Hi, welcome to your Weekend!

This week began with the news that the once-disgraced CEO of WeWork, Adam Neumann, was receiving a $350 million lifeline from Andreessen Horowitz. It ended with the news that the once-valorized CEO of Gravity Payments, Adam Price, had resigned in the wake of abuse allegations. How long before a blue-chip firm decides to buck conventional wisdom and give Price a lucrative second act? We’ll see.

Reading this weekend’s cover story by Margaux, I couldn’t help but be struck by a bitter irony: While some controversial men can’t help but fail upward, an accomplished female CEO like Kiki Freedman has to scrape and claw for a round equal to just 1% of Neumann’s check.

Freedman, the CEO of the abortion pill company Hey Jane, should be a VC’s dream: she boasts an MBA from Harvard Business School; she’s made career stops at Bain & Co. and Uber; and she has a fascinating founding team that includes a former physician at the women’s jail at Rikers Island. But because of the “controversial” nature of her business, many investors have turned their back on Hey Jane. At least, until now.

It will be fascinating to watch the reproductive health space occupied by Freedman and other female founders in the coming years. Will VCs demonstrate the same courage in backing these women leaders that they have in spraying cash at famous male flameouts? Or will their penchant for bold, contrarian gambles inexplicably peter out?

There are many reasons why investors ought to be interested in the business of abortion pills.There’s the fact that 54% of abortions are induced with them; the reality that they are as safe as Tylenol; the ease and efficiency of sending them by mail; and the low cost to consumers, often one-half to one-third the price of a surgical procedure. And yet, despite all of this, online abortion pill providers are still dwelling in an investment desert. Margaux takes us inside the fight to fund abortion-related telehealth startups.

The fully in-person startup, though still a rare breed, is beginning to proliferate in tech hubs across the U.S. Though the vast majority of tech employers have opted for hybrid or fully remote policies—including the largest companies, like Apple, Google and Meta Platforms—there are a handful of outliers embracing (and enforcing) a five-day, in-person mandate. Annie chats with employees who received their new RTO orders with open arms.

