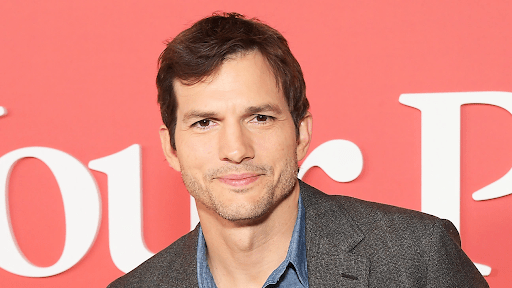

From Shazam to Vicarious FPC, here are 17 answers to the question, “What’s one of the most interesting investments Ashton Kutcher has made?”

- Shazam

- Foursquare

- Acorns

- The Fabricant

- Warby Parker

- Uber

- Beebo

- YourMechanic

- CHOOSE

- Steakholder Foods

- Skype

- OpenSea

- SoundCloud

- Thorn: Digital Defenders of Children

- Pearpop

- Airbnb

- Vicarious FPC

Shazam

From my perspective, Shazam is a very interesting investment, because the technology behind the app is highly sophisticated and proprietary, which sets it apart from its competitors and makes it a unique and valuable asset.

Also, the music industry is constantly evolving, and there are many opportunities for Shazam to expand and diversify its business, such as partnerships with music streaming services or expanding into new markets like virtual reality. The company also has a well-known and respected brand in the music industry, which can be leveraged to drive growth and attract new users.

Natalia Brzezinska, Marketing & Outreach Manager, UK Passport Photo

Foursquare

Foursquare allows users to search for places and make recommendations of where to go, discover new things, and meet up with friends. Kutcher was an early investor in the company back in 2010, and he has been actively helping them develop their business. He has even joined their board of directors. This investment shows that Kutcher is looking for innovative ways to connect people with places and experiences they might not have otherwise had access to.

Aviad Faruz, CEO, FARUZO

Acorns

Kutcher invested in Acorns, the now popular app that the actor called “a tip jar for your spending.” According to Kutcher, when you spend money, the app rounds up your purchase and invests it for you in a well-balanced portfolio.

In a CNN interview, Ashton said that creating a product that consumers will use and will be beneficial in their lives is about understanding the intuition and the feeling of the consumer. He looks for entrepreneurs that have captured that feeling, and Acorns fits the bill!

Liza Kirsh, Chief Marketing Officer, Dymapak

The Fabricant

Ashton Kutcher’s investment in The Fabricant is interesting because it’s a digital fashion platform made for digital-only clothing. This is because some of his other recent investments are more focused on professional industries like healthcare, science, blockchain, and finance.

It’s also interesting because digital fashion allows people to customize clothing in a variety of digital ways. You can choose the color, size, and style that best suit your personal taste. It is an interesting investment because digital fashion has the potential to grow rapidly in the future.

Not only are people spending more money on clothing, but they’re also buying clothes online and from mobile apps. We expect this trend to continue increasing in popularity as we move closer toward a “virtual” world where everything is connected.

Johannes Larsson, Founder & CEO, JohannesLarsson.com

Warby Parker

Along with Spotify, Airbnb, and Uber, one of Ashton Kutcher’s successful investments was putting money into Warby Parker, an eyewear company that designs, manufactures, and sells eyewear.

Ashton Kutcher invested in Warby Parker early on during the company’s Series A funding round in 2010. The company is known for its “buy a pair, give a pair” model, where for every pair of glasses sold, a pair is distributed to someone in need. It was Warby Parker’s unique business model and socially conscious approach to retail that drew Kutcher, also known for his interest in socially responsible and impact investing.

Thus, it was not only a financial decision but also an investment in a company with a good mission and values aligned with his own. The company has grown rapidly since then, becoming one of the most popular eyewear brands in the world. Today, Warby Parker is valued at over $1.50 billion and has distributed over 20 million pairs of glasses to people in need.

Nina Paczka, Community Manager, Resume Now

Uber

One of the unique investments Ashton Kutcher has made is in the company Uber. In 2011, Kutcher invested in the then-fledgling ride-sharing company, becoming one of its earliest investors.

His investment was part of a $37 million Series B round of funding, and he was one of the first celebrities to invest in a tech startup. His investment has since paid off handsomely, as Uber is now a multi-billion dollar company. Kutcher’s investment in Uber was a bold move, and it has since become one of his most successful investments.

Jimmy Minhas, Founder & CEO, GerdLi

Beebo

One of Ashton Kutcher’s most interesting investments is Beebo, a baby bottle warmer he invested in as a guest on Shark Tank. Beebo is a unique product that has the potential to revolutionize the way parents feed their babies.

Kutcher’s investment in Beebo shows his commitment to innovation and his willingness to take risks, as well as his personal connection to the product as a parent. It is also interesting to see him working with Greiner, who has an impressive track record of investing in successful companies.

Furthermore, the appearance on the show helped bring Kutcher’s active activity as an angel investor into the broader public consciousness, as most people only knew him for his acting.

Kate Duske, Editor-in-Chief, Escape Room Data

YourMechanic

YourMechanic epitomizes our growing need for making traditional services more convenient. YourMechanic takes an industry that can be overcrowded with long wait times and puts more power back into the hands of consumers.

Customers can get a quote and book auto services online with 24/7 availability, and mechanics will head straight to your home (or wherever you prefer) to perform the work. While this might not sound groundbreaking in 2023, Kutcher invested in 2012 when these types of services were nearly nonexistent. Kutcher has an eye for innovation and seems to spot some of the greatest and most creative businesses at just the right time.

