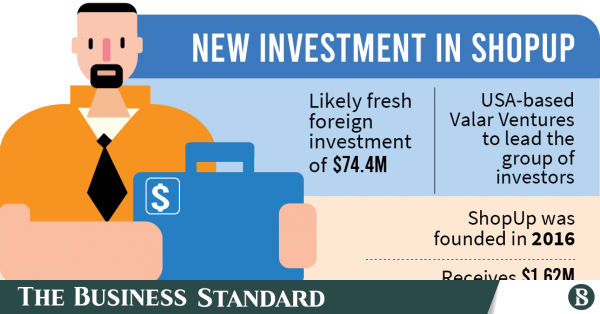

ShopUp, the country’s largest business-to-business (B2B) marketing platform to support small neighbourhood shops and online sellers, is reportedly going to receive a fresh round of venture capital funding of more than $74 million from a group of investors led by USA-based venture capitalist Valar Ventures.

DealstreetAsia, a Singapore-based investment industry portal, reported on Friday that ShopUp had already secured $74.4 million in a fresh round of funding. They cited regulatory filings by the investors to the Accounting and Corporate Regulatory Authority (ACRA) of the city-state.

Earlier, in October last year, the home-grown retail tech startup raised $22.5 million of Series-A funding from a group of investors co-led by Sequoia Capital India and Flourish Ventures, which still is the highest ever Series-A fundraising by any Bangladeshi startup.

“We do not acknowledge the media report and would request you all to wait until we come up with complete facts soon,” said Afeef Zaman, co-founder & chief executive officer of ShopUp.

He, however, did not deny that the reported development was on the table.

The country head of a venture capital network told The Business Standard that there might be some modification in the investment plan, which ultimately might result in a round of $60-70 million.

He also said Sequoia is one of the world’s largest venture capital firms that historically backed technology startups and now accounts for more than one-fifth of NASDAQ market capitalisation.

“Sequoia’s confidence in ShopUp might have attracted investors from both the east and west,” he added.

ShopUp

Three Bangladeshi tech minds – Afeef Zaman, Siffat Sarwar, and Ataur Rahim Chowdhury – founded ShopUp in 2016 as a social commerce and marketing company that supported small f-commerce entrepreneurs to better manage and promote their businesses and also to deliver their products with their limited resources.

It was a great help to many young f-commerce entrepreneurs who did not even have a credit card to digitally pay the bill for online promotions.

In 2018, ShopUp received a seed funding of $1.62 million from Omidyar Network, an impact investment firm founded by eBay founder Pierre Omidyar.

The actual boost for ShopUp was its enrollment in Sequoia Capital India’s 4-month accelerator programme “Surge” in 2019 which allowed the startup’s significant access to the international network, mentorship and investment.

The $1.5 million received from the accelerator programme on top of Omidyar Network’s $1.62 million was followed by the largest ever Series-A funding of $22.5 million.

Three other ventures joined Omidyar Network’s entity Flourish Ventures and Sequoia Capital India’s co-leadership for the biggest round then.

Meanwhile, ShopUp expanded operations to have acquired around 5 lakh small merchants that include grass roots level mom-and-pop stores and f-commerce who are sourcing products through the B2B platform with ease as ShopUp has improved in three areas – sourcing products from manufacturers or suppliers to cater the retailers under its programme “Mokam”, nationwide logistics service under its technology-enabled brand “RedX” and also on credit supplies titled “Baki”.

Since the beginning of the pandemic last year ShopUp significantly scaled up as many small shops found its combined services convenient amid their struggle to retain sales, margins and cash flow.

And now ShopUp appears to look for a much bigger scale with the fresh funding.

While speaking to The Business Standard over phone, ShopUp CEO Afeef Zaman refused to comment on the company’s expansion plan at the moment.

Credit: Source link

Comments are closed.