Drazen_/E+ via Getty Images

Co-produced with “Hidden Opportunities”

Have you ever wondered where “startups” or new businesses get the money to get rolling?

Most companies are not started by trust fund babies or millionaires looking for something new to do. Often before they have become millionaires or started trust funds, individuals who start new companies need to get cash from somewhere.

This is where venture capital plays a key role.

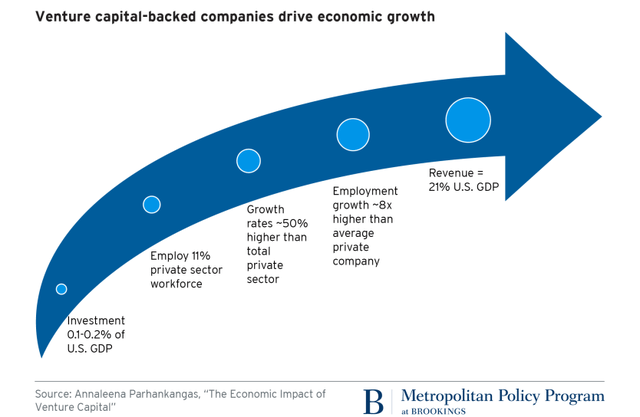

Venture Capital Is The Backbone Of American Innovation

Venture capital is a form of financing used by young companies at different stages of their growth. These companies, especially those in the startup stage, have business models that aren’t fully proven and often haven’t achieved profitability, and find it challenging to access funding. VCs play a significant role here by making risky investments in these young companies in return for equity ownership. They diversify their investments, so the winners not just balance out the failures but end up becoming blue-chip companies on a global scale.

Over the years, venture capital investment has been responsible for delivering substantial productivity gains to the U.S. economy and powering global digital transformation. Leading economists describe venture capital as the DNA of the American capitalistic economy. In recent decades VC has generated more economic and employment growth in the U.S. than any other investment sector.

Brookings.edu

Some of the largest companies in the world – Apple (AAPL), Costco (COST), Tesla (TSLA) were all VC-backed at some point in their early stages.

VC Investing Is Difficult, But The Income Method Makes It Easy

The highly-lucrative VC businesses are mostly out of reach for individual investors.

Venture capital in fast-growth companies is usually reserved to large funds (who have billions of assets under management), and super-rich individuals. Even if it were to become accessible through SPAC or other private equity exposure, they’re extremely risky, let alone be suitable to generate reliable income for retirees.

Companies that went public through SPAC mergers between January 2019 to June 2020 underperformed the Nasdaq composite by up to 64%. So if you’re investing in these to generate income periodically, you will have to sell more shares today than six months ago to generate the same income level. And the shares you own are finite, meaning you will eventually run out of shares to sell, making it a less sustainable method of generating income.

Enter TriplePoint Venture Growth (TPVG), a high-quality BDC (business development company) that focuses on venture growth stage business. As a BDC, they’re required to distribute 90% of their income to shareholders. TPVG gives the retail investor the opportunity to invest in venture capital which would otherwise not be available or offered on the stock markets. Let us now discuss how TPVG fits the requirements to be an excellent income investment.

TPVG is expected to report Q4-2021 earnings early in March 2022.

Solid Track Record Of Putting Cash Into Investors’ Pockets

Have you ever heard of early-stage companies paying dividends? This makes TPVG a unique investment where you can participate in the hot markets while collecting cash today.