Jack Underwood, CEO & Co-Founder, Circuit

CHOOOSE

Through his Sound Ventures venture capital firm, Ashton Kutcher has invested in CHOOOSE. CHOOOSE is a company that has established a powerful presence in the SaaS industry by providing a platform that helps enterprises create, manage, and report on climate programs focused on their customers.

Major companies in aviation, travel, and logistics industries collaborate with CHOOOSE to incorporate climate action in all customer interactions. The platform offers standard integrations, user-friendly interfaces, automatic CO2 emission calculation, and access to carbon solution marketplaces, enabling enterprises to engage their customers in understanding and reducing the carbon impact of products and services.

Luciano Colos, Founder & CEO, PitchGrade

Steakholder Foods

The man has invested in many interesting and innovative companies, but Steakholder Foods is arguably the strangest—in the best way possible. The company develops cultured meat using 3D-printing technology, creating the first cruelty-free meat alternative that is still technically “meat.”

They can build customizable cuts of steak with fat content options in minutes, which could revolutionize the plant-based world and traditional farm as we know it. The growth potential is astronomical!

Maximilian Wühr, CGO & Co-Founder, FINN

Skype

I was most surprised when I heard of Ashton Kutcher’s investment in Skype. I knew he had ventured into tech investments, but the idea of an actor putting money into a global telecom service seemed revolutionary.

I think what makes this so interesting is that he had the foresight to appreciate a product like Skype before it became one of the most popular video-calling services in the world. It goes to show how ahead of his time Kutcher was as an investor and how willing he was to take risks with his money. I believe this willingness is part of why I find his investment so fascinating.

Derek Bruce, First Aid Training Director, Skills Training Group

OpenSea

While Kutcher is well known for his investments in millennial-targeted service apps like Uber and Airbnb, his most interesting recent investment was in the NFT marketplace OpenSea.

OpenSea allows users to buy and sell NFTs securely on the largest marketplace online. While the daily volume of NFT trading on the site reached almost $3 billion in May of last year, it has since plummeted by 99%, making it one of the most volatile investments Kutcher has made in his career.

Bryan Jones, CEO, Truckbase

SoundCloud

According to reports, Kutcher invested in the company through his venture capital firm, A-Grade Investments, which he co-founded with Guy Oseary and Ron Burkle in 2010. It is not specified the amount of money that Ashton Kutcher invested in SoundCloud, but it is known that his investment helped SoundCloud to expand and grow in the early days.

SoundCloud was one of the first platforms to allow independent artists to upload their music, and it became a go-to place for up-and-coming musicians and DJs to share their music and gain exposure. Kutcher’s investment in SoundCloud is considered to be one of the many successful investments in the venture capitalist’s portfolio.

Matthew Appleton, Ecommerce Manager, Appleton Sweets

Thorn: Digital Defenders of Children

Kutcher’s investment in Thorn: Digital Defenders of Children works to end the sexual exploitation of children and human trafficking. It’s his only investment that aligns most succinctly with his motto, “If you’re not doing good, what are you doing?” It’s actually a good cause and one that’s not out to make a profit.

Jarir Mallah, HR Specialist, Ling App

PearPop

Kutcher partnered with PearPop, a company that connects creators to influencers. Their software activates influence and then monitors performance. Brands get where they want to go much faster with PearPop. The company has worked with the likes of Netflix, Amazon, and Madonna, to name a few. It seems they’re doing something right, and Kutcher seems to have a knack for investing in businesses that have an impact!

Kenneth Lin, CEO, BOOP Bakery

Airbnb

Airbnb is a platform that connects people who are looking for short-term accommodation with people who have space to rent out. Through this platform, people can rent out their homes or apartments to travelers who are looking for somewhere to stay for a few days.

This has revolutionized the travel industry, as it has allowed people to save money on accommodation and make money from renting out their space. Ashton Kutcher was one of the first investors to recognize the potential of Airbnb and he invested in it in 2010. Since then, Airbnb has gone from strength to strength and is now one of the most successful companies in the world. It is estimated that Airbnb is now worth over $30 billion, and Ashton Kutcher’s investment has allowed him to reap the rewards.

Michael Lazar, Executive, ReadyCloud

Vicarious FPC

Back in 2014, Elon Musk, Mark Zuckerberg, and Ashton Kutcher all invested in an AI and robotics company known as Vicarious FPC. The company hopes to build an AI system that can mimic the neocortex of the human brain.

If you aren’t aware, the neocortex of our brain handles basic body movements, vision, and understanding math and languages. Building an AI system that covers all the basic functions of the human brain is an ambitious goal. However, this is exactly why I found this investment to be Kutcher’s most interesting one.

Kutcher has invested in tech-related companies. He was quoted multiple times, saying how much he believes that technology is going to bring happiness in the future. His investment in Vicarious shows that he is being authentic about this. It highlights his genuine interest and commitment to supporting emerging tech startups.

Jonathan Merry, Founder, Moneyzine

Jordan French is the Founder and Executive Editor of Grit Daily. The champion of live journalism, Grit Daily’s team hails from ABC, CBS, CNN, Entrepreneur, Fast Company, Forbes, Fox, PopSugar, SF Chronicle, VentureBeat, Verge, Vice, and Vox. An award-winning journalist, he is on the editorial staff at TheStreet.com and a Fast 50 and Inc. 500-ranked entrepreneur with one sale. Formerly an engineer and intellectual-property attorney, his third company, BeeHex, rose to fame for its “3D printed pizza for astronauts” and is now a military contractor. A prolific investor, he’s invested in 50+ early stage startups with 7 exits through 2022.

Credit: Source link

Comments are closed.