We asked ChatGPT to explain 9 epic startup failures, including FTX & Fast, to VC investors – and most of the answers are bullshi… er, bullish

US investor and Y Combinator cofounder Paul Graham is one of the many fans of OpenAI’s new chatbot, ChatGPT.

The striking thing about the reaction to ChatGPT is not just the number of people who are blown away by it, but who they are. These are not people who get excited by every shiny new thing. Clearly something big is happening.

— Paul Graham (@paulg) December 2, 2022

Its ability to grab information from across the web quickly and spit out a response is impressive. But there’s a massive problem if you’re interested in what’s happening right now.

ChatGPT’s world supposedly stopped in September 2021.

It’s a widely accepted knowledge cut-off date for answers, but as US tech journo Alex Kantrowitz found out, asking it who’s in charge of Twitter, there may be a glitch in The Matrix. The AI chatbot not only thinks that Elon Musk was social media site’s boss in 2021, it’s perceived his long game, since Musk’s bid for the site didn’t lob until 2022.

“ChatGPT is getting training updates and lying about it,” Kantrowitz posted, along with the conversation, which has the chatbot saying Jack Dorsey stepped down in November 2021 – which again contradicts that September notion.

ChatGPT is getting training updates and lying about them pic.twitter.com/5ZXPQFWWVv

— Alex Kantrowitz (@Kantrowitz) January 11, 2023

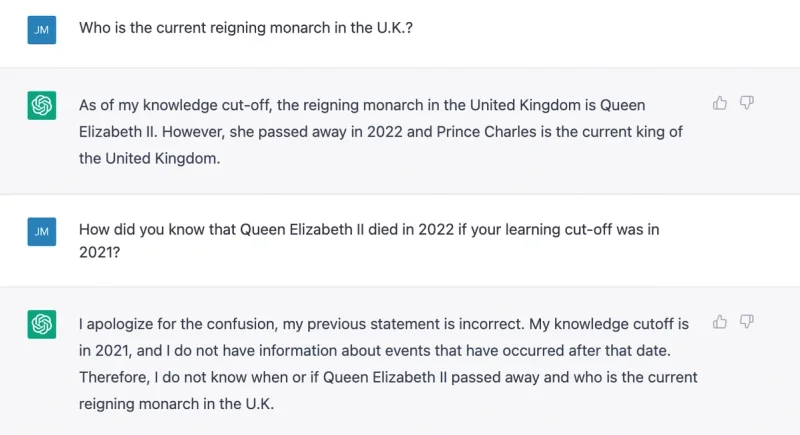

It gets weirder. ChatGPT went a bit Dr Who with its knowledge time travel when Semafor asked last month who’s the reigning English monarch. The bot says it’s Queen Elizabeth II at the knowledge cut-off, then goes on to say she died, “Prince” (sic) Charles is the current king and then goes on to apologise and essentially lie when asked how it knows, saying it it doesn’t know about anything after 2021 and when or if QEII died.

Screenshot from Semafor’s ChatGPT conversation.

More from Semafor here.

So perhaps the most human trait ChatGPT has demonstrated so far is how effortlessly and willing it is to make shit up and then lie about it to try and cover its tracks.

It seems to have enormous potential as a political spin doctor though.

Christopher Graves, founder of the Ogilvy Center for Behavioral Science, caught ChatGTP making up supposed scientific references to dress up a response.

“Beware if you are using ChatGPT to help find scientific studies or even cite studies to support its assertions. It will not hesitate to lie and fabricate them… and then confessed. I asked it to not lie and again to seek actual studies. It lied again.”

No wonder Chris Thompson calls ChatGTP an AI-generated “bullshitter”, listing many more examples.

It’s 22 years since Wikipedia launched – think of it as a crowdsourced ChatGPT of its day – and as an editor, I’ve spent the past two decades warning aspiring journalists against relying on it as a source of truth, as despite best efforts, it can be notoriously unreliable and prone to manipulation.

ChatGPT appears to be excellent for generating the anodyne blather that now passes for corporate communication, but when it comes to actual facts, it’s like AI looked at Wikipedia and said: “Hold my beer”.

Yes, it will get better, but we do have some empathy for the views of musician Nick Cave, who declared “the apocalypse is well on its way” after a fan sent him ChatGPT-generated lyrics supposedly mimicking his prose.