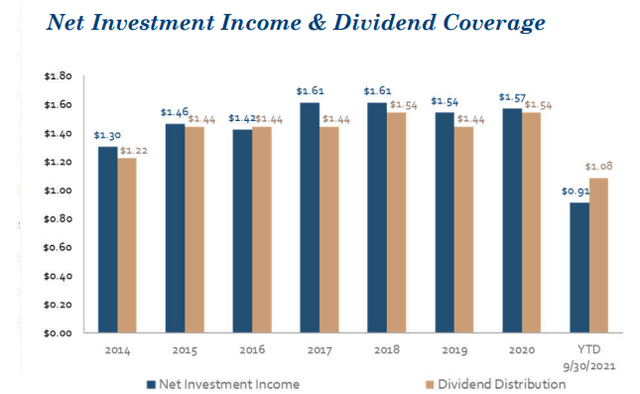

TPVG distributes $0.36/share every quarter, which calculates to an 8.6% annualized yield. The BDC has made four special distributions in its eight-year history, with the most recent one being a $0.10/share distribution in January 2021. TPVG has consistently earned in excess of its distributions and made no reductions to its distribution during the most uncertain periods of the pandemic.

TPVG November 2021 Investor Presentation

Now, looking at the chart above, you may be quick to the point that YTD Net Investment Income (‘NII’) isn’t covering the YTD distributions. Let us discuss this a bit more.

BDC income can be a bit lumpy, and income is often retained in the form of NAV growth. While this can make the dividend appear uncovered, the reality is far different under the covers. When TPVG earns over its distributions, the retained excess NII can fuel the distributions in years when the BDC chooses to retain unrealized capital gains. In fact, TPVG’s NAV (including the $0.10 special dividend) is up $0.58 from the December 31, 2019, pre-pandemic level and $1.70 since the start of the pandemic in Q1 2020. Growing NAV – this means the fund is healthy and the distributions are sustainable.

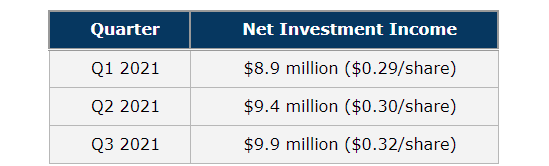

TPVG November 2021 Investor Presentation

TPVG’s 9% yield makes it an excellent income pick, no doubt. But are we paying the right price for it? Let’s find out. TPVG’s portfolio companies like Rent the Runway (RENT) and Enjoy (ENJY) completed their IPOs and SPAC mergers, respectively. The BDC holds shares and warrants in such publicly-traded companies valued at $17 million (including $13.5 million of cumulative unrealized gains). In addition, the current private warrant and equity portfolio held by TPVG has a record $30 million of cumulative unrealized gains based on private round valuations as of Q3. Let TPVG time the market and realize gains; we can sit back and collect dividends.

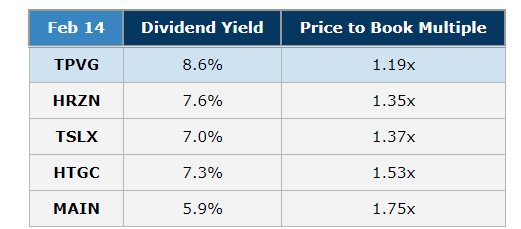

Price Is What You Pay, Value Is What You Get

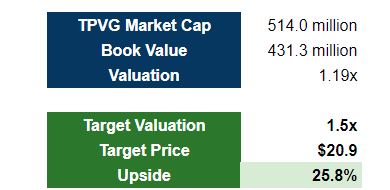

Looking at venture lending peers like Horizon Technology Finance Corp. (HRZN) and Hercules Capital (HTGC), we find TPVG’s yield to be significantly higher. Yet, TPVG is the cheapest in the peer group.

Data Source: YCharts

This means we get more value by paying less, a winning combination for income investors. A 1.5x book value multiple (which is reasonable for a quality BDC in the hot sector) results in a $20.9 price target, up to 25% upside!

