Why startup founders shouldn’t waste time worrying about things they’re not ready for, especially capital raising

Be worried about the right things at the right time.

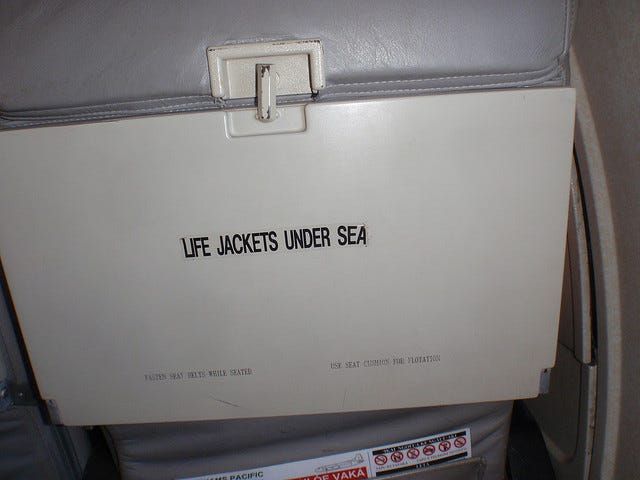

I took this photo on an ancient four-prop 30 seat passenger plane in Tonga.

It looked a bit like an old DC3 (it wasn’t) with the old-fashioned metal riveted skin and the only other time I’d flown in something like that was in Kenya.

Obviously somebody scratched out the letter T on the sticker but it made me think: if this old rattly bus of a plane went down somewhere off Vava’u, it probably didn’t matter very much where my life jacket was stowed.

In the unlikely event I survive a landing at sea long enough to get out of the plane, in the unlikely event the plane goes down at sea, in the unlikely event this well-maintained, daily-flown plane has a serious mechanical problem while in flight… I don’t really care exactly where the life jackets ought to be, or even if they’re there at all.

When startup founders ask me about how to raise investment capital, I work backwards through the following questions.

Hopefully I don’t need to work through all of them:

- How fast is your revenue growing versus your competitors? (30% risk)

- No revenue yet? OK, how much progress are you making with increasing engagement among your users? (40% risk)

- No progress on engagement? OK, how are you doing at reducing the number of users you lose each month? (50% risk)

- No progress on retention? OK, how fast are you acquiring new users? (60% risk)

- Only beta test users so far? OK, how much does it cost you to acquire beta users? (70% risk)

- Your beta users are all friends and people you know? OK, why would you want to try and raise capital now? (80% risk)

- You believe you need to raise capital because you can’t afford to finish your product? What evidence do you have that anybody needs your product? (90% risk)

- OK, you’re hoping to find an investor to back your startup based on your personal belief that the world needs your product? Can you tell me about a previous startup you’ve built that shows you’re good at picking what the world needs? (100% risk)

- No? OK, I don’t think raising capital is what you need to be worrying about right now.

It’s called “venture capital” because there’s meant to be some risk involved, but the level risk is meant to be measurable and needs to be less than 100%, which is where it’s at if you’re a first-time founder with an idea or early prototype of a product that almost nobody has used and nobody’s paying to use.

It’s possible to raise money for your idea at that stage, but only from people who’ve known you for decades as a relative, co-worker or mentor.

They may be prepared to shoulder that kind of risk because they love you, want you to succeed, and trust that you’ll give this 110% because you can’t afford to let them down.

Angel and venture capital fund investors probably could invest in your idea now, but almost certainly won’t.

It’s nothing personal — they just have more attractive/less risky opportunities to invest in other startups where we don’t have to go through that entire list of questions, where the risk is reduced and the business model is better understood.

Don’t waste your time worrying about things you’re not ready for.

Credit: Source link

Comments are closed.