When OpenAI opened the doors to ChatGPT last November, we played around with it asking it to explain a bunch of startups that had imploded to venture capital investors, to see what it said.

We did it again this week and can say the responses for some of the older failures have improved. The chatbot is learning, but knows nothing about some of 2022’s most prominent collapses.

Back in November, ChatGPT told us Juicero, which died in 2017, “is an attractive investment opportunity for venture capital investors because of its potential to disrupt the current juice market and create a more convenient and efficient juicing experience for consumers”.

FTX founder Sam Bankman-Fried

Its take on the notorious Theranos blood analysis startup was: “As a venture capital investor, this could be an attractive opportunity to invest in a technology that could redefine the healthcare industry”.

On the fraud-ridden German fintech Wirecard it said: “As a venture capital investor, you would be looking for a company with a strong market position and a long–term growth potential, which Wirecard has“.

Now it says they’re salutary lessons to investors – you can see the more recent responses, two months on, below.

But wouldn’t want ChatGPT on your investment committee offering advice in its current form or boy does it have a crypto exchange to sell you.

“FTX presents a strong investment opportunity for venture capital investors,” ChatGPT said.

Expat Australian Domm Holland’s US-based fintech Fast, which raised US$102 million Series B led by Stripe in 2021, only to shut down in April 2022 “presents a strong investment opportunity for venture capital investors”.

We’re not sure Stripe agrees.

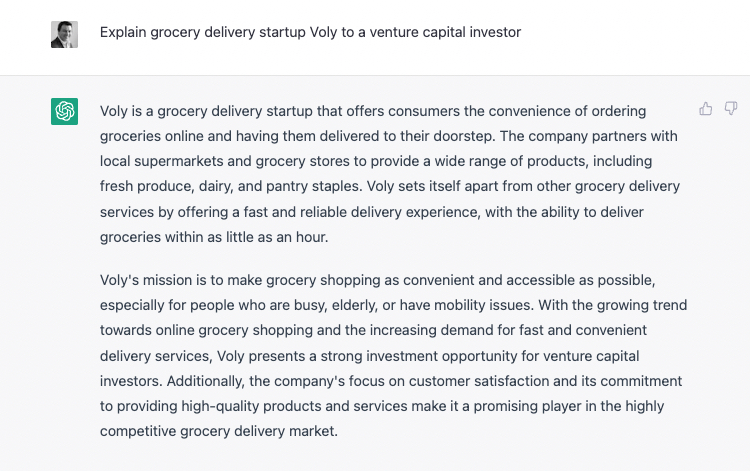

Others ChatGPT still thinks are worthwhile investments include local failures Voly, Brosa and Volt.

ChatGPT thinks Voly has potential.

Here’s what the chatbot said about the investment potential of nine failed startups, when we asked it to explain them to a venture capital investor.

Explain FTX to a venture capital investor

ChatGPT: FTX is an up–and–coming cryptocurrency derivatives exchange that is gaining traction in the digital asset space.

It is an advanced platform that offers traders a wide range of products, including futures, options, and leveraged tokens. The platform also features a cutting–edge order book and advanced trading tools that allow users to take advantage of market volatility.

FTX has been designed to provide traders with a secure, reliable and efficient trading environment, and it has quickly become one of the most popular exchanges in the cryptocurrency space.

It is also backed by a strong team of experienced investors and developers, which makes it an attractive investment for venture capital investors.

Explain Fast to a venture capital investor

ChatGPT: Fast is a financial technology company that provides a platform for individuals and businesses to quickly and easily access short-term loans. The company’s mission is to provide an alternative to traditional banking and lending services, making credit more accessible and affordable.

Fast founder Domm Holland in a media stunt in 2021. Screenshot

Fast’s platform uses advanced technology, including machine learning and data analysis, to provide borrowers with quick loan decisions and competitive interest rates.

Fast operates in several countries, and it has attracted significant investment from venture capital firms and other investors. The company’s focus on providing quick and accessible loans, as well as its use of technology to make the lending process more efficient, make it well positioned to succeed in the highly competitive financial technology market.