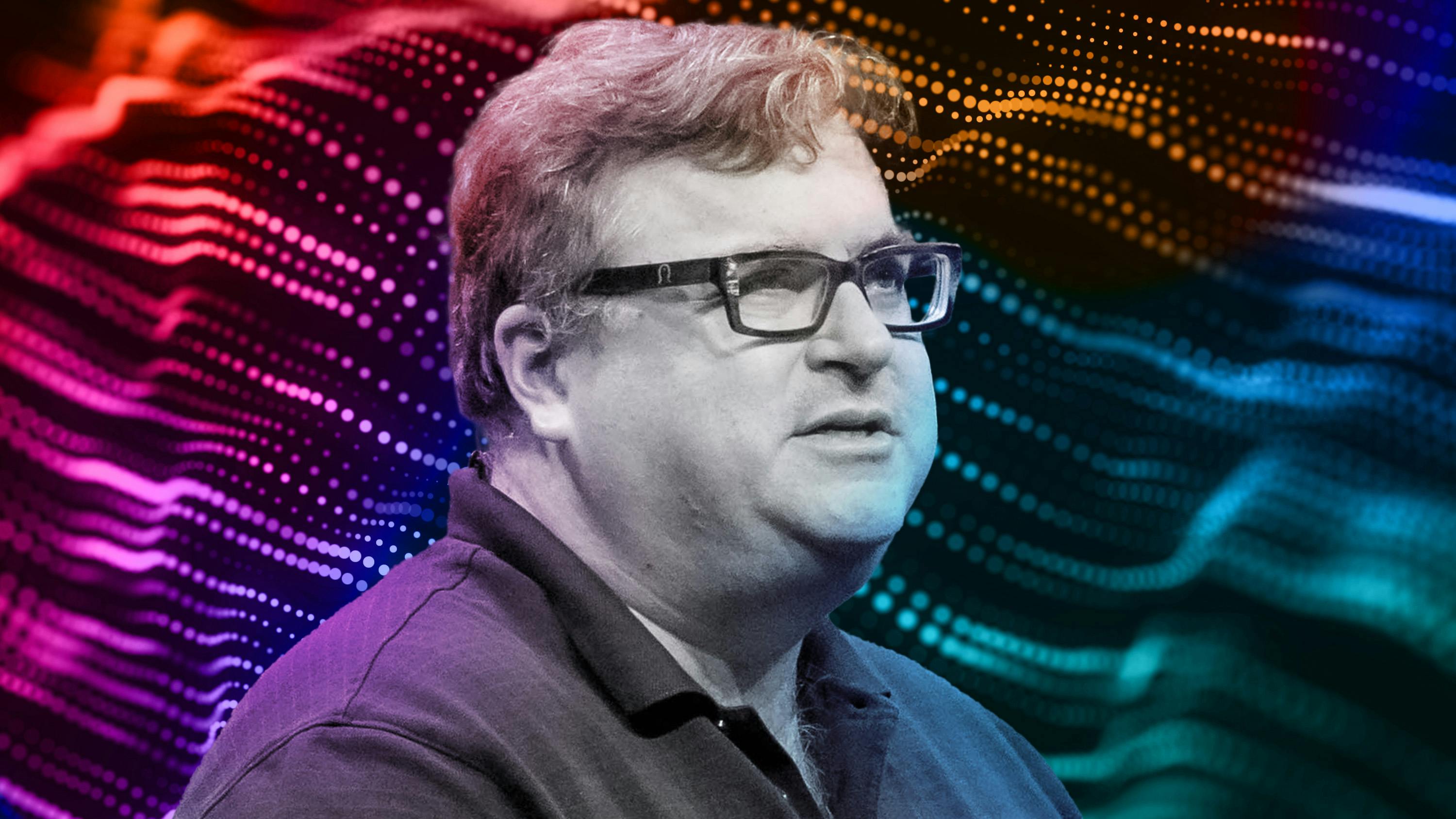

In the latest installment of our 1:1 series, Adam Lashinsky sits down with Hoffman, the Valley’s quintessential connector-donor-entrepreneur, as he preps for the midterms and appraises some of his recent moves. These include a new NFT scheme that turns untranslatable foreign words—that is, “words from another language that have no single-word equivalent in your own language”—into images using Dall-e.

After spending the past nine years as a partner at Greylock Ventures, Guo struck out on her own in June. Now she’s launching her own fund, Conviction, focused on early-stage tech investments. For this week’s edition of ‘Screentime,’ Guo unlocks her smartphone and shows us some of her wide-ranging sources of inspiration.

Watching: Nathan Fielder’s Rehearsalverse

Many expectant parents might research child-rearing by reading a book or two. But not Fielder—he hired a bunch of child actors and spent 24 hours a day over several weeks pretending to raise them. In Fielder’s new HBO Max show “The Rehearsal,” the comedian one-ups Borat by putting real people in surreal situations and watching them squirm. The show is itself hilarious, best the part may be logging onto Reddit after watching an episode, where you can join Fielder’s cult followers as they dissect what was real and what was a manipulation. Better yet, join a new subReddit where fans “rehearse” their reactions to “The Rehearsal” before a new episode airs. —Margaux

Reading: How Three Arrows “vaporized” a trillion dollars

Three Arrows Capital was on top of the world. The Singapore-based crypto hedge fund run by two 35-year-old former Andover classmates was once “the most highly regarded investment fund” in the crypto market. But the emperors of decentralization had no clothes. For “New York” magazine, Jen Wieczner takes readers inside what was once an ultra-promising fund, built by mass speculation and social media savviness. That is, until a July combustion, when the founders declared bankruptcy and essentially disappeared, leaving a crowd of investors (and a $50 million dollar yacht) high and dry. —Annie

Noticing: The eerie quiet of early SPAC boosters

For would-be SPAC kings, the world may end not with a bang but a whimper. Per Bloomberg, Chamath Palihapitiya and others who popularized the special purpose acquisition companies in last year’s frothy market now face ominous deadlines to deploy their raised capital—or close up shop. Bill Ackman has already given back the money in his $4 billion SPAC. Vehicles from KKR and billionaire Bill Foley need to ink deals by next June. Meanwhile, Palihapitiya, the once-swaggering poster boy for these blank-check companies, has gone largely silent about SPACs—as a supposed promised land looks more and more like a wasteland. —Abe

Makes You Think

Behold the famed Zuckerberg of Nazareth.

Until next Weekend, thanks for reading.

—Jon

Weekend Editor, The Information

Credit: Source link

Comments are closed.