Author’s Calculation

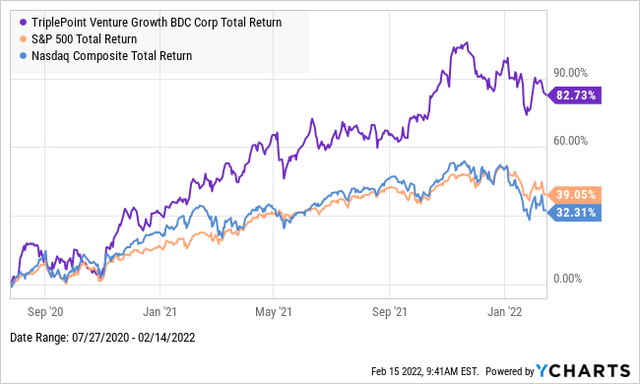

Also, it’s no secret that the U.S. markets have been on a tear since mid-2020. TPVG produced double the returns of the S&P 500 or the Nasdaq Composite in the 18 months of the bull market:

YCharts

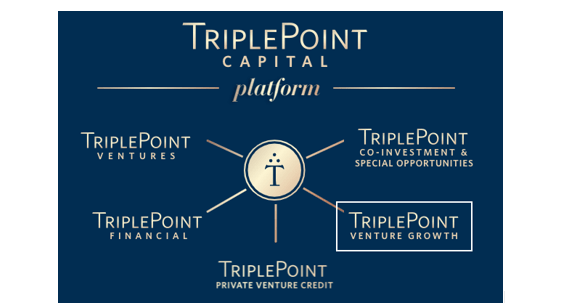

Industry-Leading Management Team

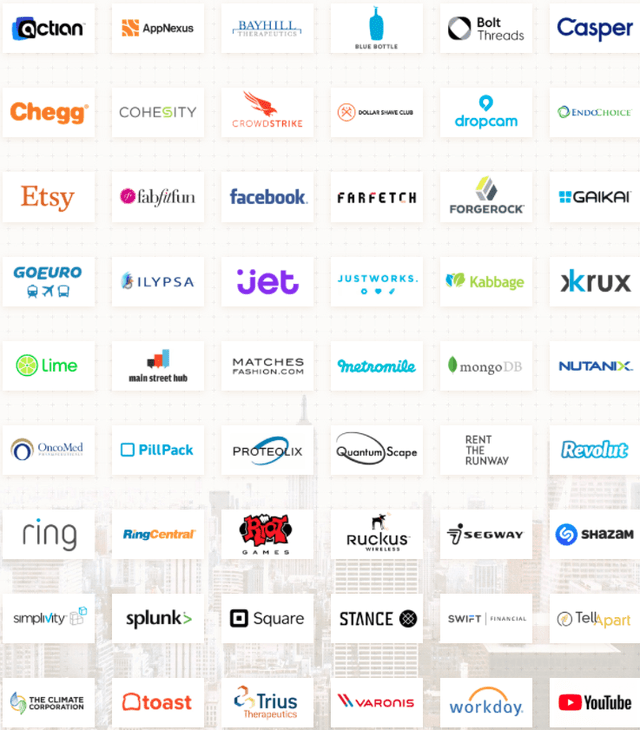

With BDCs, the experience and track record of the management team is the most critical factor in evaluating the investment’s quality. TPVG’s sponsor, TriplePoint Capital, is a global leader in venture finance who has provided more than $5 billion in commitments to over 650 venture capital-backed companies across the globe. TPVG’s investments constitute almost $1 billion of those commitments. The image below highlights TriplePoint Capital’s success over the years, with backed companies either being acquired by blue-chip companies or becoming blue-chip investments themselves.

TriplePointCapital.com

TriplePoint Capital’s core team is highly experienced in the venture financing industry, providing more than $9 billion in leases and loans to more than 3,000 leading venture capital-backed companies over the past 30 years.

TPVG was formed to expand the sponsor’s venture growth stage business through the fund’s regulatory benefits as a BDC.

TriplePointCapital.com

Overall, with TPVG, you can rest assured your money is being managed by some of the most experienced teams in the venture financing industry.

