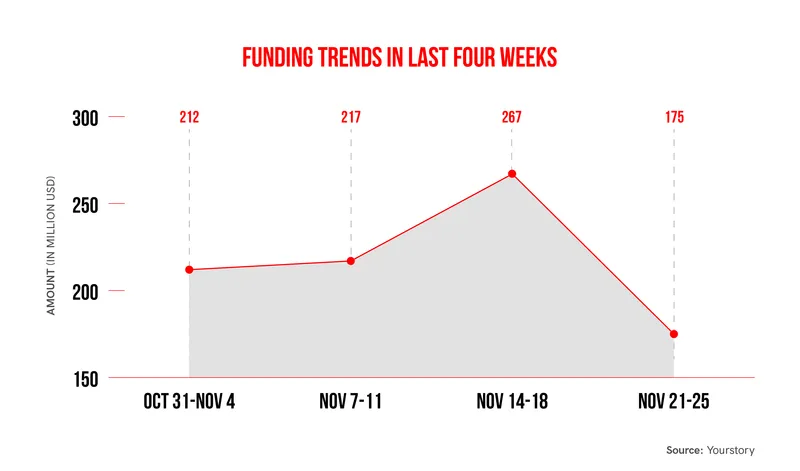

The venture capital inflow into Indian startups for the fourth week of November dipped by 35% given the absence of large deals and coupled with the fact that the year is coming to a close where things slowed down.

The total funding during the week stood at $175 million cutting across 20 deals. In comparison, the previous week saw an inflow of $267 million.

The slowdown in venture capital funding has been visible for quite some time now on a weekly basis as the amount raised has been in the range of $200 million. It is expected that this trend is likely to continue for another quarter at least.

This environment could also lead to increased merger and acquisition activity as those startups which are struggling to raise the required capital may become potential targets for stronger companies in a similar line of business.

Transactions

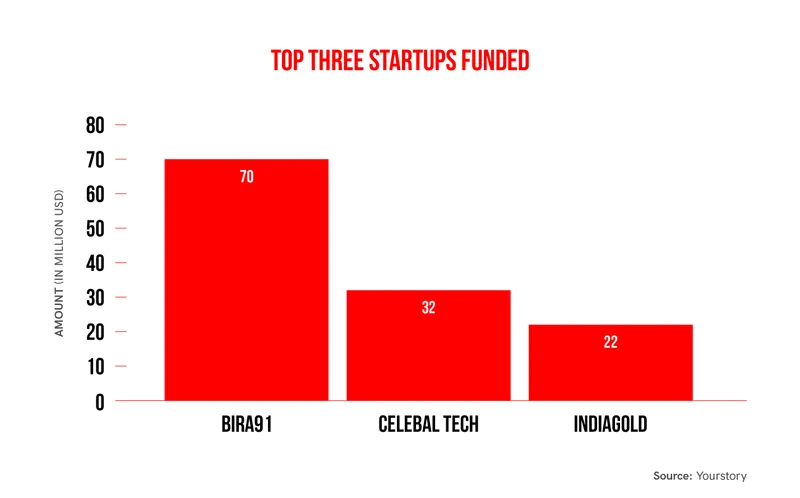

Bira91 has raised $70 million in Series D funding from Japan’s Kirin Holdings. The deal takes Kirin’s shareholding in the company to nearly 20% from its earlier 10%.

Celebal Technologies, a software service company, raised $32 million from Norwest Venture Partners, the first institutional investment in the company.

Fintech startup IndiaGold closed its Series A funding round at $22 million from Alpha Wave, 3one4 Capital, PayU, Leo Capital and Better Tomorrow Ventures.

Sukoon Healthcare, the hospital focused on psychiatry services, has raised $15 million from Lightrock India.

ProcMart, a Noida-based B2B procurement marketplace raised $10 million in a Series A round of funding led by Sixth Sense Ventures.

Koo App raised $6.3 million from Tiger Global, Accel Partners, Kalaari Capital, 3one4 Capital, and Dream Incubator (DI).

D2C brand Rapidbox raised $4.5 million from SIG Venture Capital, Tanglin Venture Partners, India Quotient, and Ananya Goenka.

Credit: Source link

Comments are closed.