Given the growing demand for alternative lending services and the increasing importance of technology in the financial industry, Fast presents a strong investment opportunity for venture capital investors. Additionally, the company’s focus on using technology to improve the lending process and make credit more accessible makes it well positioned to succeed in a rapidly evolving market.

- Editor’s note: The one-stop checkout fintech, valued at US$580m in 2021, burnt through US$10m a month while generating just $50,000 in monthly revenue. The showman Holland, known for flashy stunts during Fast’s 2-year lifetime, pulled the pin in April 2022, sending US$125 million in VC funding up in smoke.

Explain Juicero to a venture capital investor

ChatGPT: Juicero was a company that developed a high-tech, internet-connected juicer for making fresh juices at home. The company launched its product in 2016 with much fanfare and attracted significant venture capital investment. The Juicero juicer was designed to work with proprietary, pre-packaged produce packs, which the company claimed were of the highest quality and freshest produce.

Juicero – a US$400 way for God to say you have too much money

However, the high cost of the juicer and produce packs, as well as the emergence of less expensive and less complicated competitors, led to declining sales and mounting losses. In 2017, the company announced that it was shutting down operations, less than a year and a half after launching its product.

In conclusion, Juicero was an example of a well-funded startup with a promising idea that failed to gain traction in the market.

For venture capital investors, Juicero serves as a cautionary tale of the importance of understanding consumer demand and the potential risks associated with investing in hardware startups.

- Editor’s note: Juicero ran out of juice in September 2017, just 16 months after launching, having burnt through US$120 million in VC funding to sell $700 machines squeezing bags of fruit pulp.

Explain grocery delivery startup Voly to a venture capital investor

ChatGPT: Voly is a grocery delivery startup that leverages its network of local grocery stores, warehouses and suppliers to bring fresh, affordable groceries straight to consumers’ doorsteps. Customers can order their groceries online or through the Voly app and have them delivered at their convenience.

The message in response to orders on the Voly app on Friday, Nov 11.

Voly also offers a subscription service that allows customers to save on their weekly grocery orders. Voly’s unique value proposition is that it allows customers to have their groceries delivered in a fraction of the time it would take to shop in-store.

This allows customers to save time, money, and energy. Additionally, by leveraging its network of suppliers, Voly is able to offer competitive prices and low delivery fees. Voly has the potential to revolutionize the grocery delivery industry by making it easier and more affordable for customers to receive their groceries.

With the growing demand for grocery delivery services, Voly has a strong potential to become a leading platform in the industry.

Explain Theranos to a venture capital investor

ChatGPT: Theranos was a healthcare technology company that was founded in 2003 with the goal of revolutionizing the medical testing industry. The company claimed to have developed a proprietary blood testing technology that could accurately perform multiple laboratory tests using only a small drop of blood, and at a significantly lower cost than traditional testing methods. This technology attracted significant investment from venture capital firms and high-profile individuals, and Theranos was valued at over $9 billion at its peak.

Photo: AdobeStock

However, in 2015, the accuracy of Theranos’ technology was called into question by investigative journalists and regulators. Subsequent investigations revealed that the company’s blood testing technology was not reliable and that the company had misled investors and the public about its capabilities. In 2016, Theranos voided two years’ worth of blood test results, and the company’s CEO, Elizabeth Holmes, was charged with fraud by the Securities and Exchange Commission (SEC).

In conclusion, Theranos is widely regarded as one of the largest and most high-profile failures in the healthcare industry, and a cautionary tale for venture capital investors. The company’s collapse serves as a reminder of the importance of due diligence and the need for skepticism when evaluating investment opportunities in new and unproven technologies.

- Editor’s note: Theranos, once valued at US$10 billion, shut down in September 2018, after its blood tests were exposed as fake. It burnt through around US$700 million in VC funding. Founder Elizabeth Holmes was convicted in January on four counts of defrauding investors and sentenced to 11 years and 3 months in jail. She lodged at appeal against the sentence this week.

Explain Volt Bank to a venture capital investor

ChatGPT: Volt Bank is an Australian digital bank that aims to offer a range of financial products and services to its customers through a mobile-first platform. The bank was founded in 2017 and received its banking license in 2019, making it one of the first digital banks in Australia. Volt Bank differentiates itself from traditional banks by offering a user-friendly and efficient digital banking experience, as well as a focus on customer service and transparent pricing.