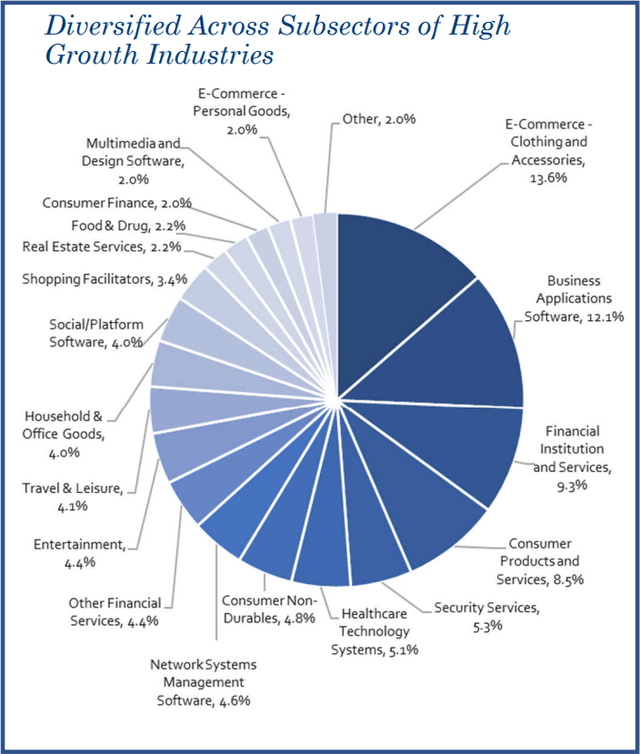

Healthy Composition Of High-Growth Sectors

TPVG demonstrates that high yields can be obtained from high-growth industries. The BDC is well diversified into several attractive areas, but E-commerce, Software technology, and financial services represent almost 35% of the portfolio.

TPVG November 2021 Investor Presentation

-

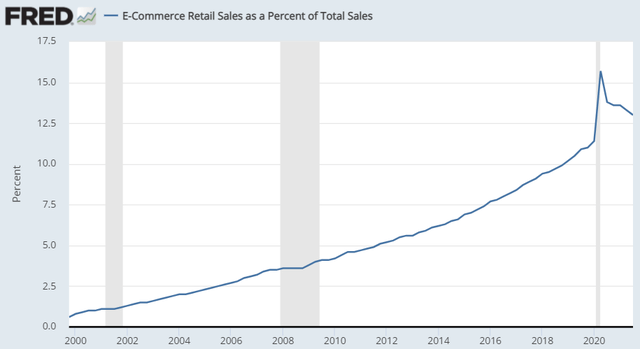

E-commerce: Despite the growing popularity of e-commerce and the companies like Amazon (AMZN), Shopify (SHOP), and PayPal (PYPL) that are driving the growth, online sales represent less than 15% of total retail sales.

St. Louis Federal Reserve

The global pandemic demonstrated the power of the Internet when there was breathing space between severe waves of the coronavirus mutations and shoppers’ love for in-person shopping was revealed. The opportunities to enhance the personalized experience for shoppers online and in-person are endless, making this a massive growth sector.

-

Technology: In 2020-21, we saw enterprises rapidly adopt digital technologies to improve overall collaboration and facilitate productivity from home. When the pandemic becomes endemic, everyone is not going back to conference rooms, whiteboards, and on-premise IT infrastructure. Instead, they’re going to invest more in customizing their digital deployments to suit their needs better. Overall, this sector is promising, and we will continue to see significant innovation for the years to come.

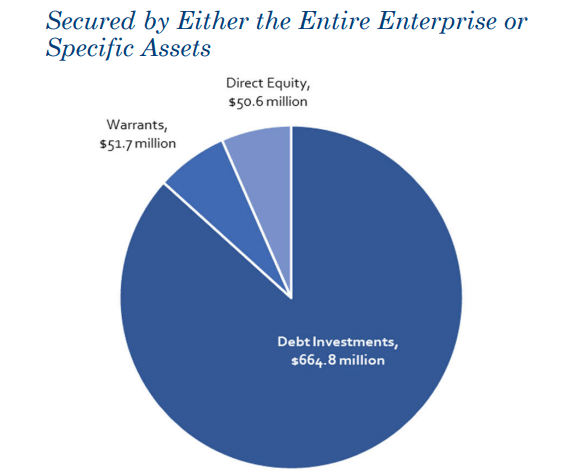

TPVG is well diversified into over 146 securities, with first-lien senior secured debt instruments constituting around 85% of the portfolio. The BDC also receives equity “kickers” – warrants, preferred equity, and common equity, which present a high-risk, high-reward situation. The exposure is small but significant to reward shareholders when portfolio companies IPO or get acquired.

