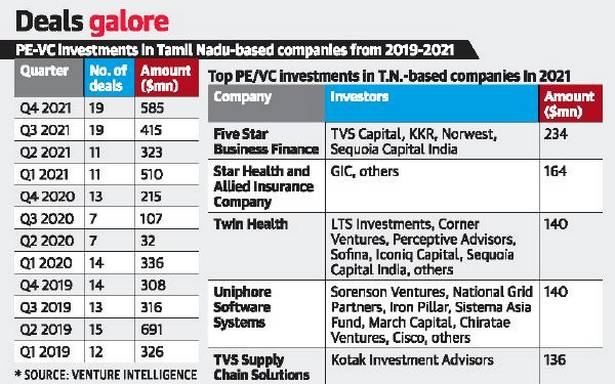

Private equity and venture capital companies invested around $1.8 billion in Tamil Nadu based firms through 60 deals during 2021. Data collated by Venture Intelligence, a research firm focused on private company financials, transactions and their valuations, shows that in the first quarter of 2021, firms invested $510 million across 11 deals and during the second quarter around $323 million came through 11 deals.

In September and December quarters, around $415 million (19 deals) and $585 million (19 deals) came into State-based firms. In 2020, PE-VC firms invested $690 million through 41 deals in State-based firms.

Arun Natarajan, founder of Venture Intelligence, said: “PE-VC investments in Tamil Nadu-based companies zoomed 166% year-on-year in 2021 to over $1.8 billion (across 60 deals). Fintech start-ups from Chennai like M2P Fintech, CredAvenue and GuardianLink made a strong mark on the radar of Indian and international VC investors during 2021,” Mr. Natarajan said.

“It was also interesting to see B2C brands from the State like Juicy Chemistry, TenderCuts and The Indus Valley attract VC investors from outside the State,” he added.

The year 2021 saw established companies like TVS Logistics and IPO-bound financial services companies like Five Star Business Finance and Star Health Insurance attract mega investments (of over $100 million each). The traditional investor favoured sectors of enterprise technology and especially SaaS exemplified by Uniphore Software and ChargeBee continued to attract large size investments during 2021.

“The Nasdaq IPO of SaaS unicorn Freshworks and exit of cross-border software start-up Ally (via acquisition by Microsoft) is only going to put more wind behind the sails of the enterprise technology start-ups in the State,” Mr. Natarajan said.

Investments by Angel Networks and “Super Angels” in Tamil Nadu-based companies also grew by 46% year on year to 38 deals in 2021. The number of such investments registered a steady rise in each quarter during 2021, Mr. Natarajan said.

Last year, the State saw 26 angel investment deals. Some of the firms that received angel investments were Blaer Motors (raised Rs.2.61 crore from The Chennai Angels), Planys Technologies (raised $1.6 million as part of its ongoing pre-series A round) and Agnikul (raised $11 million in a series A round led by Mayfield India).

In February, Mahindra Group Chairman Anand Mahindra had invested in Agnikul.

In 2021, two companies from Tamil Nadu, Chargebee Technologies and Five Star Business Finance turned Unicorns.

Credit: Source link

Comments are closed.