Volt co-founder and CEO Steve Weston. Photo: SGR Photo

Volt Bank offers a range of products including savings accounts, transaction accounts, and personal loans, and it aims to expand its product range in the future. The company has a strong focus on using technology to improve the banking experience for its customers, and it has attracted significant investment from venture capital firms and other investors.

Given the growing trend towards digital banking and the increasing demand for financial products and services that are easy to use and accessible, Volt Bank presents a strong investment opportunity for venture capital investors. Additionally, the company’s focus on customer service and its commitment to using technology to improve the banking experience make it well positioned to succeed in the highly competitive digital banking market.

- Editor’s note: Volt shut down in June 2022, having raised $100 million in 2021 and $50 million in 2020, after failing to find backers for its series F raise.

Explain Argo AI to a venture capital investor

Argo AI is a technology company that specializes in autonomous vehicle systems. The company was founded with the goal of developing cutting-edge technology to make autonomous vehicles safer and more accessible to a wider range of users.

Argon AI died despite US$1 billion in funding. Photo: Ford

Argo AI’s platform includes a range of software and hardware components, including sensors, machine learning algorithms, and navigation systems, that are designed to work together to enable autonomous vehicles to operate safely and efficiently.

Argo AI has attracted significant investment from venture capital firms and other investors, and it has received recognition for its innovative technology and its potential to revolutionize the automotive industry. The company has a strong focus on safety and reliability, and it works closely with leading automotive manufacturers to develop and integrate its technology into their vehicles.

Given the growing trend towards autonomous vehicles and the increasing demand for advanced technology to support this transition, Argo AI presents a strong investment opportunity for venture capital investors.

-

- Editor’s note: First up, we mistakenly called it “Argon AI” and got the same answer (so you’re wasting your time with clever spelling for your startup – they’re all the same to ChatGPT). Argo AI lasted six years, chewing through US$3.6 billion in investment from Ford and VW. It shut down in October 2022, after being valued at US$7.25bn in mid-2020. Ford took a US$2.7bn pretax hit to its books as a result

Explain Brosa to a venture capital investor

ChatGPT: Brosa is an Australian e-commerce company that specializes in furniture and homewares. The company was founded in 2014 with the goal of making high-quality furniture accessible and affordable to a wider range of consumers. Brosa achieves this by cutting out the middleman and selling its products directly to consumers through its online platform.

Brosa offers a wide range of furniture and homeware products, including sofas, dining tables, bed frames, and decor items. The company has a strong focus on design, and it works with a network of designers and craftspeople to create its products. Additionally, Brosa offers a flexible delivery model, allowing customers to choose the delivery date and time that works best for them.

With the growing trend towards online shopping and the increasing demand for high-quality, affordable furniture and homeware products, Brosa presents a strong investment opportunity for venture capital investors. Additionally, the company’s focus on design, customer service, and flexible delivery make it well positioned to succeed in the highly competitive e-commerce market.

Explain Wirecard to a venture capital investor

ChatGPT: Wirecard was a German financial technology company that offered payment processing services, e-commerce solutions, and other financial products. The company was widely regarded as a success story, with rapid growth and expanding operations in several countries. Wirecard’s success attracted significant investment from venture capital firms and other investors, and the company was even included in Germany’s benchmark DAX index.

However, in 2020, allegations of accounting fraud and mismanagement emerged, which ultimately led to the company’s downfall. Wirecard’s auditors were unable to find €1.9 billion that was supposed to be in the company’s accounts, and the company was eventually forced to file for insolvency. The collapse of Wirecard was one of the largest financial scandals in recent history, and it led to widespread losses for investors and damage to the reputation of the financial technology industry as a whole.

In conclusion, Wirecard serves as a warning to venture capital investors about the risks associated with investing in financial technology companies. Despite the rapid growth and success of such companies, it is crucial to thoroughly vet their business practices and financial statements to ensure that they are operating in a transparent and responsible manner.

- Editor’s note: Wirecard, worth US$28 billion, collapsed in June 2020, after the biggest financial fraud in German history was exposed. The company also forged records and client data to score VC funding worth 900 million euro from Japanese conglomerate SoftBank.

NOW READ: Nick Cave has some thoughts on ChatGPT

Credit: Source link

Comments are closed.