Quick blog here to update you on some pretty important movements in the market. Today, in a nasty day for stocks generally, shares of software and cloud companies took a pounding.

In numerical terms, the Nasdaq Composite lost 2.51%, per CNBC data. That’s a very bad day for a huge, critical category of publicly traded wealth. And then the Bessemer Cloud Index, our favorite method of tracking a more targeted basket of modern software concerns, tanked 5.45% during regular trading.

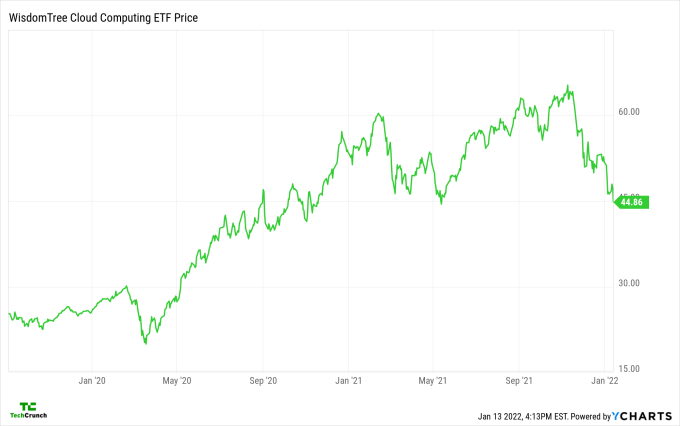

That’s a lot of deleted value in a single day. But because the declines come after the startup-critical index already endured sharp drops recently, it was insult to injury. Here’s the chart:

Image Credits: YCharts

You need to glean two things from this collection of graphed data:

- Software stocks have given back more than all their gains from late 2020, and have retreated more than 30% from recent highs. That’s pretty bad.

- Software stocks remain richly valued and are worth far more than they were at the start of 2020, a period of time roughly two years ago. That’s pretty good.

So things are not great, but also not terrible, for modren public software companies.

The issue that TechCrunch continues to track is how quickly — if at all — the declines shown above begin to trickle into startup valuations. We’re seeing some chop in the private-public market divide, where IPOs and direct listings try to carry companies from one shore to the other. But in terms of sheer startup fundraising momentum, you wouldn’t know that revenue multiples are taking a huge cut on the public markets. For most startups, it’s still heady days.

Credit: Source link

Comments are closed.