TPVG November 2021 Investor Presentation

TPVG maintains an investment-grade balance sheet with an asset coverage ratio of 120% (leverage ratio of 0.82x). During the Q3 conference call, management reported that 98% of TPVG’s debt investments were performing at or better than expectation, indicating their selective choosing to create a high-quality portfolio.

The Demand For Venture Capital Is Strong And Defaults Are Low

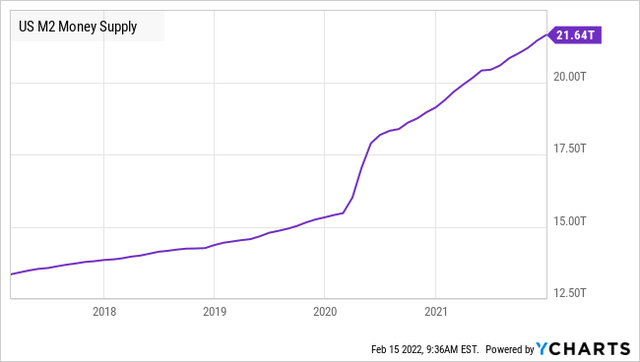

2022 is set to see solid economic growth, which is bullish for startup companies. Furthermore, liquidity in the system is around its highest levels. The M2 measure of the nation’s money supply is up 40% since January 2020, an unprecedented increase in the history of the U.S. economy.

YCharts

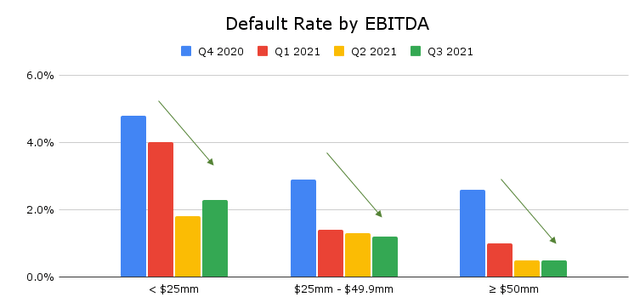

Banks and non-bank BDCs’ venture financing is highly regulated and has public reporting requirements. In October 2021, Proskauer, a leading international law firm, announced the Q3 overall default rate of 1.5% for the Proskauer Private Credit Default Index. This index tracks the default rates of senior-secured and unitranche loans. Private debt default rates have trended lower since Q2 2020 when they peaked at 8.1%.

Proskauer.com

– Data Source: Proskauer

Credit default will continue trending low with strong economic growth and high liquidity in the system. Additionally, TPVG is extremely picky about who they lend to, positioning this BDC for a stellar year, rewarding shareholders along the way.

Getty

Conclusion

Income investing doesn’t have to be only through boring companies and sectors. Today, we present an excellent way to boost your passive income through diversified exposure into VC stage companies – one of the hottest sectors in the modern market.

Venture capital is ordinarily reserved for the ultra-rich or large funds with billions in AUM. It’s available for retail investors through TPVG, a BDC managed by experts in venture financing and has produced market-beating results through growing NAV and sizable yields. With TPVG in your portfolio, you can let the experts pick the disruptors and future leaders and time the market in selling shares. You can sit back and wait for up to 25% upside while collecting high yields amounting to 8.6%. This is the Income Method of investing in growth, and these discounted prices won’t last long.

Credit: Source link

Comments are closed.