2021 around 10 startups in the State received funding. Last year, during the same period, seven startups received angel funding. Fieldproxy, IppoPay, Chai Waale and NimbleBox.ai are some of the firms that received angel funding in recent months.

Initial public offerings

“While it is heartening to see the record pace of PE-VC investments in India sustaining, the highlight of the latest quarter was the successful initial public offerings (IPOs) of the Indian consumer market focused Zomato and the global enterprise software as a service (SaaS) focused Freshworks,” said Arun Natarajan, founder of Venture Intelligence.

“Such exemplary liquidity events will expand the share of the asset allocation pie that PE-VC investing in India commands from both domestic and foreign investors,” he added. During the same period in 2020, when businesses were slowly opening up post lifting of the first lockdown, PE-VC investors had put in $107 million across seven deals in T.N. firms.

At the national level, PE-VC firms invested a record $49 billion across 840 deals in Indian companies during the first 9 months of 2021. These figures, which have already surpassed the full year investment total of $39.5 billion (across 892 deals) in the entire of 2020, represent a 52% increase over the $32.2 billion (across 651 deals) in the first nine months of 2020.

Credit: Source link

Comments are closed.